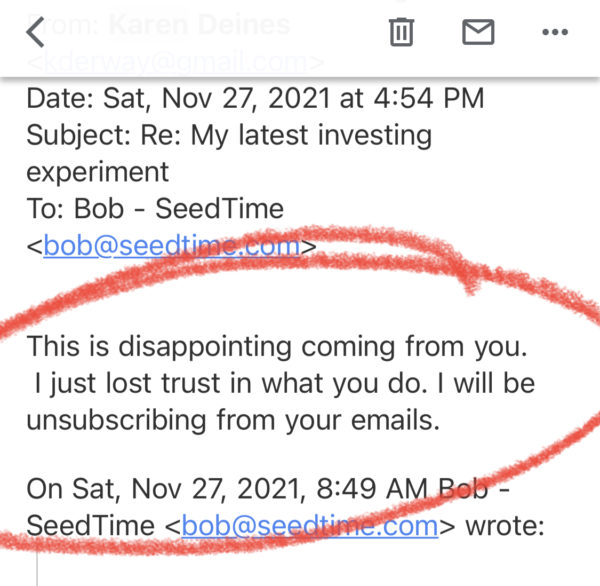

I recently sent out an email to our subscribers sharing a new investing strategy I am testing out and like usual when a new/unfamiliar idea is presented there are some naysayers…

And this wasn’t really an email that I thought was controversial in the least.

It was basically an email explaining that I view my job as experimenting with my money so you don’t have to…

And that I have been digging into and researching crypto for the last couple years to see what I need to learn.

Want to get my thoughts? Check out the video below:

But I get it

It is easy to dismiss new technologies and cling to the way things have always been or used to be.

When I am feeling nervous about the crazy financial world we live in, I long for the days of just using good ‘ol paper cash for everything.

It seemed much simpler then.

And you know, I really miss actually driving to a Blockbuster and picking out a movie.

But as we all know, things have changed.

Some say for the worse and some say for the better.

But either way, they have changed – and they will alway continue to change.

Alright, just a reminder, everything that follows (and all our articles/emails/etc for that matter) are not specific financial advice for you. I am a certified educator of personal finance, but I am not your personal advisor. I share what I am doing for your information only and I would encourage you to do your own research before any investment of any sort. Now with that out of the way…

The future of money

I remember attempting to “use the internet” in 1993 at the library. It was horribly difficult, inefficient, and seemed just goofy.

From a short-sighted perspective, it was easy to look at it and think “this is just a fad that won’t go anywhere”.

But at some point over the years that followed as the tech continued to advance, most people reached a point where they realized, “Oh, now I see where we are heading”.

And as those dots began getting connected in people’s minds, investors flocked to buy up dotcom stocks.

Pretty much any business with a website was suddenly worth millions of dollars – even if they hadn’t made a sale.

It was insane.

So many of these companies were terrible and some were downright scams just trying to rip off investors.

Many of these companies were incredibly overvalued and in the late 90s it was really easy to be a good investor.

Making money in stocks was easy. So easy in fact that I remember my 1st year of college, hearing my roommate (who knew nothing about investing) tell of all the money he was making with some of his dotcom stocks.

This all sounds kind of familiar to crypto right now, right?

Kind of like the mid-90s?

I tend to think we are in about the equivalent of the mid-90’s using this internet analogy.

There are a lot of people who still think crypto and the blockchain stuff is “just a fad” and there are more and more people who are seeing it as the future.

And as the hype surrounding crypto continues to expand, the prices keep going up and some people are making a lot of money – just like in the 90s.

But the important thing to remember is that just because there is a ton of hype surrounding crypto and a growing bubble, it doesn’t mean it isn’t where we are heading in the years to come.

So, is Crypto a big bubble right now?

Personally I think it is a bit of a bubble. I lived through the dot-com boom and burst of that bubble and it feels incredibly similar.

All the hype, all the returns, all the ease of it, and “irrational exuberance” that was so common in the late 90s frenzy.

But just because it is a bubble doesn’t mean it should be ignored.

And for those who can stomach the roller coaster ride of the ups and downs, it can provide some big wins.

Bubbles are actually normal

The simple fact is that bubbles are a normal part of investing.

The market seems to be like a pendulum swinging from one side of over-confidence to the other of under-confidence.

Rarely spending much time in the balanced middle.

Some are small and get corrected without much pain, and others are particularly large bubbles that are really painful when they burst, like in the dotcom boom where many dotcom stocks dropped by 90% or more.

Amazon is a great example

The scammy and overhyped companies of the dotcom boom didn’t last.

But the legit companies survived and have thrived in the years that followed. Amazon, Ebay, Priceline, to name a few.

Personally I think we will see something similar with the crypto world. There are over 10,000 coins at this point, and I suspect a lot of them will be a distant memory in 10 years.

But which ones are going to be the Amazon and Ebay of the next 10-20 years?

That’s what I am trying to figure out.

Just like everything I teach with my stock-picking strategy, there has to be a reason behind the investment. You have to look at the company (or coin in this case) and have a logical and justified reason for buying it.

It can’t be just because “it has gone up a lot lately”.

What is the purpose behind the coin?

What problem does it solve?

If I can’t (at a minimum) answer those questions, I don’t invest in anything – crypto, stocks, real estate, etc.

My start in cryptoland

In February of 2020, I bought $1k worth of Bitcoin.

It was my first step into cryptoland…

And less than a month later it was down 50% and worth $500.

And now, almost 2 years later, it is worth $6k.

Welcome to the rollercoaster.

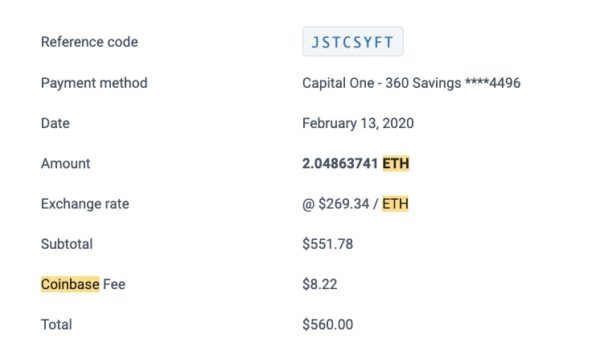

That same time I bought $560 Ethereum and it has really taken off…

That purchase is now worth about $9,500.

As you can see these returns are just insane.

So…

How I am investing in crypto now

1. I am not investing anything I am not comfortable losing

I consider this to be very speculative and I am only investing money that I am comfortable losing. I personally believe the upside potential is really big, but I am still limiting the amount we invest in it.

The majority of our assets are in real estate, index funds, and stocks. Real estate and index funds being the foundation and then smaller, riskier layers on top with stocks and then a small amount in crypto.

2. I am thinking long-term

For the types of coins I own currently, I am banking on coins that I think have a long-term potential to last.

- Bitcoin is the biggest one that I don’t see going anywhere soon, because it is synonyomous with crypto. But, on the other hand it doesn’t seem to be nearly as useful in many ways that a lot of others are, so I don’t know what is going to happen there.

- Ethereum is a blockchain that a lot of other cryptos are built on so I see a good long term use there.

- Solano is a competitor to Ethereum that is gaining more and more traction as it has some better features than Ethereum.

These are a few of the slightly less volatile coins that I am interested in for the long-term.

3. I am experimenting with another strategy

Third, I am experimenting with a passive investing strategy to profit off the volatility of crypto (rather than the price increase).

I am not ready to recommend it because I have only been doing it for about a month and I want to really try this out for a while before I recommend something like this.

That said, the thing that is most intriguing to me is that with this strategy, you can profit independently of the crypto market. You can actually make money when the prices go down.

So while I certainly still view this as speculative, it might be a little less so than just owning crypto outright.

I know some of you like to experiment like me so send me an email if you try it out and we can learn together.

Summing this all up

It doesn’t matter how you feel about Crypto, I would recommend paying a little attention to it.

Don’t just dismiss it as a “fad”.

Many of the top financial institutions and organizations own it, heck some countries are even making Bitcoin legal tender.

I have no idea what is going to happen the next 10-20 years, but from everything I have investigated, it is hard to imagine any possibility of it not being one where cryptocurrency of some form isn’t front and center in our financial transactions.

And even outside that there are endless possibilities of how blockchain technologies (the underlying tech that crypto is built on) are going to change everything in our world.

Kind of like how the internet has the last 25 years.

I believe we are on the verge of a financial revolution and I believe the blockchain and cryptocurrency (in some form) is going to play a significant part in it.

And the more we are aware of what is going on, the better.

Hopefully this helps a bit.

Your friend and coach,