Watch this 2-minute video to see:

Why Budgeting Programs

You’ve Tried in the Past

Have Failed You

The Real Money Method

No cash envelopes. Real accountability. Learn it in an hour.

This re-imagined approach (we call it UN-budgeting) is so quick you can do it during a Hulu commercial break, so easy your spouse will be on board, and it even works if you’ve always struggled sticking with a budget.

See if it’s for you with this quick quiz:

If you can check any of these boxes, then the Real Money Method (un)budgeting course can help you begin reaching your financial goals up to 10x faster.

1. You have a decent (or good) income, but aren’t sure where it all is going

- You feel like there should be money left over at the end of the month and there rarely is.

- Or you feel out of control with your spending.

2. You have tried budgeting (or currently are) but you can’t seem to stick with it.

- Maybe you are using a software or method that isn’t actually holding you accountable (most people are).

- You find at the end of each month your spending just didn’t match your plan.

- You don’t want to feel guilty for what you do with your money.

3. You just want a simple system to manage your money and then get on with your life.

- You don’t have tons of time to spend thinking about budgeting or money management.

- You want to get ahead financially, without sacrificing everything you care about.

- You want an automated system to build savings and reach financial goals without trying so hard.

If any of these sound familiar, then you are a good candidate for the Real Money Method…

So what exactly is the Real Money Method?

It’s essentially a modern-day envelope system with the convenience of a debit card.

In this quick online (un)budgeting course we teach you how to manage your money with your own bank accounts.

- Unlike all the budgeting apps/software out there, it can’t be cheated – and as a result it actually ensures you stick with it.

- That means more money every month going to the things you want and NOT getting wasted on the things you don’t care about.

The course is broken into 4 easy-to-follow sections:

1. Prepwork: Quickly find leaks in your spending and redirect that money where YOU want it to go.

2. Setup: Define your spending categories and follow the step-by-step walkthrough to setup your new automated accounts.

3. Troubleshooting: What to expect the first month and how to set up a proper buffer.

4. Optimization: Refine and build off your success to grow the amount of money you have left over each and every month.

IT IS YOUR SECRET ACCELERATOR THAT’LL HELP YOU REACH YOUR FINANCIAL GOALS UP TO 10X FASTER

10 Problems the Real Money Method Will Solve

After completing the short course you will:

1. Find it easier to control your spending (painlessly).

Fundamentally, the goal of budgeting is to help you control your spending. But the problem is that traditional budgeting has been really hard to succeed with. You have needed to basically be an accountant to stick with it.

Because of the built-in accountability of the method (not an accountability group, but the actual method holds you accountable) it is finally easier to win with money than to fail.

2. Have a simple, easy-to-follow system you can’t cheat

- You will know EXACTLY how much you need for groceries, household items, entertainment, etc.

- We will hold your hand as you quickly and painlessly create a REALISITIC spending plan that you can stick with for your future spending.

3. Be able to delete all your budgeting apps

The beauty of the Real Money Method is its simplicity. It is quick, easy, and the simplest money management method you will find. Since you use your own bank account you can ditch all the budgeting software and apps.

4. Have less stress, guilt, and shame with money

In the U.S. most people have at least one (if not all) of these.

But you my friend don’t need to have any of them – and we are going to help you eliminate all three of them.

5. Be paying down your debts considerably faster

Our average student effortlessly frees up hundreds of dollars each month by using this approach.

If you have debt, you’ll be able to take that savings and start paying off your car loans, credit cards, student loans, and even your mortgage considerably faster.

6. Learn how to thrive even if you have irregular income

We have had irregular income for over 10 years and this method has worked better than anything else for us.

The training contains specific instructions for those dealing with that hurdle.

7. Get your spouse on board without World War 3

If you are married, you know how important it is to be on the same page as your spouse.

In this course we address this head on and provide actionable steps (that actually work) to help get 100% on the same page as your spouse.

8. Throw away your cash envelopes

It’s the 21st century and every day it is getting harder and harder to actually use cash. As most of us know now that Covid hit, many places literally don’t accept cash.

No worries, no cash envelopes needed for this.

9. You don’t have to cut up your credit cards

This is a judgment-free zone. We don’t really care if you use credit cards or not. I’d love to see you pay them off each month, but we are all adults here and we aren’t going to treat you like a child.

If you don’t use them great. If you do that is fine too. Many of our students use the Real Money Method while earning credit card points.

10. Be easily saving hundreds each month WITHOUT being hyper-frugal

The thing we hear over and over from our students is how much money they began saving after beginning the method. And very often they say things like “without even trying.”

So if you are saving for retirement, college education, to sponsor a child, or anything else, this will help you get there faster.

What our students are saying:

“We are now nearing the end of our first full month using your program… We have been able to free up nearly $900 this month, which is quite honestly mind-blowing!”

Chrysti B.

“I cut my spending by over $800/month without even feeling it.“

Lauren C.

“We are really enjoying it! …Overall it’s working so much better than YNAB did for us and I love the ease of the capital one app as well.”

Katie M.

“The course is great. Straight and to the point. thank you for introducing the system. It’s genius. I can see it working better than any budgeting concepts I’ve tried in the past.”

Matthew P.

“Our monthly bottom-line went from about $500 in the red to $1,160 in the black.“

John P.

“You and Linda make it easy without making me feel dumb. I have been budgeting for 21 years but have never had it working like it should and I could never figure out why all the extra money was gone at the end of the month. But now we can see exactly what is going on (unlike before with other software) and as a result there is money leftover each month.”

Joanna P.

“I’m loving the Real Money Method. I’ve saved hundreds of dollars and I’ve never felt so in control of my spending.“

Kayla R.

“I have been able to save about 6 months of living expenses. Trust me when I say this has been SUCH a blessing in these crazy times and I know that it would not have happened without the course.”

Sheri J.

“I decided to go with your budgeting plan, what a difference it’s made! We’ve increased our savings by $16,000 and we’ve been able to save $3,000+ in our HSA account.”

Neal H.

Want to see more?

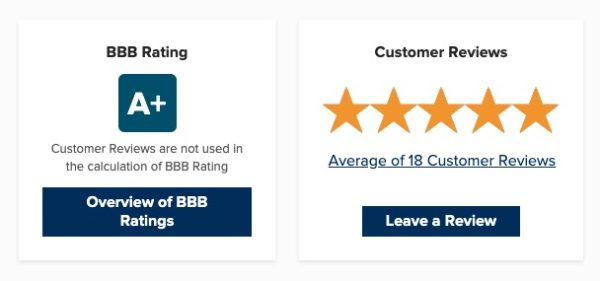

Check out dozens of other reviews from our students here.

Master your money, design the life you want, and painlessly save hundreds in just minutes each week

What’s included?

- Access to the full RMM course ($97)

- FREE future updates ($47)

- Budget case studies library ($97)

- Save hours with Bill Pay optimizer system ($97)

- Bill negotiating training ($47)

- Recommended spending percentage cheatsheet ($17)

- 3 months unlimited email consulting ($147)

- a lot more…

Total value = $549

But for a limited time, get started with the Real Money Method for just $97!

To begin changing your financial future now, simply click the button below, fill out the order form, and we will immediately send your login information. See ya inside!

- Access to the RMM video training

- 1-year access & FREE future updates

- 60-day money-back guarantee

- Everything in the

Standard Package Plus: - LIFETIME access to course materials

- FREE future updates

- Budget case studies library

- Save hours with ‘Bill Pay Optimizer’

- Bill-negotiating training

- Budget Percentages cheatsheet

- 3 months of unlimited email consulting

Included for FREE with the Plus package…

For a limited time, we are including these bonuses in the plus package:

Make paying bills faster, easier, and never late with our “Bill Pay Optimizer”

#1 LIMITED TIME BONUS ($97 value)

This is the exact system I have used for over a decade to pay our bills each month. The system and corresponding worksheet (included) have saved me hours every month and virtually guarantee that you’ll never have an accidental late payment again.

Recommended Spending Percentages Cheatsheet

#2 LIMITED TIME BONUS ($17 value)

Are you curious if your spending is just wildly off the mark from the amounts the experts recommend? While no one’s situation is exactly the same, this cheatsheet will give you a head start on determining if you are hitting the recommended amounts.

See what my spending actually looks like (and many others) with our Case Study Library

#3 LIMITED TIME BONUS ($97 value)

Want to peek over my shoulder and see exactly what my (un)budget looks like? Or want to see how much other students spend for groceries for a family of 4? And want to know why? This ever-growing library of case-studies will give you a sneak peek at how other successful (un)budgeters are doing it.

Have someone else negotiate your bills for you – without costing you a penny

#4 LIMITED TIME BONUS ($47 value)

Many students can save many hundreds of dollars a year with just this training lesson alone.

Quick Case Study: Meet Lauren & Jeff

“I cut my spending by over $800/month without even feeling it.“

Lauren is a self-confessed impulse buyer, “I’ll go to the inexpensive grocery store with a list of necessities and feel great about how much I saved on milk and eggs and then I’ll grab a $10 “special buy” and bust my grocery budget.”

“Enter the Real Money method. Once I committed to it and knowing where my money was actually going, I cut my spending by over $800 each month without even feeling it.“

“It was basically like getting paid to budget.“

“I now know exactly how much money I have for each category, and when the money is gone, it’s gone. The guessing games are over and I feel more in control of my money than I ever have.”

- Access to the RMM video training

- 1-year access & FREE future updates

- 60-day money-back guarantee

- Everything in the

Standard Package Plus: - LIFETIME access to course materials

- FREE future updates

- Budget case studies library

- Save hours with ‘Bill Pay Optimizer’

- Bill-negotiating training

- Budget Percentages cheatsheet

- 3 months of unlimited email consulting

It will save you hundreds, or else…

If it doesn’t save you hundreds, we will personally work with you until it does or refund 100% of your money.

To be honest, I didn’t feel comfortable making this promise when we first launched the course, but now after having over 1,000 students enroll, and seeing the results they are getting, I can safely make this offer – because I know it works!

I have been in the financial services industry for 20+ years now and I have never seen something that works this well.

That is why I am comfortable taking all the risk and offering a guarantee like this.

Plus the “Kill Your Budget” Guarantee:

If you ever switch from the Real Money Method, just let us know for a 100% refund. Enjoy the peace of mind that you’ll never have to set up another budget again!

Forget about hyper-frugality to save money, do this instead…

You’ve probably tried budgeting in the past…

You’ve watched Dave Ramsey, downloaded budgeting apps, and tried cash envelopes, but you just can’t seem to get full control of your money (or stay in control when emergencies happen).

You might be discouraged with your inability to get ahead financially. And maybe feel like no matter what you try, it’s not going to work.

You aren’t alone, a lot of our students used to feel that way.

Why this is RADICALLY different than ANYTHING you’ve tried before

It is a money management method that actually provides REAL accountability to stick with it, unlike all the software which can so easily be “cheated” when you go over in a category each month.

Since this method uses your REAL money in your bank account (as opposed to just numbers on a screen with software) you will actually stick with it.

And as a result, your money will go where you want it to go and you will massively accelerate toward your financial goals.

So, who are you anyway?

I, Bob Lotich, am a Certified Educator in Personal Finance (CEPF®), founder of SeedTime.com, and am a high-performance financial coach.

And Linda is my better, yet more spend-happy, half. And trust me, if she likes the Real Money method, there is hope for your spouse too!

And together we used the Real Money method to pay off over $200k of debt.

Quick Case Study: Meet John

“After 17 years of struggling with budgeting and personal finances, in the last 4 months we have saved $14,000”

“We’re also able to give more generously than ever before. The Real Money course works. Thank you.”

- John is an author who lives in Oregon with his wife and 2 kids. They had tried many budgeting methods in the past, but none worked consistently for them.

- He said their budget was like a “leaky boat”, but they couldn’t find out where the holes were and every month they had significantly more money going out than coming in. And they “dreaded talking about personal finances”.

- They joined the course in Dec 2019 and immediately implemented the Real Money method.

- They learned how to tell exactly where the “leaky holes” were and quickly paid off a $1k car loan. And then a $4k line of credit.

- Seeing this progress and forward momentum, they began to love talking about money… “We now look forward to talking about the budget. No kidding, we literally can’t wait.”

- Over the following 5 months they saved $14k. And John says they are now “less stressed and argue less about money”. He is also contributing to an IRA for “basically the first time ever.” And are “giving more than 6x what we did in November”.

“I’ve never felt so compelled to reach out to a course creator and say “this has been actually life-changing” and I am just so grateful. It’s been a huge turnaround for us and very empowering.“

Still Got Questions? We got answers…

When does the course start?

Immediately! It is self-study, so you can take it at anytime – on your schedule.

Does it work with Mac, PC, Linux?

It works on any and all computers and mobile devices because it isn’t a software that is used.

Can I take the course on my smartphone?

Yep, absolutely. It is just as easy doing it on your phone, tablet, laptop, or desktop.

What are the requirements?

- You must have 5-10 minutes per week to spend to maintain

- You do NOT need to change banks – many of our top performing banks stuck with the bank they were using. But if you want to make it as quick and simple as humanly possible (which is what I always prefer) you may want to consider opening a new account with one of our recommended banks. But just to be clear you do not need to leave your current bank.

How much time will be involved?

You will be able to get through the course videos in less than an hour. It should take about 2 hours (spread over a week or so) to get the system in place. From there, it will require about 5-10 mins a week to maintain which is less than any traditional budgeting approaches I’ve ever tried.

Can this (un)budget be done with paper or does it have to be done on the computer?

Sorry, it doesn’t work with paper only. You need to have access to a computer, tablet, or smartphone.

What if I am outside the US?

The method can work anywhere in the world that has banks. Some banks make it more difficult to implement than others, so if your current bank doesn’t work well with the method, we have an ever-growing list of banks that our students are using successfully as well as our top recommendations.

Do I have to change banks?

Nope. You may want to open an additional account at one of our recommended banks to make it as easy and quick as possible. But you don’t need to leave your current bank.

Do I need to change my direct deposit?

No, one of the reasons we use them for this system is because our recommended banks allow you to transfer back and forth to your current bank for free. So you can do your monthly transfers that way or you could have your direct deposit divided up between your two banks. Either works.

Are there banking fees involved in setup and going forward?

No fees! That is one of many features that we look for in our recommended banks for the Real Money method.

Does this course sync with my bank account?

Nope, it is just a method of managing expenses that this course teaches. The method doesn’t use any software, it just teaches you how to manage your money with your own bank account.

Do you have access to my bank account?

Nope, not at all. By purchasing the course, you will gain access to training on how to use the method with your own bank account.

Can I gift the course to someone?

Absolutely! In fact, we even have gift cards available. Just purchase the course and then email us and we will send you one if you’d like!

Do the videos have closed captioning?

Yes, each video has the option to turn closed captioning on!

How similar/different is this from the Dave Ramsey budgeting system? I tried that in the past and felt like I couldn’t spend any money.

It is very different. Dave’s program unfortunately has the same issue that all traditional budgeting approaches have in that it offers a veil of accountability, but not real accountability. That is what makes RMM so effective for our students. Personally, Linda and I have found that this method allows us to say YES to much more stuff than NO. Now, there certainly are times where we choose NOT to do things because of our (un)budget, but the thing to remember is that you are not a slave to it, it works for you. You get to tell it what and where you want to spend your money. It is basically an agreement with you and your spouse about what is most important to you and where you want to choose to spend your money.

How easy is it to transfer money from my current bank to your recommended banks?

Super easy. You do it all from the app/website and it’s just a few simple steps. You can probably do it in 15 seconds.

Does this sync up to my bank account, and are any of my records kept online?

Nothing with your bank account is synced to the Real Money Method. It isn’t a software that you are using but a method of how to organize and categorize your accounts. So we won’t have access to any of your information through the course.

I wondered if you have a list of spending percentage guidelines? We are interested in what categories and percentages you recommend?

Yes that is included in the PLUS package!

Does this system work with an iPad. I do not have a “regular computer”

Yep, no “regular computer” needed! It works on tablets and smartphones.

Can I still use my credit card for purchases to get rewards points with this method?

The short answer is yes. But the goal of the method is to make it as simple as possible and as such using a debit card is the absolute simplest approach. But many of our students still use credit cards with it and we have a lesson in the course showing two different ways to use this method and still use your credit cards to get points.

Does this method work for those with inconsistent or irregular income?

Yes it does. We have been in that boat for over 10 years and it has worked better than anything else for us. We have a specific lesson in the course for those with irregular income.

Ready? Let’s do this!

Just click select your package below to get started!

- Access to the RMM video training

- 1-year access & FREE future updates

- 60-day money-back guarantee

- Everything in the

Standard Package Plus: - LIFETIME access to course materials

- FREE future updates

- Budget case studies library

- Save hours with ‘Bill Pay Optimizer’

- Bill-negotiating training

- Budget Percentages cheatsheet

- 3 months of unlimited email consulting