This is written for students of our 10x Investing course who are following the strategies we teach to pick solid investments. But regardless, if you have picked solid investments and are wondering what to do when they are losing value, this will help.

Over the last few days I have been fielding a lot of questions from readers, listeners, and students who are freaking out because they are watching their investments go down.

If you are one of our 10x Investing students, much of this will sound familiar, but for those who are not, I think this will help.

These are just a few questions i’ve heard:

Why are my investments losing money? Is everyone losing money in the stock market right now? What do I do when my investments are dropping in value?

1. This is completely normal

Even though it feels like the sky is falling, it is important to remember that market corrections are always happening.

Investing in the stock market, bonds, real estate, or anything with any decent potential for gains is always going to have ups and downs.

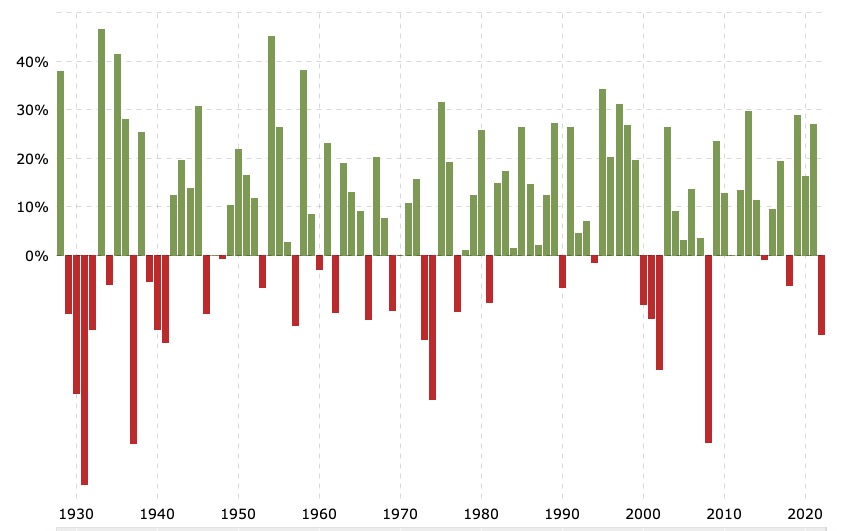

Now, let”s talk about S&P 500 index funds (which are a good general representation of the U.S. stock market as a whole). The chart below shows the performance of the S&P 500 for the last 90 years.

Notice that there have always been ups and downs. And notice there are many 1 year periods where you would have lost money.

Also notice there are far more where you would have made money.

And it is important to note that over the worst 10 year period the worst you would have done is about a -3% return.

And zooming out even further, there hasn’t ever been a 15-year period where you would have lost money.

And when you average it all together, you get an average annual return of about 10%.

So when I zoom out to see the big picture and not just the panic and the noise going on all around us, I sit back with a reasonable expectation of earning an average of about 10% per year on my investments in the S&P 500.

Side note: I show you exactly how to set this up in our 10x Investing course if you need help

2. You”d probably be better off not looking

For my long-term investments (which are almost all of them) I check them once per year. I know many people think that is crazy, but having done the check-3-times-a-day and doing the once a year thing, I think the constant checking is crazy.

It certainly added a lot more stress to my life with nothing to show for it.

The way I see it, If I am investing for the long-term, then there is no need for me to look at what is going on now. I invested in index funds and stocks that I plan on holding for 5-10 years and so it doesn’t really matter if it drops by 10% or even 50% because I am not planning on selling it for a long time.

And what the market thinks in a freak out moment doesn’t (or shouldn’t) change my mind about my conviction of why I chose that particular investment.

If I needed the money next month and it dropped by 50%, then that is a completely different story – which is why I don’t invest in the stock market for short-term investments – because you never know what might happen in the short term.

3. You haven’t actually lost any money until you sell

This is an important distinction to make because I keep talking to students who are saying that “their investments are losing money” or that they “lost X amount of dollars in the last week”.

And the truth is, the value of a particular investment might be down, but you haven’t lost anything (or made anything) until you sell.

I know it might feel like splitting hairs, but this point is an important one if you are viewing it from a long-term perspective.

For me, with investments that I am excited about, this just confirms that now is definitely not when I should sell. Because I don’t want to sell at a 30% loss, i”d rather wait until I can sell at a gain.

Which leads to the next point…

4. Panic selling is almost always a bad idea

The temptation is to see investments going down in value is to run and sell them off before it goes any lower. I”ve made this mistake enough to know that in most cases, it is a bad idea.

The best investors learn to have nerves of steel and can stand by their investments with conviction that they are good investments (assuming they are) regardless of how the market is freaking out at the moment.

This is why Warren Buffett is widely viewed as the best investor of the last 100 years. He often gives the advice “Be fearful when others are greedy, and greedy when others are fearful” meaning when everyone is making tons of money, that”s when we should be cautious, and when everyone is losing money, that”s when we should see the opportunities to buy in at lower prices.

This is the time when the best investors get excited because things are “on sale”.

If your favorite ice cream went on sale at the grocery store and was 30% off you might stock up and buy a few because it is a good deal.

It is the same with good investments. When I see a stock that I want to own because I am so confident in the company and it is at a 20-30% discount, why not buy more?

The price of an investment (at any given moment) is based on people”s emotional responses and whether the masses are panicking.

But this is often completely disconnected to the actual value. And over the long-term we tend to find that the price eventually catches up to the reality of what”s going on.

Quick example

At the end of 1999 (at the peak of the Dotcom boom) Amazon”s stock price was $106 per share. Over the 2 years that followed, as the Dotcom bubble burst, the price of Amazon”s stock dropped all the way down to about $6 per share as everyone was panic selling all their tech stocks.

Jeff Bezos said that during that time Amazon”s business growth was stunning. Every metric showed they were on a path to becoming a thriving business, but yet the stock price indicated the complete opposite.

Wise investors spotted this and invested in Amazon at a great discount and made a lot of money when the stock price eventually more accurately reflected the truth of what Amazon was worth.

5. God is still on the throne

One of the best things I have ever done for my mental health in this area is to start saying “eh, it”s just money”.

It has been helpful when an investment didn’t go as planned, when people have stolen from me, when I got laid off, when I had to drain our emergency fund because of unexpected medical bills, and a lot more.

At the end of the day, God is our source. He is our provider. He is the one who is responsible for taking care of our needs – and He will always do a better job than you and I ever could.

And when I find myself in the position of clinging to the money in my account, or frustrated that I lost a bunch of money, I always sense Him gently reminding me that He is my source and my trust needs to be in Him.

Not in what I can do in my own strength.

So just a reminder; He is still on the throne. He isn’t surprised by what has happened to your investments, and He isn’t scratching His head trying to figure out how to take care of you.

Phil 4:19 has always been and will always be true:

My God shall supply all your needs according to His riches in glory by Christ Jesus.

So, do yourself a favor and write this down and meditate on it day and night until peace comes.

That”s all for today!

Your friend and coach,