Ok, I keep getting asked about the business bank account that we use…

These are just 2 in the last week…

And, honestly, I feel like I get this question all the time, so let’s chat…

I haven’t liked many business checking accounts.

In the last 16 years, I have had quite a few business checking accounts, and I have been disappointed by most, unfortunately.

And I think the biggest reason is that all of them from U.S. Bank, to BOA, to other regional banks, have all made me feel like they are always out to “get me”.

As in, if you don’t follow the 15 random weird rules with this account we are going to charge you a $30 fee each month.

So “if you don’t make 7 deposits each month, we are going to getcha!”

Or “if your average daily balance falls below $2,000, we are going to getcha!”

Or “if you transfer too much money out, we are going to getcha!”

Or “if you look at us the wrong way, we are going to getcha!”

Anyway, you get the point.

And then for the smaller banks or credit unions I have tried, they have been about 20 years behind with their tech, so they are just too limited.

Enter Relay Bank

So a few years ago I read this book Profit First, which encourages a business money management method that is actually pretty similar to our Real Money Method (for personal banking) and most banks do NOT work with that method.

And, in my research I found one bank that seemed perfectly designed and suited for the method, and it was Relay Bank.

I quickly switched and honestly have loved it ever since.

They don’t have all the insane fees that big banks have, and I have found that they have customer support reps who actually think and act human rather than just reading off scripts for every question you ask.

They don’t have any physical branches so if that something you feel like you need you could keep your brick and mortar biz acct for those tasks and use Relay for everything else.

I actually still have a biz acct at U.S. Bank for just that reason, but that is literally the only reason.

To say I am not a fan of U.S. Bank is an understatement.

But about 2 times a year it comes in handy to have a physical branch I can walk into.

So anyway, there is the answer to the question I keep getting which I am selfishly answering like this so I can just send this to the next person who asks rather than typing the same thing over and over LOL.

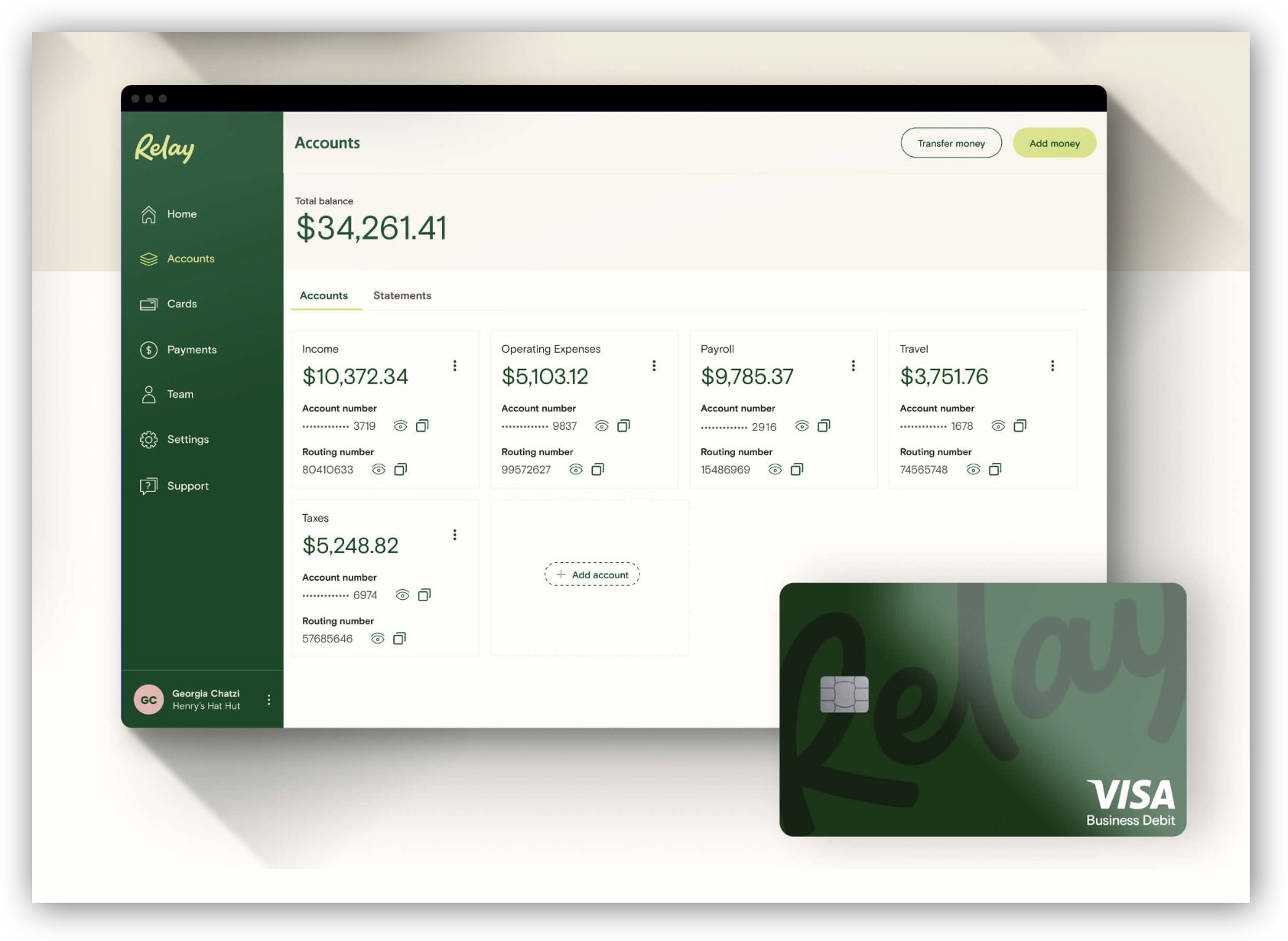

Here are more details and things I like about Relay bank…

- No account fees, overdraft fees or minimum balances – woo hoo!

- Unlike most banks, they have a great mobile app

- They offer regular debit cards, but they also allow you to create “virtual” debit cards that you can use for specific purposes. I.E. giving one to each employee, or using one only for online purchases, etc

- Integrates with Quickbooks Online and Xero

- You can deposit/withdraw cash at Allpoint ATMs

- Domestic wire transfers are $5 (almost every other bank I have used charges $30)

- You can deposit checks easily with their app

- And they are FDIC insured. That wasn’t something people thought much about until recently, but yes they are FDIC insured up to $250k per depositor.

Is Relay a Legit bank?

The short answer is yes. They have over 36,000 small businesses that use their accounts, have a ton of great reviews on Trustpilot, and is FDIC insured.

Who owns Relay bank?

Relay (like a lot of the newer banks) is actually owned by a larger bank called Evolve Bank and Trust that has been around for nearly 100 years.

U.S. Businesses only?

Kind of. As long as the business has an operating presence in the U.S. (even if you are based out of another country) then you can open a Relay bank account.

Anyway, so there you have it. That is the bank that I use for my business that is the first one that I have actually liked LOL.

If you decide to sign up, they are currently offering a $50 signup bonus if you use this link.

And, like always, when you do use our referral link, it doesn’t cost you anything but it contributes to our giveaway fund for you! And since we are talking about it, we are currently giving away $2,000! Get in on it here!

Some more FAQs

Does Relay Bank handle international wire transfers?

Yes! If you need to send money overseas, Relay’s got your back with international wire transfers.

Are there any sneaky fees I should know about?

One of the things I love about Relay is that they don’t play the “gotcha” game. No account maintenance fees, no overdraft fees, no minimum balances—none of that nonsense. Domestic wires are just $5, which is a steal compared to the $30 other banks like to charge.

Can I sync Relay Bank with my accounting software?

Relay integrates seamlessly with QuickBooks Online and Xero. Makes life so much easier when everything talks to each other, right?

Is my money safe with Relay Bank?

They use all the high-tech security measures you’d expect—encryption, two-factor authentication, etc. Plus, they’re FDIC insured up to $250k per depositor, so your cash is as safe as it gets.

How’s their customer support?

In my experience, their customer support has been top-notch. You get to talk to real humans who actually listen and help, not just someone reading off a script.

Can I set up multiple accounts or sub-accounts with Relay?

Yes, You can create up to 20 checking accounts. This is a game-changer if you’re following the Profit First method or just like keeping your funds organized.

Any issues with depositing or withdrawing cash?

You can deposit and withdraw cash at any Allpoint ATM, which are pretty much everywhere. Just keep an eye out for any potential ATM fees, but other than that no issues.

Does Relay Bank offer business loans or lines of credit?

Last I checked, no. As of now, Relay focuses on checking accounts and cash management tools.

How does Relay Bank support the Profit First methodology?

If you’re into the Profit First approach (which I highly recommend), Relay makes it super easy. With the ability to set up multiple accounts, you can allocate funds for profit, taxes, expenses—you name it—without juggling multiple banks or accounts.