Saving for your child’s college tuition can be a difficult task, especially in today’s economy. According to a study by Sallie Mae, 60% American families save regularly for their child’s college tuition. A surprising 24% of parents who save, however, admit to using their retirement savings to cover tuition for their children. Tapping into your retirement savings for tuition can jeopardize your financial future and may not be the best thing for your child either.

The Negatives of Raiding Your Retirement

Your financial plan may already be suffering

If you’re part of the 60% of baby boomers surveyed by WSJ who feel unprepared for retirement, dipping into your retirement account will only set you back even further in your financial goals. In a time that you should be increasing your savings, you’re taking a big risk by shrinking your retirement account with the withdrawal.

Catching up is even more difficult

Sure, you’re allowed to make catch up contributions to your retirement account if you’re over 50, but will you actually follow through? Relying on unknown future income to repay your retirement balance is a giant risk that isn’t very wise.

Withdrawals are subject to income taxes

Yes, the 10% early withdrawal penalty is waived for college expenses, but the amount you withdraw is still subject to income taxes. This is an important thing to consider because an increase in your income will affect your child’s financial aid eligibility for the next year. Higher income can mean less financial aid for your student.

It may spur a sense of entitlement

Although your goal is to provide your children with the best schooling available, paying their way may cause an unintended sense of entitlement. Teaching them proper money management skills and taking advantage of the saving options at the end of this article may be a better solution than paying their tuition and sacrificing your retirement for it.

The Consequences Of Using Retirement Funds For Tuition

If you’re 45 years old and have about $100,000 in your 401(k), let’s see how your retirement goals can be affected by withdrawing funds to pay for college.

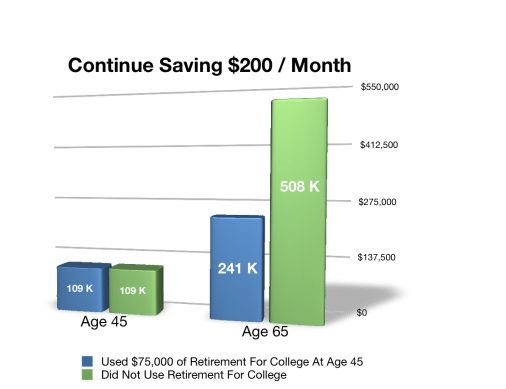

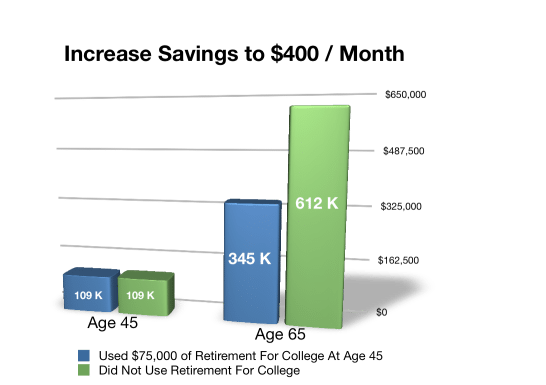

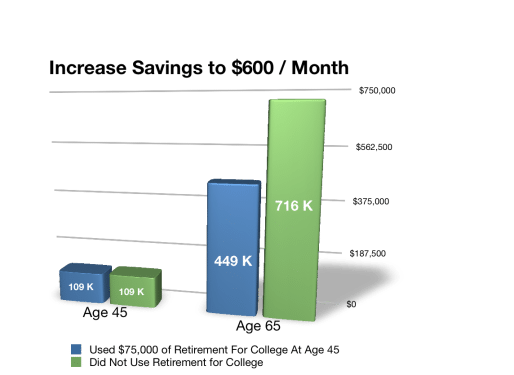

You want to dip into your retirement account to pay for your children’s college totaling $75,000. You’ve been saving $200 each month for twenty years at 7% and think that if you simply increase your contribution, the $75,000 ‘dip’ will be recovered in no time. You have another 20 years til retirement to catch up…right?

Your friend (green bar) doesn’t dip and contributes the same as you. Instead of taking a large portion of his retirement account, he helps his children when he can by paying for books and food here and there.

Even if you tripled your contribution to $600 per month for the next twenty years, you’re worse off than someone who simply maintained contributions of $200 each month.

(‘Dip’ with additional $600/ month = $449K vs. No ‘Dip’ at $200/ month = $509K)

Don’t Be Fooled With These Excuses

But the 10% penalty is waived!

Just because the IRS allows something doesn’t mean it’s a good thing. In the example above, the person who dipped into their account had significantly less – even with the added catch-up contributions. The math doesn’t work in your favor.

I can borrow from my 401(k)

Yes, you can borrow from your 401(k), but you have to pay it back in 5 years and sometimes immediately if you change jobs. The student can repay a standard government loan over a period of 10 years and sometimes extend the term if needed.

My kids will take care of me

Do you really want to depend on your children for your financial future? That can be an even bigger burden to your children than repaying a school loan

Let’s face it, your children have a better chance of surviving financially because they have this on their side: TIME. Your children are young and can use compounding to their benefit. With proper planning, your child can manage their student loans, save for their own retirement, and still live a financially balanced life. If you dip into your retirement funds, you won’t let compounding interest work in your favor as greatly, you might stress over making catch up contributions, and you may get behind in your financial plan. Even more, by trying to keep your children from having the burden of student debt, you may unintentionally create a new burden of taking care of Mom and Dad financially.

Instead of risking your retirement for your kid’s tuition, take advantage of these better options for saving for college:

- 529 College Savings Plan

- Apply for Financial Aid or Scholarships

- Federal Loans – Student Loan Forgiveness Programs

- Work Study Programs / Part Time College Jobs

What’s your opinion on this issue? Do you plan on using retirement funds to pay for your child’s college tuition?