I recently did a review of my results of this new Crypto bots experiment using “The Plan” by Dan Hollings that I’ve been doing for the last 5 months.

You can watch the full video below or keep reading for the transcription.

(The following is an abbreviated transcription from a video I recorded on May 5th, 2022. Scroll to see my most recent update. Please excuse any typos or errors.)

Today I want to talk about something pretty interesting. I want to share how I’m making about $400 a month passive income from crypto bots on a relatively small investment. And if you’re part of the SeedTime community and have been paying attention at all, you know, that I’m working towards having a full-time passive income by 2024.

I’m in the phase of trying a lot of stuff out and experimenting with a lot of different stuff and this is an experiment that I’ve actually been working on for about five months. So I want to take you into my account and show you exactly how this works, exactly what I’ve been doing and what kind of results I’ve been getting from it.

The plan bot trading disclaimer 🙂

Before we dive in, I have to say that this is not financial advice for you. I’m not your financial advisor and we’re talking about cryptocurrency. So in case you don’t know, this is risky. You can lose money with any investment but cryptocurrency is probably one of the more risky investments that you can make.

But I will say that I’ve experimented with a lot of different crypto stuff over the last five months or so and I think this is one of the least risky ways to invest in crypto.

But the point is that you can lose money. You have to know that upfront. There’s no investment that is a guarantee that you will not lose money. So you have to know that this is cryptocurrency and there’s definitely risk involved. So I just want to make sure we are on the same page with that before we dive deeper into this.

What is this crypto bot experiment?

Passive income crypto bots?

Ok so let’s break down The Plan cryptocurrency bot trading thing. Explaining what’s actually happening here and what we’re doing before I dive into our account – what I am doing with this method is I am setting up bots that are automatically trading. It’s called grid trading. So they are automatically trading at different points as the price of a specific cryptocurrency goes up or down. And so it’s completely passive, which I absolutely love.

With this method, you’re profiting off of the volatility of crypto. We all know crypto is very volatile. It’s going up and down a lot, and that’s what makes this work. If crypto wasn’t volatile, this wouldn’t work at all but because it is, we can set up little automated bots that are constantly buying and selling for us as the market moves up and down a little bit. And each time they do, we make just a little bit of money.

A lot of these trades that they are making for me, I might only be making $.25 or $.50, but when it’s making hundreds or thousands of trades, that begins to add up. This is a unique approach to investing in crypto that I haven’t seen before at all.

Let’s take a look at my crypto bots

This is my Bitsgap account, and this is the actual trading software that I’m using to make all these trades. I have two bots set up and what’s happening here is all the little dots are all the grid lines. So each time you see a little dot, it’s a buy or sell. This is called grid trading and what we’re doing is we’re setting up a whole bunch of buy and sell lines, spread out just a little bit all throughout here for these different prices.

You can see the red lines and the green lines. When we set up one of these bots, we’re setting up all these different buy and sell orders at different prices all throughout and then, as the price of the coin goes up and down, each time it’ll buy some or it’ll sell some and then each time it sells some, I’m making just a little bit of money.

The plan crypto course

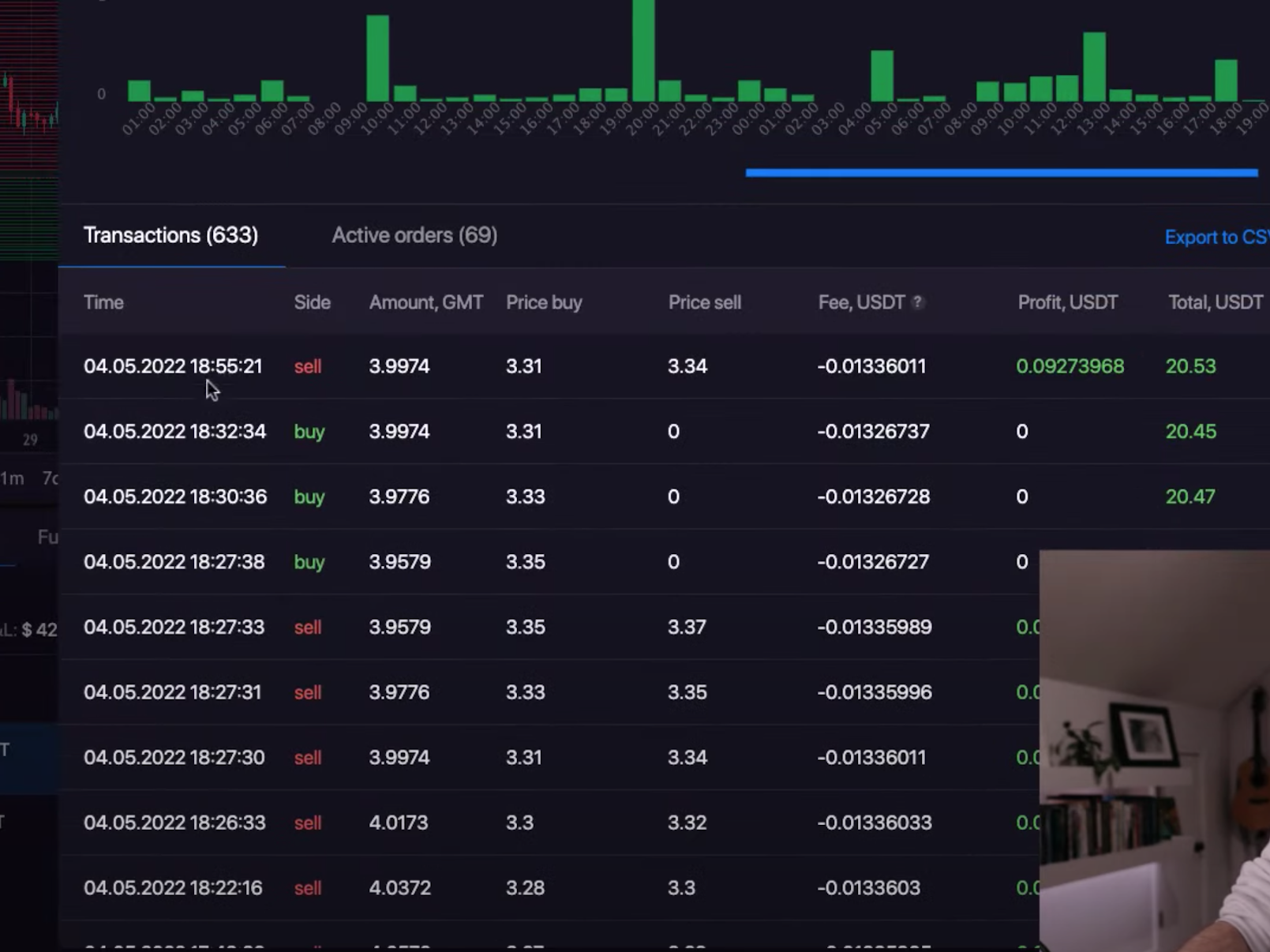

On all of the different buy and sell orders, the amount of profit I’m making is about $.09 on each of them and there’s about 633 transactions, most of them being sell orders so I’m making about $.09 each time. So for the one that has been up for a little less than 4 days, it’s yielded me $20.

And again, this was off about a $900 investment in 20 days, which if it continues at this rate that comes out to $180 or something in one month off of $900. So that’s the gist of how this one has been performing.

Results from one of my crypto bots

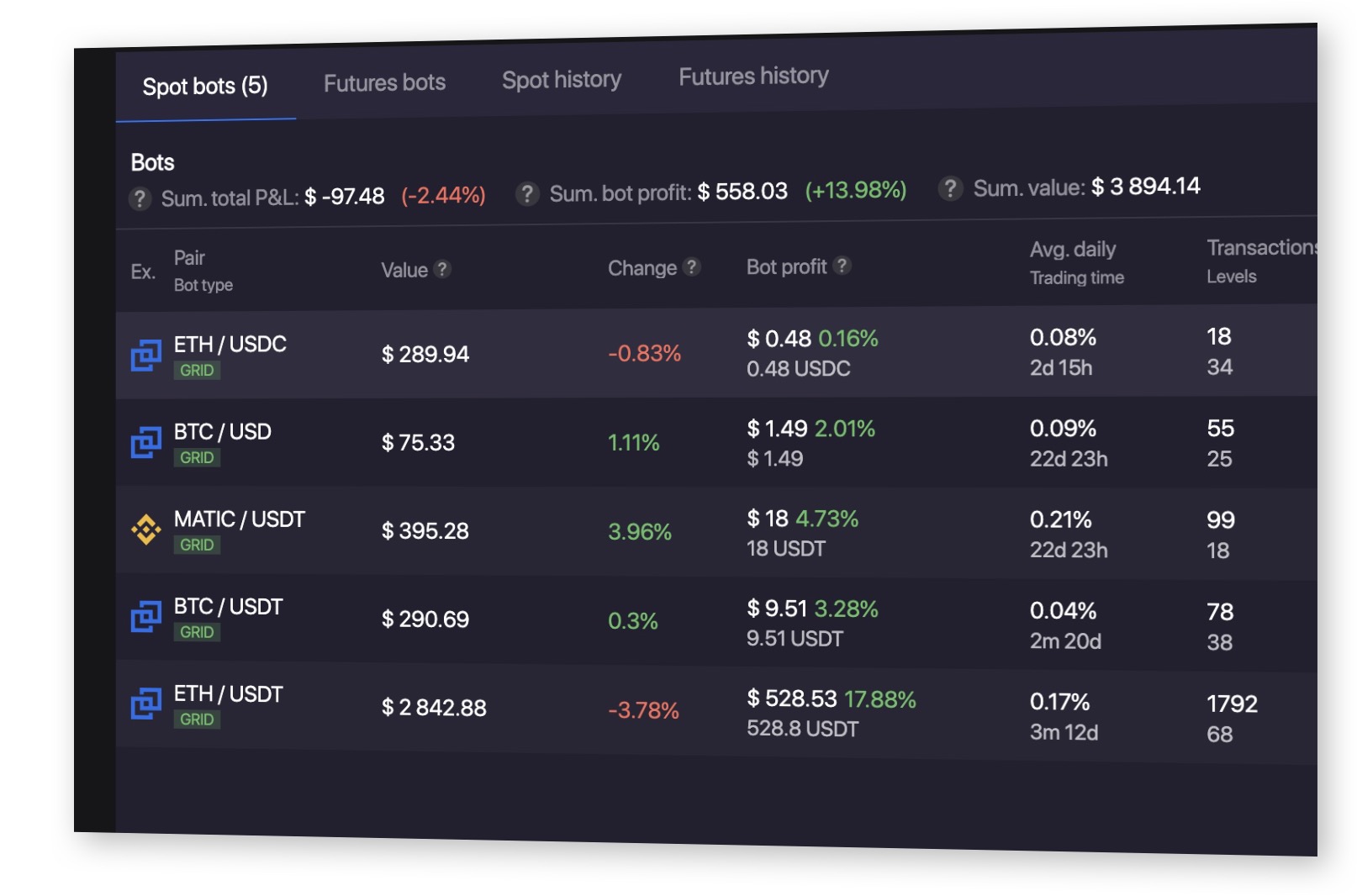

The other one you see is Ethereum/USDT. You’ve probably heard of Ethereum and USDT is a stable coin. So this is a coin pairing and those two are working together. It’s alternating between the two, either buying Ethereum and trading that for USDT or doing the opposite. And this particular one I’ve had open for about two months and a day, and it’s earned me $449. I think it was about a $5,000 investment, which comes out to an 8.5% return over two months.

This continues to be hard for me to wrap my brain around because I come from the financial world where if you’re making more than 10% per year, you should be really, really happy, you know? And no doubt, in crypto there’s a lot of volatility, but I’m really excited about the potential of this. And like I said, I’ve been doing this for five months now and experimenting with it and I’ve opened some bots and close some bots and I’ve seen the market go up and I’ve seen the market come down. In November and December, we saw the market dropped quite a bit. And that was interesting for me to watch and I’m really glad I got to experience it.

The bot profit is what the bot has actually earned. So in this case, the GMT bot has earned $20 in the three days that has been open, the ETH/USDT one has earned about $450 in the two months it’s been opened. So this is actual earnings that I have. So, because it sold it, this money has now added to my account so I can just leave these bots and just let them keep running and it’s just going to be spitting little amounts of money into my account and then I can take that money and then do whatever I want. So it’s just straight passive income and that is what’s really cool about this.

And they don’t always continue at such a great rate. The ETH/USDT one was actually over 10% for a while and now it’s down to 8.5%. So they’re not necessarily always staying at the same rate of return because it’s based off of how volatile that coin is and how many trades you’re doing.

Then you can see our total bot profit of $469, our total average return since we’ve done this and then the sum total (P&L) is only $48. And the reason for this is because two of these coins have actually gone down in value. The coins can go up or down in value themselves, which will either amplify or decrease what’s going on with your total earnings. So even though the bots have earned me $469, my total, if I were to close everything out right now, would only be a $48 gain because the coins have gone down in value. Now, if the coins are going up in value, then it kind of amplifies it.

So I might have had $469 in bot profit, but I might have $700 of total profit because the coins went up. So what’s cool about this it reduces your losses – I saw this firsthand in November and December when the market was just kind of tanking. If you’re going to be holding cryptocurrency anyway, if you’re holding Bitcoin, Ethereum, or really any other altcoins that you’re excited about holding for the long term, what’s great is that when those coins go down, you’re still making money. So it reduces your loss. And that’s what I meant at the beginning where I said this might be the least risky way to invest in cryptocurrency, or it could be depending on what you’re investing in. And so I found that to be pretty cool because there were certain coins I was invested in that dropped 50% in value, but I only actually lost about 20% because of this, because it was earning me money all the way down.

Are crypto trading bots worth it?

Ultimately, you will need to decide for yourself. If you have money that you can afford to lose (because crypto is really volatile) and want a good chance at beating traditional stock market returns, then this might be something to consider.

So how did I learn about this?

Back in October, I had a friend who was recommending a program that he went through from this guy named Dan who was teaching his exact strategy of how he did this. And this guy actually spent millions of dollars kind of going through, trying to figure out the perfect settings and the perfect way to do this, to minimize risk and maximize gains.

So I ended up going through his program and that’s how I learned this whole thing. And I would love to share all the details with you, the exact details, but I can’t. Part of being a part of that program is that you have to sign an NDA non-disclosure agreement basically saying that you will not share the secret sauce with anyone else.

Like I said, Dan spent millions of dollars figuring this out so I can appreciate that he doesn’t want it to get out too far and wide. So you have to go through his course in order to learn the actual method and I can speak to it being a good course since I went through it.

So who is Dan Hollings?

He’s a former teacher so he’s really good at explaining things. And I’ve been in a lot of different online courses and there’s a lot of people with online courses who are not good teachers and he’s actually a really good teacher. I found it to be very, very helpful and I honestly think even if you don’t know anything about crypto, he can take you from those beginning stages to kind of help you navigate through this because, to be honest, it’s really pretty easy. You need to go through the training, it’ll take some time to learn everything but then once you have everything setup, it’s super passive and it’s very set it and forget it.

Some of my experience

Since I’ve began, I’ve changed my bots maybe three or four times. And you can just leave a bot run for sometimes months at a time without making any changes. And as Dan says in the class, a lot of times the best ones are the ones who just don’t do anything, just leave it alone and just let it run and run its course and just let it keep making you money passively throughout.

So like I said, I started doing this about five months ago and I feel like I’ve learned a lot in this process and I’ll just share a few of the highlights of things, some pros and cons.

Pros

1. I definitely think it’s legit

When I first saw this, there was a part of me that thought “no way, this is too good to be true.” But I don’t think this is a scam in any way. I’ve had my own money invested in this for over five months now, Dan seems completely legit, they have over 10,000 students at this point and he just does a lot of things really, really well.

2. You’ll have some hand-holding if you need it

The training is very thorough and very comprehensive. I went through at 2x speed because I’ve already been invested in some crypto and I feel like I knew the space a little bit, but for someone who hasn’t invested in any crypto at all, he definitely holds your hand and guides you through the whole process really well.

3. Fantastic customer support

They are very responsive and just very, very helpful. There were a lot of questions that I asked, maybe even to an annoying point, and they answered them all and there were even a handful where Dan himself came back and answered for me if someone else couldn’t find the answer.

And let me just make this clear – I consider this an experiment for myself and I’m okay losing my own money but before I ever talk about it with you, I want to feel confident that this isn’t a scam. Which I do feel confident of now! But I can’t guarantee that anyone is going to make or lose money with this. Which leads me to my next point – I want to show you how I did actually lose some money on a bot.

Like I was saying, when the coin value goes down – the GMT coin, let’s say this drops by 50% – if that’s the case, the value of this is going to go down. So unless I’ve earned enough to offset that with bot profit, if I were to sell it at this point, I would lose money in total on this bot. But that’s the thing, you don’t actually lose money until you sell. A big part of this whole thing is figuring out which coin pairs to pick and that is part of what Dan and his whole training was helpful in figuring out. So if I’m I’m confident in the coin pair I have, I can just hold onto it because it’s still making me money in the process. As long as it doesn’t go out of the grid range. And even if it does, I can still expand to that grid range. So even if it drops all the way down out of the grid range and it’s not making me money, I can extend the grid down and have it be making me money again.

All that to say, I had a couple coins that dropped in value but because I was using these bots on a lot of the coins I was holding, I didn’t lose nearly as much because it was making me money in the process.

“Cons”

1. Training takes some time

I probably spent a few hours going through the training so to some that might be a con. I already owned some Bitcoin, Ethereum, I had exchanges setup, I had a headstart. Someone brand new to crypto is going to have to open those accounts and some of those accounts take a day or two to open so it’s going to take a little time transferring money, etc. But once that’s done, like I said above, you’re literally just doing what he says to do and it’s pretty simple.

2. The course is expensive

Like I said above, Dan spent a lot of money trying to figure out the secret sauce so I understand why he wants to protect it so it’s an expensive thing to get into. But, if you look at the returns that you’re getting on even just a single bot, you can see how you’re earning your money back. Even if I continue to get 8% for the rest of the year, that’s close to a 50% return from this one coin pair. And that example is Ethereum which is proably one of the least volatile coins. So if I were investing in any other coins, even a little bit more volatile than this, the returns get a lot better.

To continue this example, in those transactions, it shows in just 4 days, it has done 636 transactions. Meanwhile, the far less volatile one has done 74 transactions in 2 months. More volatile = more transactions = more opportunity for earnings.

Dan said in the program that the average student is earning about 70% per year, which, again coming from the financial world is insane.

The caveat here, again, is that this is risky. It’s crypto, it’s a new world and a new industry. Just like when the internet started, there were so many people who made a lot of money because they were at the beginning of something really big. We’re still relatively at the beginning of mass adoption with crypto, and it’s becoming more and more widely used and adopted, but there’s still a lot of opportunity.

3. Sales team is a little pushy IMO

Like I said earlier, Dan is a former teacher, very gentle and does a great job explaining all this stuff. But the sales team he hired is a little bit salesy for my taste. And I might be sensitive to this but it’s just a bit more salesy than I’d like.

So what I did and what I would recommend you do is just look past that and look at the actual product itself and decide for yourself if this is something that you want to do.

4. It’s risky

I know I’ve said this a million times already but I want to make sure this isn’t lost on anyone. Risky means that there’s a big upside but there’s also a big downside. And you just have to know that going into it. I would never invest money that I was not comfortable losing in this. So don’t invest your grocery money, your retirement savings or your kids college funds in this.

We talk about the more stable, slower approach to investing in our 10x Investing Course and that is where I feel very confident in over the longterm. There will still be ups and downs but with crypto, it’s just a bigger roller coaster of ups and downs.

UPDATE 10/07/22

Since I wrote this in May, the market has been mostly down but the bots have been continuing to passively kick out profit each day.

My current returns are a little lower than they were in May, but for the last 3.5 months they have generated a 13.98% return of $558 of which I am thrilled.

And as to the passive nature of it, I changed a couple bots and added a couple new ones with profits and have probably spent less than 1 hour over the last 5 months working on it.

So all in all, I am happy with how they have been working. I would never want something like this to be my ONLY investment as it is too risky, but I personally allocate about 10% of my investments to riskier ones like this.

Interested in learning more about “the Plan”?

They only open enrollment 2-3 times a year and are currently closed. If you drop your email down below I can send you an email when they open up again.

Want to just try to this whole thing out without the training I took?

I am deeply grateful for “The Plan” and what I learned in it, but it is only open for enrollment a few times a year and I know some of you are adventurous explorers and like to just dive in. If that is you, you can learn more about the actual bot software that I use called Bitsgap here for as little as $29/month.

The training provides a ton of valuable info as well as Dan’s “secret sauce” settings to use at Bitsgap to get the best returns. But again if you want to explore Bitsgap on your own go for it!

If you join, let me know!

And if you have are part of the program, send me an email and let me know because I created a private group where we are all sharing ideas and what is working best with each other. Really I have just found it to be helpful to have others to chat with about the whole thing.

Have questions or comments? Leave them below and I’ll do my best to get back to you. I’m happy to be at the point with this that I feel comfortable sharing my opinion on this and helping you make the right decision for yourself, whatever that is!