One of my distinct childhood memories is riding with my Dad as I sat in the passenger seat of our old Ford Escort. It was a hot summer day but we had the windows down because the A/C didn’t work.

We were on a busy road, and as my dad pulled up to a stoplight, the transmission made a sound that, even as an 8-year-old, I thought, “that didn’t sound good”.

The light turned green, my dad hit the gas pedal and got nothing but a revving engine. I could immediately see the concern in his eyes as he quickly grabbed the gear shifter, trying to get the car in gear.

After about 10 seconds, the car behind us began honking.

And then he honked again and again, clearly agitated. And then other cars joined in the chorus of honking cars.

As a kid, all I knew was that our car wasn’t working, but looking back, I can see the tremendous pile of stress that was piled on my dad in that moment.

Because he had been out of work for nearly a year at that point because of a job-related injury.

And in his blue-collar workplace, if you didn’t work, you didn’t get paid.

Truth be told, there were probably 5+ years of my childhood when he wasn’t working because of injuries from his job.

And even with a full savings account, if you are out of work for years, things become pretty tight really quickly.

But being “broke” is relative. At our worst financial point, there are plenty of people who would have gladly traded positions with us.

All that to say, these are the lessons that I learned growing up broke.

1. You have to remember that someone always has it worse.

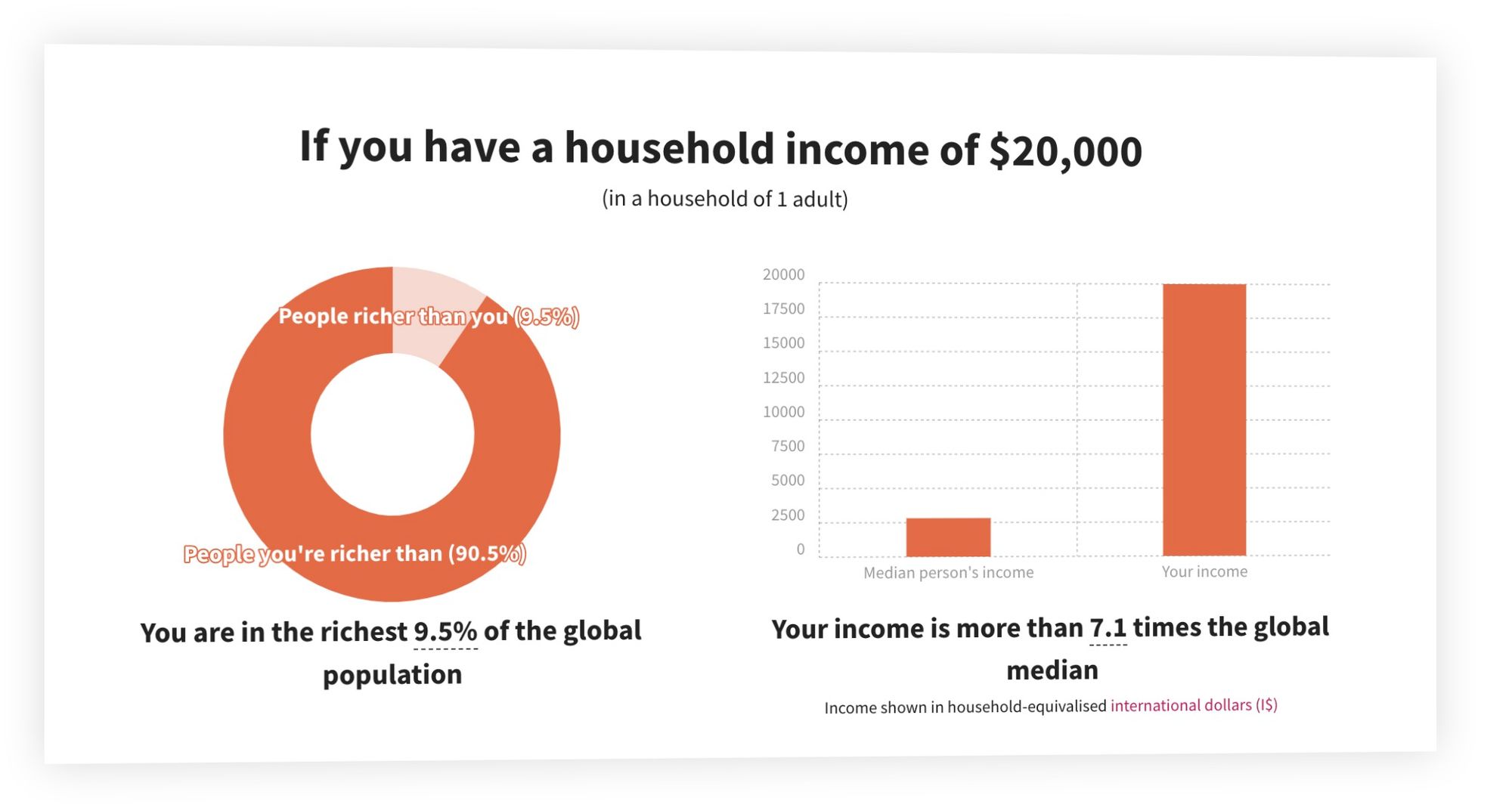

Like I just mentioned, in my case, even at my brokest point, I was still probably richer than 90% of the rest of the world.

And if you are reading this, you probably are, too.

I don’t know about you, but for me, this strangely made it easier to handle when I discovered so many others are making it with far less.

2. It costs MORE to be broke.

When I was 20, I worked at a bank, and I distinctly remember our branch manager bragging about how this one customer (who over-drafted at least weekly) had generated over $700 in extra revenue for the bank.

So when you overdraft your bank account by $20, then the bank charges you a $30 overdraft fee, you now need to come up with $50 just to get back to $0.

Or if your utilities get shut off because you were late on payments, you almost always have to pay an extra fee just to get them turned back on.

Or how I love shopping at Costco to get the bulk discount, but when you are broke, you have to buy the smallest quantities just to survive – which always cost considerably more.

The point is, when you are broke, the odds are stacked against you. Which is really hard and unfair, but it leads to the next point…

3. You have to pick your hard.

It is really hard climbing out of a deep financial hole. But it is also really hard living in it.

And if you don’t try to claw your way out, it just gets harder.

So, if it is going to be hard either way, you might as well choose the hard that will ultimately get you where you want to be.

4. When “there isn’t enough money to budget” is when it is the most important thing to do.

I hear this all the time. And my question is always the same.

What better alternative do you have?

It is like being in a canoe in the middle of a lake with five holes in it. You can’t plug them all, but if you try to plug what you can, you might just be able to row to the shore before you sink.

If you want to check out what has worked for us (when nothing else did), check out our Real Money Method course.

5. Working hard is good, but working smart is better.

Not enough people understand the value of working hard. But you probably know a lot of people who work really hard and who are still broke.

Working hard alone isn’t the answer. It is far more important to work on the right thing than to work hard on the wrong thing.

6. You can’t let it define you!

Being broke can be a temporary condition, or it can be a belief or mindset that you carry all your life. Never let the current circumstances affect your beliefs or mindset – because that makes it really hard to climb out.

Someone with a wealthy mindset who finds themself broke because of bad circumstances will find themselves getting out of that situation a lot quicker than someone with the belief that this is who they are rather than looking at the situation and the current circumstances that brought them to that place.

My parents did this really well. Even though they were dealt some particularly challenging financial circumstances that lasted for many years, they never let them define them. They kept on working and eventually found themselves in far better circumstances than I think they ever thought possible.

7. Hard things make you stronger if you let them.

The strongest people I know are the ones who have gone through a thing or two. But as they say, the same sun that melts wax hardens clay. It is up to us how we respond to the challenges that we face.

So we can let the circumstances put a chip on our shoulder, or we can see that God might just want to use our challenges and experiences to be a vehicle to help other people dealing with theirs.

And let me encourage you…

If this is where you are right now…

Or even if this is where you have ALWAYS been… it is not your final destination.

God isn’t done with you yet.

I have watched God do miracles and move so many up and out of terrible and unfair financial situations.

Stir up your faith and get your expectations up of what God wants to do in your financial life!

Fear not, for I am with you; be not dismayed, for I am your God; I will strengthen you, I will help you, I will uphold you with my righteous right hand.

Isaiah 41:10

Your friend and coach,