A recent survey done by Bankrate showed that 56% of Americans have less than $1,000 in their bank account (both savings & checking).

Just reaching that $1k milestone is proving to be a significant one in this economy that we find ourselves in.

So, if you have, you know it’s a fantastic feeling knowing you’ve got a little cushion.

But now that you’ve reached this milestone, what’s next?

How can you make the most of this money and set yourself up for a brighter financial future?

Here are 5 smart moves to consider:

(Disclaimer: I have personally made each of these moves and found them to be incredibly beneficial, but please don’t take this as specific financial advice for your situation. Please prayerfully do your own research to determine what is best for you!)

1. Get the passive income App that Allowed Me to Start Investing in Real Estate with only $10

Real estate investing can be a powerful way to multiply your money, but it often feels out of reach for the average person.

That’s where Fundrise comes in.

With as little as $10, and in 5 minutes, you can start investing in a diversified portfolio of real estate projects.

It’s a simple, accessible way to dip your toes into the world of real estate investing and potentially earn solid returns.

I have personally been investing with them for over 7 years at this point, and it is one of my favorite sources of 100% passive income.

A quick note on recommendations: I’m incredibly picky about what I share. My rule? If I wouldn’t recommend it to my mom or sister, I don’t share it with you. I’ve actively invested with Fundrise since 2017 and have really enjoyed it which is why I recommend them. If you do decide to join and use our links, we will earn a small commission which helps support our work and funds our community giveaways. Thank you for supporting the work we do. Find out more here.

2. Open a High-Yield Savings Account That Puts Your Bank to Shame

The sad truth is if you bank at any of the top 3 biggest banks in the US, you are getting massively ripped off.

Each of them is currently paying you a measly 0.1% (or less) on your savings.

Meanwhile, smaller and mid-sized banks like CIT are paying 45x more (currently 3.9%).

So what I did was keep my checking at my big bank, but I also set up a savings at CIT so I can easily transfer money back and forth and earn 4500% more on my savings than what US Bank was paying me.

(For those RMM students wondering, Ally is competitive on their savings rates as well.)

If your $1,000 is just sitting in a traditional checking account, it’s not doing much for you.

You might want to consider moving some to a high-yield savings account like CIT Bank’s Savings Connect, with their 3.9% APY.

It’ll probably take you 20-30 minutes of “work”, you will be earning significantly more interest, and your money will grow faster without any extra effort on your part.

3. Get the credit card the financial experts can’t stop talking about

I have been a professional money blogger for the last 17 years, and whenever I go out to dinner with financial experts, there is one credit card that I see pulled out more than any other, and it is the Chase Sapphire Preferred.

It is the card that most financial experts use, and for good reason.

But why? What is it about this particular card that has earned it such a loyal following among finance experts?

For starters, it offers an unbeatable combination of rewards, perks, and flexibility.

With bonus points on travel and dining purchases, a generous sign-up bonus, and the ability to transfer points to a wide variety of travel partners, it’s no wonder this card is a hit among those who appreciate maximizing their spending power.

It also offers a host of travel protections, including trip cancellation and interruption insurance, baggage delay insurance, and primary car rental coverage. For financial experts who are constantly on the go, these added layers of security can be invaluable.

And speaking for our family, being the nerd that I am, I actually opened 34 different credit cards to find the one that was best for our family and this was the winner, and has been our go-to card for the last decade.

As I always say, the rewards on this card are fantastic, but there is no point if you aren’t paying off the balance in full each month! So, know yourself, and always remember to pay off your balance each month to avoid interest charges!

4. Take an Investing Class (Especially if You’re Serious About Growing your Money)

When I was just 17, my uncle handed me a book that would change the course of my life.

It was a guide to investing, written by the experts at The Motley Fool – arguably the most respected investing education company in the world.

That book planted a seed of curiosity that quickly grew into a full-blown passion. Inspired by what I learned, I started saving every penny I could, eager to dive into the world of investing.

With my meager savings, I bought my first stock, then some mutual funds. From there, it was like a snowball gaining momentum down a hill.

Just a few years later, a single stock sale allowed us to pay off our entire mortgage. It was a moment that left me stunned, grateful, and forever indebted to my uncle and The Motley Fool. They had made the complex world of investing accessible to me, even as a teenager, just starting to find my way.

If you’re ready to start your own investing journey, The Motley Fool’s investing classes offer a wealth of knowledge that can put you on the path to financial freedom, just like they did for me.

Or, if you are interested in getting a Biblical perspective in my 10x Investing course you’ll learn how to multiply the money you’ve been entrusted with using time-tested and proven investing strategies.

You’ll get our 7-day checklist to your first investment, and you’ll look over my shoulder as I show you (down to the buttons to press) how to begin your investing journey.

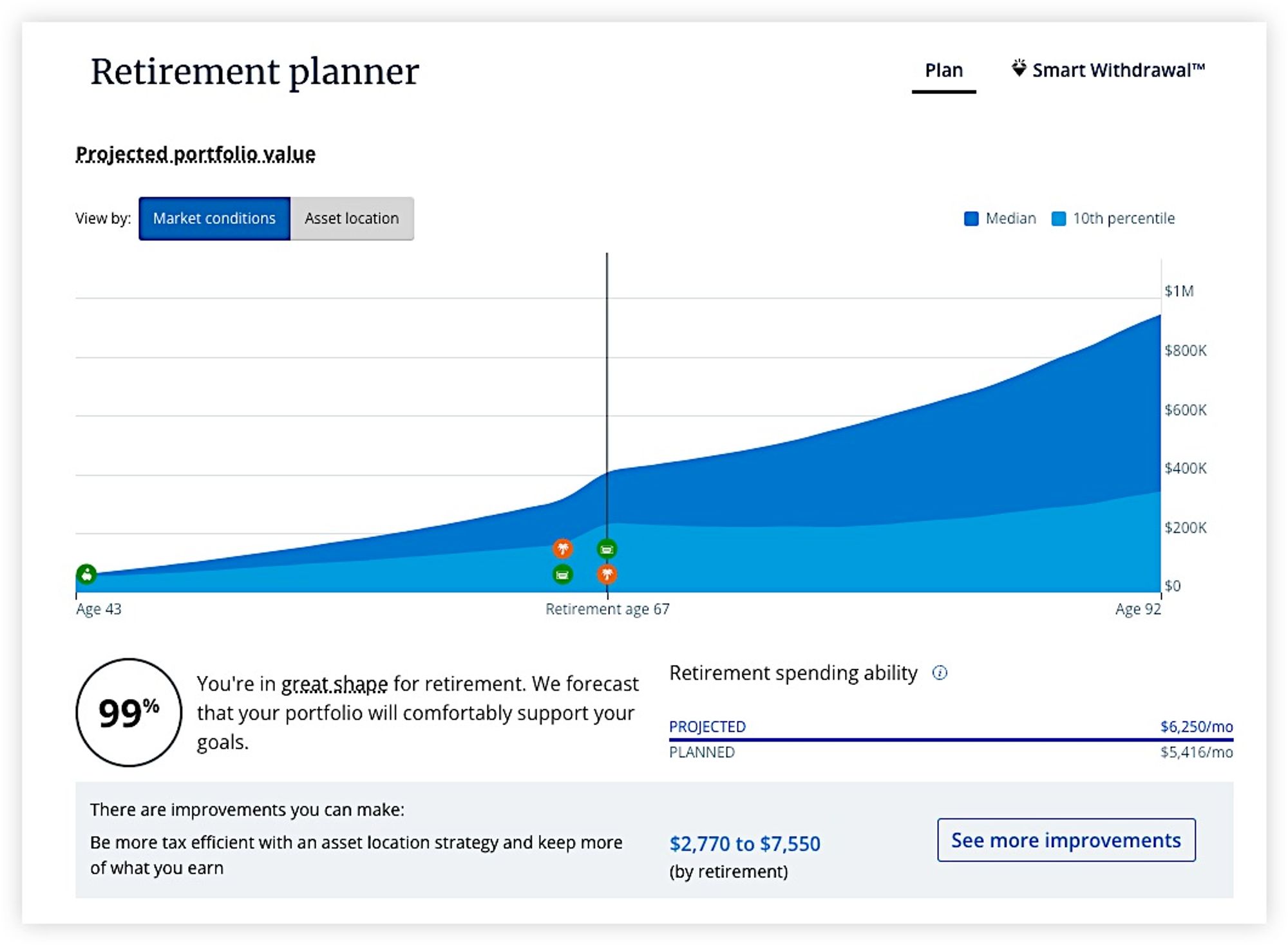

5. Discover when you’ll be able to retire with Empower’s Retirement Planner

Imagine if you could get a clear estimate of when you can realistically expect to retire – all in just 5-10 minutes.

Sounds too good to be true, right?

But that’s exactly what I’ve done with the FREE Empower Personal Dashboard app.

Here’s how it works: First, download the app or sign up for a free account on their website. Then, securely link your 401k, IRA, and bank accounts using their state-of-the-art, bank-level encryption.

Next, navigate to the Retirement Planner tab. Input your target retirement age and a few other key details. Within minutes, the app will generate a comprehensive projection of when you can realistically expect to retire based on your current financial trajectory.

But it doesn’t stop there.

They’ll also provide you with specific, actionable recommendations tailored to your unique situation. These insights can help you optimize your savings, investments, and financial habits, ensuring you’re on track to retire on your terms, with the income you need to live the life you’ve always dreamed of.

I personally no longer use it for expense tracking, but it has so many other great uses that it is still high on my list of recommended tools.

In my opinion, Empower’s Personal Dashboard is hands-down one of the most powerful financial tools available today – and the fact that it’s completely FREE is just mind-boggling.

Hitting the $1,000 mark in your checking account is a significant milestone, but it’s just the beginning…

By making smart moves with that money – investing wisely, protecting your identity, and planning for the future – you’re setting yourself up for long-term success.

Remember, every step you take today, no matter how small, can have a profound impact on your tomorrow.

So don’t let that $1,000 just sit idle. Put it to work for you.

Your $1,000 is a seed – it’s up to you to nurture it, grow it, and watch it blossom into the financial future you’ve always dreamed of.

So take that first step today, and keep moving forward. Your future self will thank you.

Your friend and coach,