The hidden cost of compromise in financial discipleship—and what church leaders can do about it

Churches across America have been running financial classes for decades. Yet here’s an uncomfortable question worth asking: If these classes are working, why isn’t the church becoming measurably more financially free—or more generous?

The data tells a sobering story. Consumer debt continues climbing to record levels. According to Nonprofits Source, church giving has remained stuck at 2-3% of income for years. And by most financial measures, Christians look remarkably similar to everyone else when it comes to how we handle money.

What if the financial struggle in our churches isn’t because people won’t change—but because we’ve given them a compromised approach that was never designed for the world they actually live in?

The Hidden Experiment Nobody Signed Up For

Something unprecedented happened between 1950 and today. In 1950, Diners Club introduced the first multipurpose charge card. Eight years later, Bank of America launched what would become Visa. By the end of the 1960s, credit cards had transformed from a novelty into an industry.

The numbers tell the story. According to the Federal Reserve Bank of New York’s Q4 2024 report, consumer debt has exploded from nearly zero in the 1950s to over $18 trillion today. Credit card debt alone now exceeds $1.2 trillion, with average interest rates above 22%.

We’ve never seen anything like this in human history.

No generation before ours has lived with this level of frictionless spending, targeted advertising, debt normalization, and constant financial comparison through social media. We’re living inside a massive experiment—and most of us were never taught how to survive it.

When churches first started helping people with finances decades ago, the world looked nothing like it does today. The gig economy didn’t exist. Instant credit didn’t exist. Social media-driven consumer pressure didn’t exist. Even managing a dozen subscription payments wasn’t a thing.

So the first wave of financial teaching in the church made perfect sense for its time: “Let’s just teach people the Bible verses about money. That should fix it.” And honestly, in a simpler financial world, that approach had merit.

But the financial world radically changed while much of that teaching stayed frozen in place. People became increasingly overwhelmed, and what once worked stopped working.

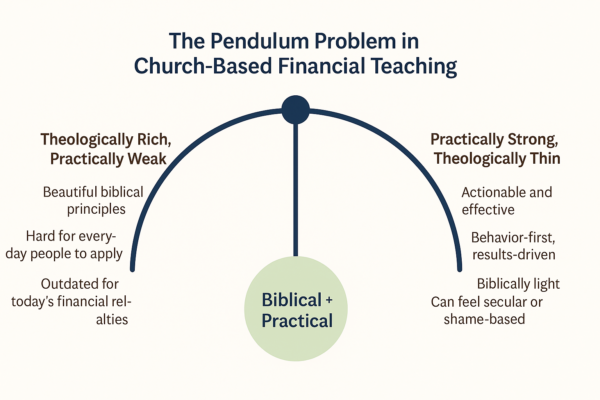

The Pendulum Problem

When church leaders try to address personal finance, the pendulum almost always swings to one of two extremes.

On one side: theologically rich but practically weak.

This is the world of biblical principles—which are beautiful and true—but often really hard for everyday people to actually do anything with. People nod their heads, agree with the teaching, but nothing changes in their day-to-day financial lives. As the financial reality for many has become more complicated, that gap has only grown.

On the other side: practically strong but theologically thin.

These programs get very step-by-step, very behavior-first. And they can work—but sometimes they feel more like secular financial coaching with a couple Bible verses sprinkled on top. The deeper discipleship gets lost. Pastors feel that tension, even if they can’t quite name it.

For decades, churches have been asked to choose: Do we want something deeply Biblical but hard for people to live out? Or something really practical but not very Scripturally rooted?

“God’s Word speaks to every financial decision anyone makes at any time, under any set of circumstances.”

— Ron Blue, Founder of Kingdom Advisors

Meanwhile, millions of Christians are faithfully showing up at church every week while quietly drowning financially—not because they’re irresponsible, but because no one taught them how to survive the world they actually live in.

The Hidden Cost of Compromise

Compromise always feels harmless in the moment. It feels like “this is the best we can do right now.” But compromise has a cost—and it’s not small.

Research from Barna Group reveals a troubling reality about Christian financial health:

- 32% of practicing Christians struggle with personal debt

- 40% of Millennial Christians struggle with debt

- 33% of born-again Christians say it’s impossible to get ahead because of debt

- 37% of regular church attenders give nothing to their church

Compromise costs people their freedom. When we do nothing or rely on outdated tools, people stay stuck—in debt, in anxiety, in patterns they don’t know how to break.

Compromise costs marriages. Doing nothing—or doing the wrong thing—leaves couples fighting battles alone that the church could help them win.

“Arguments about money is by far the top predictor of divorce.”

— Dr. Sonya Britt, Kansas State University study of 4,500+ couples

Compromise costs discipleship. Money is forming our people every single day. If the church doesn’t disciple them here, the world absolutely will. And is.

Compromise costs pastors their time and energy. According to Lifeway Research, 65% of pastors work 50+ hours per week. They end up counseling the symptoms of financial problems—marriage conflict, anxiety, burnout—instead of addressing the root.

Compromise costs generosity and mission capacity. People genuinely want to give. They want to live generously. But they’re financially strapped and emotionally exhausted. According to Nonprofits Source, Christians today give approximately 2.5% of their income—less than the 3.3% given during the Great Depression.

Compromise costs the church credibility. When the church avoids the topic that creates the most stress in people’s lives, it unintentionally communicates: “We can’t help you with the thing you’re actually struggling with.”

The painful truth is that most of these costs stay hidden until it’s too late—until a couple is in crisis, until a person is drowning in debt, until a pastor is overwhelmed, until giving is down and ministry is strained.

A Better Way Forward

Somewhere along the way, we started believing our only choices were to do nothing (and leave it to someone else), settle for good teaching but little change, or accept legalistic rule-thumping that guilts people into action.

But what if those weren’t the only options?

Churches don’t have to settle for either/or. Christians shouldn’t have to choose between being discipled Biblically and actually getting the practical help they need.

There’s a middle space—one that is both fully Biblical and fully practical, designed for the financial world people are actually living in today. An approach that honors discipleship and drives real behavior change.

What does that look like in practice?

It starts with grace, not guilt. After teaching 10,000+ students over 15 years, we’ve learned that people are already burdened with financial guilt and shame. They don’t need more. What they need is a judgment-free space to learn, grow, and discover the freedom that comes from aligning their finances with God’s will.

It focuses on what actually works today—not 20 years ago. The specific apps, tools, and systems that help people manage money in a world of subscriptions, gig income, and instant credit. Not textbook theory. Practical application.

It’s rooted in stewardship, not accumulation. We’re not owners but managers of everything in our possession. True financial freedom isn’t about yachts and private islands—it’s about being free to fulfill your God-given purpose without money getting in the way.

It makes generosity the goal, not an afterthought. Financial success shouldn’t be measured by how much we accumulate but by how much we give. When people get their finances in order through a grace-based approach, generosity becomes the natural overflow—not a guilt-driven obligation.

The Question Worth Asking

For any leader in the church, it comes down to this: Why are we compromising?

The world has changed dramatically. People’s financial pressures have multiplied. And the church has an opportunity—maybe even a responsibility—to meet people where they actually are with something that actually works.

Because compromise isn’t neutral. It’s shaping people whether we acknowledge it or not.

The good news? There’s a better path. One that doesn’t require choosing between two bad extremes. One that transforms the way people think about money, helps them find financial freedom, and makes them naturally more generous along the way.

That’s not just possible. It’s happening in churches right now.

The only question is whether your church will be one of them.

• • •

About the Author

Bob Lotich is a Certified Educator in Personal Finance and co-creator of True Financial Freedom, a grace-based financial curriculum for churches. Along with his wife Linda, he’s spent 15 years helping Christians discover that managing money for God’s glory doesn’t have to involve guilt or shame.

Their work has been featured on Focus on the Family, the Carey Nieuwhof Leadership Podcast, Proverbs 31 Ministries, and the YouVersion Bible app. Their book Simple Money, Rich Life was named the 2022 Christian Book of the Year.

To learn more about bringing True Financial Freedom to your church, visit seedtime.com/true.

—

Sources

Federal Reserve Bank of New York, Quarterly Report on Household Debt and Credit, Q4 2024

Barna Group, Christian financial health and tithing research (2008-2024)

Dr. Sonya Britt, Kansas State University, “Examining the Relationship Between Financial Issues and Divorce,” Family Relations (2012)

Lifeway Research, Pastor time usage and ministry health studies (2008-2023)

Nonprofits Source, Charitable Giving Statistics 2024

Ron Blue Institute for Financial Planning