It isn’t too difficult to find a place to file your federal tax return for free, but finding a way to get free state income tax filing is another story.

So if you are asking “where can I file my state taxes for free?” – you are in for good news!

I did a little digging and found a few options to consider . . . .

How to File Your State Tax Return for Free!

As you have probably noticed, many places offer a free filing of a Federal return but don’t offer free state filing.

But there are a few ways to get your state income tax returns done for free and in this article, I am showing you free file programs that I found…

1. TurboTax (Free File program)

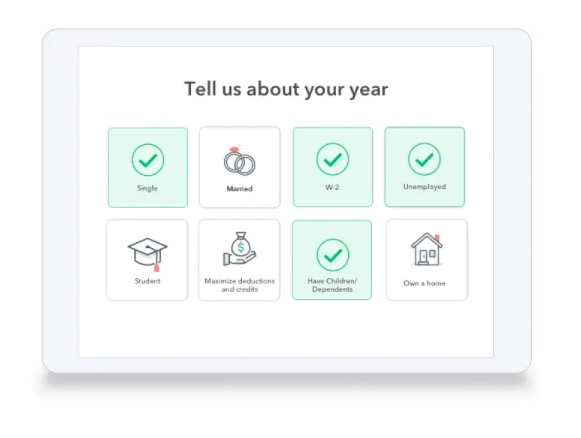

TurboTax (for a limited time) has rolled out their TurboTax FREE file program (for simple tax returns only; not all taxpayers qualify) where you can get your Federal, State, and filing all done free.

(for simple returns only)

They still offer paid options for more complicated tax returns, but if you don’t have too much craziness going on with your taxes you will probably be eligible for their free program.

TurboTax has a long history of offering free Federal returns but people were always asking “Is TurboTax free for state filing?” and now the answer is a “yes”! (for simple tax returns only)

I personally love how simple and intuitive TurboTax is to use. You just answer their simple questions and they tax care of the rest.

You can read more about the details of who is eligible on their website and get started on the TurboTax Website.

2. Cash App Tax

This is a service of Credit Karma and was formerly known as Credit Karma Tax. They too offer a legitimate totally free way to prepare and file both your state and federal taxes.

They are no longer the new-kid on the block in the financial world, but have grown to be a very reputable company who offers a lot of great products for free.

Get started with Cash App Tax.

Other Free State Income Tax Filing Websites

3. MyFreeTaxes.com ”“ This is a not-for-profit with funding from the Walmart Foundation, The United Way and H&R block ”“ and they offer free state and federal tax returns if you meet the criteria.

4. On-Line Taxes ”“ This one is pretty simple. You have to have an adjusted gross income within a certain range. If you don’t qualify both returns cost $7.95. They are a little bit different than many of the other places in that they offer free customer service with a toll-free number, e-mail, and live tax help. They also allow you to view the forms before paying.

Do I need to file a State tax return?

Sadly, most of us in the United States do.

So just check the list below to see if your state is listed. If it is, then you probably are going to want to use some of the free state tax filing options above.

(Accurate at the time of the last update: 3-8-2021)

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- New Hampshire*

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee*

- Utah

- Vermont

- Virginia

- West Virginia

- Wisconsin

(* these are special cases, talk to your accountant)

How to File Your Federal Tax Return for Free!

In the past, I have gone to the IRS free file webpage, because they have links to a bunch of tax preparers that offer free tax return filing (for federal anyway). Some of them offer a state return to be filed for free as well, but most don’t.

If you are interested in this option, you will have to use the links on the IRS page in order to get the free efile deal they are offering. Many of the tax preparation websites listed will not offer you the free efile if you go directly to their website.

Another Option: Go to Your Local State Government Website

Also, you can go directly to your state’s Department of Revenue website to see if they offer a free income tax filing option.

Worst Option: Get the Paper Forms and Mail Them In

Yes, it sounds pretty archaic, but if you really want to file your state return for free and don’t qualify for the options listed above, this might not be a bad option. If you have already completed the federal form online, it should be pretty easy to fill out the state return. You can get the forms from your local library or you can print them off at your state’s Department of Revenue website.

One Last Tip About E-Filing Your Tax Return

Do it before Friday morning. The government processes tax returns in week-long blocks. So Friday morning at 11 am, they process all the returns they received over the previous week.

So if you can sneak it in right before the cutoff (Fridays at 11 am EST) you will just get your refund that much quicker . . . .