(The following is an abbreviated transcription from a video I recorded. Please excuse any typos or errors.)

I remember when I first started looking at Medishare, I was clueless as to how much it would cost compared to traditional health insurance.

It ended up costing us about 50% less than regular insurance, which was really nice to see.

At this point, I have been using Medi-Share for my family as our health insurance alternative for over 10 years.

And the truth is that when it comes to determining how much it costs to use Medishare the prices vary quite a bit based on a whole bunch of factors.

To get the exact monthly cost of what it would cost you and your family, just go fill out this quick form here to get the EXACT cost.

But, after you fill that out, you will find that another big factor that affects how much Medishare will cost you and your family each month is the deductible (or “Annual Household Portion” or AHP as they call it).

And this is where things get interesting.

AHP: The Medishare Cost you can easily control

With Medishare the AHP functions just like an Annual Deductible. So you pay for everything out of pocket until you reach that annual deductible, and they pay for everything else for the rest of that year.

Understanding how the Medishare AHP works

For example: say you had a $3,000 AHP with them. And then a $1,000 medical bill comes in. First they would negotiate that bill down for you to say $500. Then you would pay that $500 out of pocket and it would use up $500 of your AHP, leaving you with $2,500 left until they begin covering the bills. If next month you had another $500 bill you would be responsible to pay it, but you would only have $2,000 left in your AHP. But over that 12 month period if your bills crossed that $3,000 point, then they would begin covering them.

Or looking at another example: say you had $20,000 in medical bills (we actually just recently had this happen to us) and you had the $3,000 AHP, then you would only be responsible for $3,000 and Medishare would cover the other $17,000 in bills. Additionally any other medical bills that came in until that year was complete would be covered by them.

Now that is out of the way, let’s get to the fun stuff… how to determine which AHP to use to reduce your Medishare costs.

Medi-Share AHP Cost Calculator and Comparison

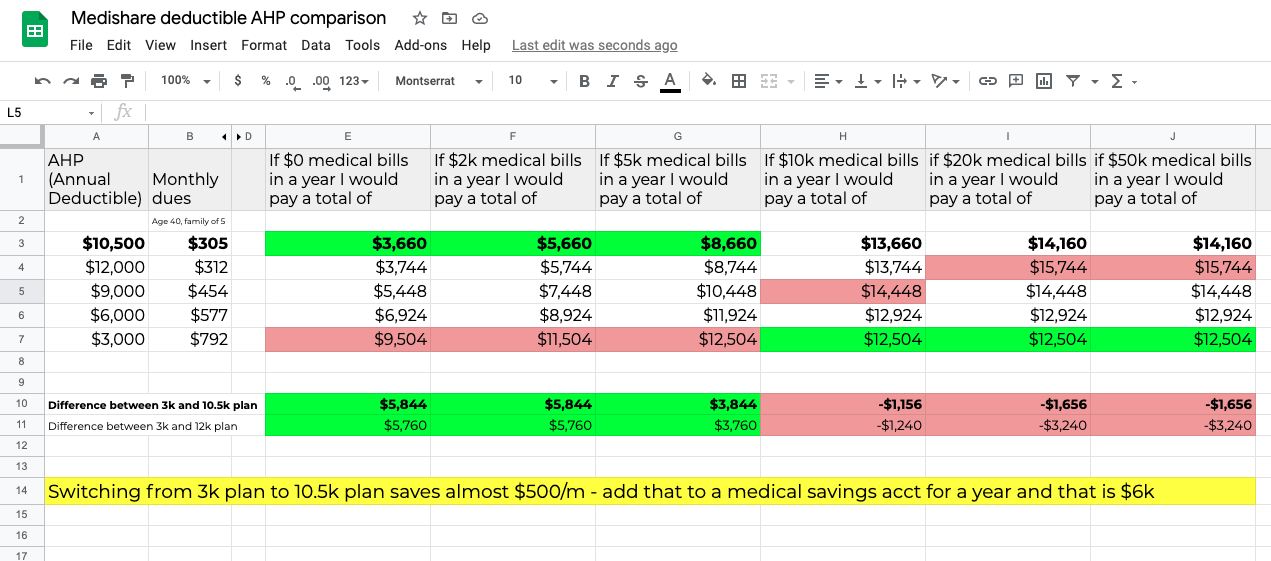

I decided to get all numbers nerd on this and build out a cost calculator (spreadsheet) comparing the different AHP options

I recorded a video going into full detail that will help better explain the numbers…

Spreadsheet Overview

Before we get started, I’ve already broke it all down for you! I created this spreadsheet to make deductible selection easier or you. It’s totally customizable and you can download your free copy of this Medishare cost calculator by clicking this link.

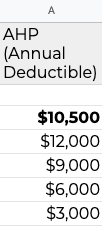

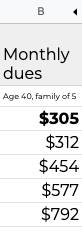

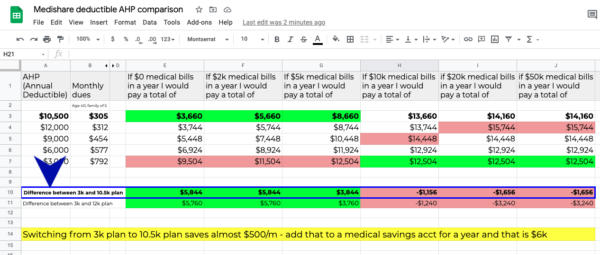

You will notice on row 3, this is the plan that I currently have, which is grandfathered in. I don’t think they offer it anymore. But per year we have to incur $10,500 of expenses before they begin paying. We intentionally have a high deductible plan because the dues are so much lower.

So first column (column A) is the AHP. This is their annual deductible. They call it an annual household portion. And so this is the annual amount that you need to reach before they start paying anything.

The second column (column B) displays the monthly dues. And this is what we have to pay each month for our family of five. And, I’m age 40… for anyone who is curious.

If we had zero in medical bills

So what did, is I broke down all these different categories of if we had zero in medical bills. How much would we have to pay total for the entire year in actual medical bills? Along with the total of our dues.

I broke it up by $0, $2,000, $5,000, $10,000, $20,000 and $50,000. And I want to talk through this just a little bit.

If we opted for the low AHP (deductible)

We could get the really low AHP or annual deductible. But then our monthly dues go up almost $500 more, about an additional $6,000 a year (specifically, we would go from paying $305/month with the higher AHP to $792/month for the lower AHP).

Currently (at our high AHP/deductible of $10,500), if we incurred $0 in medical bills in a given year, we would pay these monthly dues for 12 months (at $305/month). It would be a total cost of $3,660.

Now, if we switched to the lowest AHP of $3,000 (deductible) and had zero medical bills, we’d be paying about $9,500 for the year ($792/month times 12).

So that’s a huge savings.

Difference in cost: my $10,500 AHP plan vs. the new high AHP selection of $12,000

In row 10 (outlined in blue) you will see my grandfathered in high AHP plan of $10,500. I wanted to show you this because right now, if you opt for the high deductible plan with Medi-Share, I think the only option you have is the new $12,000 AHP plan. In rows 10 and 11, you will see the difference between the old high AHP (what I have of $10,500) and the new high AHP ($12,000).

So the point is, I’m saving $5,800 out of pocket if I have zero medical bills in a given year with my current $10,500 AHP plan. And, it’s also very similar if you had the $12,000 AHP plan.

The bottom line is in this case, if you don’t have any medical bills, or if you’re someone who just never goes to the doctor, you’re going to save a lot of money by getting the high AHP (deductible) plan.

Evaluating the high AHP differences

We’ve been on this high AHP (deductible) plan for probably eight or nine years now. And honestly this year is the first year that we ever reached our deductible of $10,500. Every other year, we haven’t had enough medical bills to reach that amount. And I would guess that our average medical bills total somewhere in between $2,000 and $5,000 for an average year.

Averaging $3,500 a year in medical bills

In each of these higher AHP cases, let’s say we average $3,500 a year in medical bills, we’re still coming out way ahead (than if we opted for the lower AHP selections). So with the $12,000 AHP plan, we still come out almost $6,000 ahead annually and really similar to our $10,500 AHP plan (saving $5,800 annually).

Averaging $5,000 a year in medical bills

Even if we went up to $5,000 a year in medical bills, we still are coming out almost $4,000 ahead, than if we had opted for the low AHP plan.

Selecting a lower AHP plan: $6,000 or $9,000

Now, these aren’t the only two options. They have some options in between as well, this $6,000 and $9,000 option as well. And I just broke this up between the high and the low just for my information.

Opting for the High AHP plan

But the point being here for me is we are definitely going to stay on the high deductible plan with the low monthly dues.

So instead of paying $800 a month, we’re only paying $300. We’re putting $500 a month into a savings account that we’re earning interest on and that we can actually do other things with it if we need to. By just doing that, if we just say $500 a month over the course of the year, that’s $6,000.

So that’s a ton of money between having the low deductible plan and the high deductible plan. Like that’s a lot of money over the course of the year that we could have up to $6,000 being saved into that account that we’re earning interest on that we don’t have to use on medical bills. So that just provides a big kind of cushion.

Unforeseen medical expenses

Now like I said, this year was the first year Linda had a little medical emergency. And so we ended up having some pretty big hospital bills. And so we crossed the $10,500 point for the first year since we’ve had Medi-Share.

We’re probably in the $15,000 range in medical bills year, and not under the $10,500. When I split the difference between these two, we’re probably only $1,500 worse off this year than if we would have been on the low AHP (deductible) plan.

But in our case, every other year we’ve been averaging probably only $3,500/$4,000 a year in medical bills. We’ve come out so much further ahead than having one year where we’re a little bit behind by being on this high deductible plan, where it bites us a little bit. It’s still not too bad at all.

What if there were $50,000 in medical bills?

I took it all the way up to $50,000 in medical bills, just to see what would happen. In that case, being on the low AHP plan, you are going to benefit the most. So that if you have $50,000 in medical bills in a year, you’re going to spend $12,500 total on all of those medical expenses for that year.

And the difference here again, between at our $10,500 AHP plan and the low AHP plan is only $1,500. So it seems to me, the trend here is pretty much that these two are the same. And it seems like it’s just going to carry forward.

What if the medical bills exceeded $100,000?

Even if we go up to $100,000 or $200,000 in medical bills, or something crazy, The worst case scenario for us is that we come out negative a hundred and $1,600.

And so for me, when the most likely scenario is that we are probably going to be about $4,000 ahead for our family. To have a small chance of being negative $1,500, the high deductible plan for us just makes so much more sense, you know?

Looking closely at the $12,000 AHP plan

And so your family might be a little bit different and because we’re grandfathered into this better plan, it’s a little bit different when you have the $12,000 deductible. So in this case, the worst case scenario, looks like you’re going to be out about $3,240. That’s a little bit different. It gets a little bit closer to something where you want to consider this a little bit more.

Now with that said, still looking at row 11. For example. If we didn’t have the $10,500 plan, it was gone and we had to have the $12,000 plan, I think I would still stay on that for our particular family (who spends, again, let’s just say $4,000 a year). We’re still going to come out ahead most years. We’d have about $4,000 in savings for most years. And then occasionally, if we do have a really bad year where we have a lot of medical expenses, we’re going to be negative $3,200.

Now for us, looking back these last nine years, eight of those nine years we’ve probably averaged about $4,000 in annual medical bills. And now we have one year where we have $10,000 to $15,000 in bills. So most years we’re going to be about $4,000 ahead with occasionally having a year where maybe we’re somewhere from $2,000 to $3,000 behind.

Summary

In the long run, I think we’re still going to come out way ahead for our family with the $12,000 AHP deductible (if we had to change from the $10,500 AHP plan).

Anyway, those are just some big picture thoughts on this and breaking some of these numbers down for you.

I don’t know your family and I don’t know your situation. You’ll have figure out which AHP (deductible) plan is best for your own family. To help you, here again is the link to the cost calculator spreadsheet so you can play around with the figures for yourself to make the decision that is right for particular situation.

Hopefully you found this helpful. And, if you are trying to figure out what Medi-Share AHP makes the most sense for you, hopefully this gives you a little bit of insight and gives you some things to think about.