I’ll be honest. I get contacted multiple times a day from various companies wanting to advertise on SeedTime or wanting us to promote “their thing”.

And 99.9% of them get the delete button. Not all of them are bad (though many are), but I only work with advertisers that have products that I am actually interested in myself.

So when Prudential reached out wanting to advertise their new savings goal calculator with me I was skeptical, but I figured I would at least look into it – after all, they are Prudential – I think they were around before my grandparents were born. 😉

And in looking in to the new tool they created, I was actually kind of impressed – so I agreed.

All that to say that this is an article that they sponsored, but as with every review I write, I maintain 100% control of what I say about the product – whether good or bad.

So what is this new savings goal calc they created?

They call it LINK by Prudential and they describe it like this:

“LINK by Prudential is a personalized experience that learns about what’s important to you and connects you with solutions and financial professionals to help you achieve your goals. No matter what changes come your way. LINK is flexible, giving you guidance throughout your financial journey.”

So the gist of it is that it is a savings calculator/estimator that creates personalized info for you about whether you will reach your savings/retirement goals as well as what you need to do now to get there.

That in and of itself isn’t that unique, but the fact that it continually adjusts for you as you move forward is pretty interesting.

Getting started

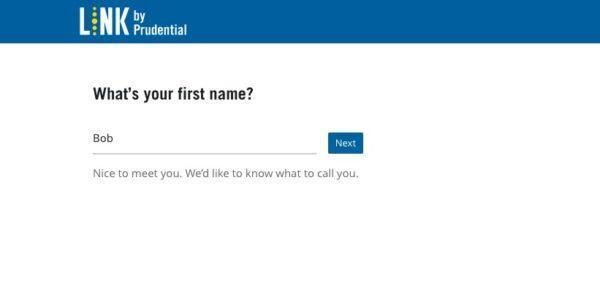

First thing is to start answering some basic information like:

- Name

- Marital status

- Number of dependents and ages

- Place of residence

- Age

- Current income

- Your monthly expense total

- Current college savings for your kids

From there is creates a few financial goals that it thinks you might be interested in like:

- Creating an emergency fund

- Saving for a new baby

- Saving for a house

- Saving for college for each child

- Saving for retirement

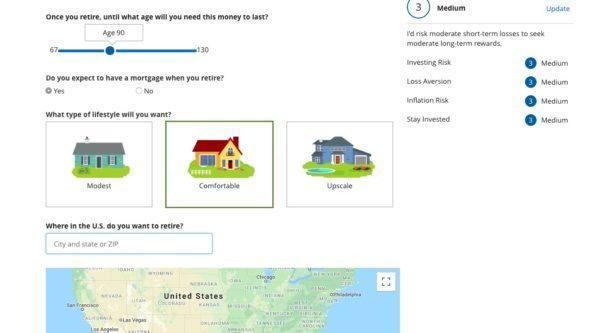

And then it also assesses your risk tolerance.

It goes on to ask you more questions about each particular goal. In my case, I used some sample data and it asked me these questions about my desires for “retirement”.

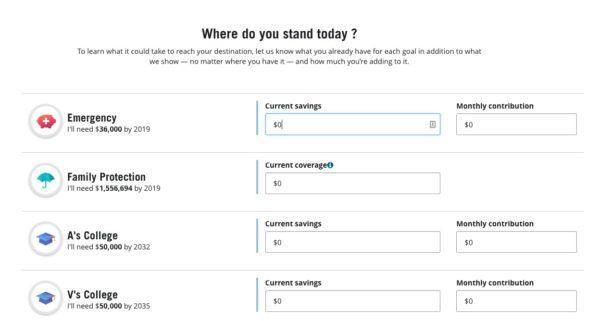

And next it asks for specific detail about where you are currently in terms of reaching your goals:

And after providing that info, it is now ready to provide your savings goal calculations of what you need and whether or not you are on track to reach those goals.

As with most of retirement savings estimators, I find the recommendations for retirement savings amounts to be a little insane. But that is more of a philosophical difference that we can agree to disagree on.

At this point you can continue refining to make adjustments to help you get on track to reach your savings goals.

It is a free savings calculator, but at this point, you begin to see how they make money from it. They make it really easy to work with one of their financial advisors or get started with Prudential services.

Some people might be annoyed by this, but personally, I love this business model. Personal Capital was the first company I saw do this: creating an amazing free tool that is better than paid options out there and use that to generate leads.

To me, it is a win-win. A great free tool for users who just want a free tool, and a ton of access to leads who might be interested in the companies services.

Final thoughts

All in all, I think LINK by Prudential has a leg up on all the competition for free savings goal calculators. Those who stick with it over time are the ones who are most likely to really see it shine as it continues to update and adapt to your situation over time.

If you are interested in checking it out, you can try it out here.

If you give it a go, I’d love to hear your thoughts/opinions on it so let me know in the comments below.