I have been getting emails from a bunch of readers asking for us to do a Tranzact debit card review wanting to know what I think about the Tranzact rewards card.

If you haven’t heard, basically, it is a debit card with a positive social impact that provides “Z-Bucks” that can be used to buy everyday items.

In theory, I love what Tranzact is doing, but in reality, I will be really surprised if this is still around in a year.

I have seen a lot of MLMs (Multi-Level Marketing companies) like this come and go and as much as I would love to see this succeed, it feels like a big pyramid scheme to me and so I am passing on it.

I have some friends who are using it and who are excited about it, but I always do my own due diligence and go with my intuition and I am not feeling good about Tranzact card.

These are the red flags and the reasons I am passing on Tranzact (and make sure you read til the last one, because it is the nail in the coffin for me.)

4 red flags and reasons I am not going to get the Tranzact card

1. They talk more about making money than the product itself

I use and recommend a lot of products that have referral programs because the referral model just works.

But it is always a red flag to me with any product when they spend more time talking about how you can make money from the product than the actual product itself.

It is a clear indication of their focus.

And especially with a potentially revolutionary product like this, there should be a lot more time explaining the ins and outs of the product, rather than just talking so much about how you make money referring the product…

Because when all people focus on is how much they can earn from SELLING the product, it is easy to hide that the product itself isn’t actually that good.

2. You have to pay fees to make money

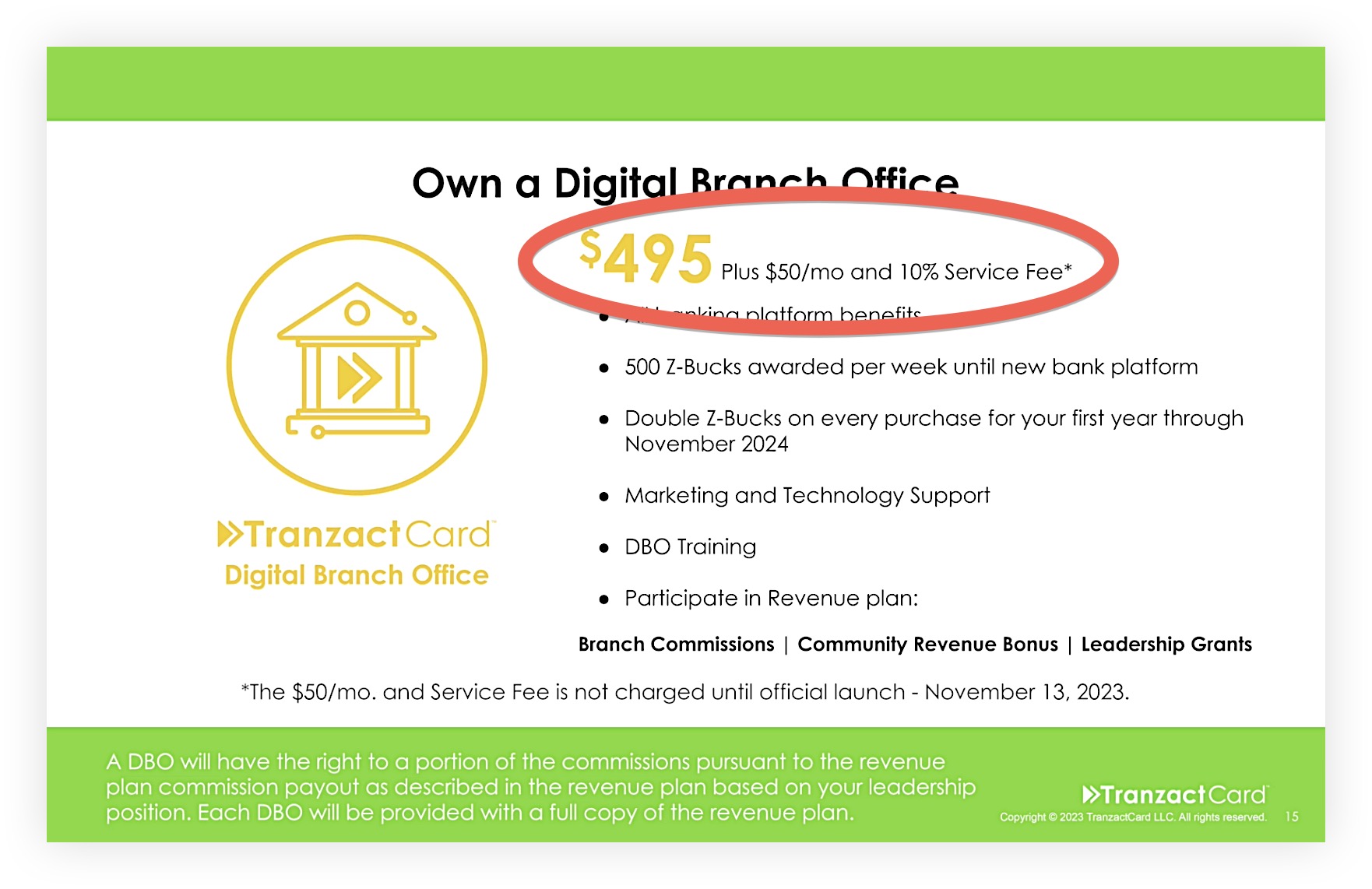

In order to actually make money referring people from this, you have to pay $495 and then $50/m and 10% service fee.

(Yes I know that if you pay $25 to be a member you can get Z-bucks and in the next point i’ll explain why I don’t believe that to be what they are promising.)

So, I am a business owner and we have an affiliate program where anyone can join and refer people to our courses.

How much do we charge our affiliates to join the program?

ZERO DOLLARS!

Why would we make them PAY to refer people to us?

It makes no sense unless you actually need those fees and that revenue to cover the costs of the Z-buck rewards you are paying out. And that’s where we start getting into Ponzi territory.

Additionally, I have been an affiliate and part of well over 100+ referral programs, and not a single one made me PAY to earn money from referring people… And the reason why is that from a business perspective, it just doesn’t make sense UNLESS those fees are a primary part of your revenue.

An alternative example

As an alternative example here, Rakuten is a cash-back app that has paid literally paid us over $3,000 dollars (not in “z-bucks” but in actual real money) over the last few years.

It isn’t trying to be a bank like Transzact is, but it is solving the same problem: making the things that we buy cheaper.

And not only is Rakuten 100% free to sign up but they offer a $30 signup bonus to join.

So when I see Transzact making users pay to be able to refer others, it just makes no sense and is a big red flag to me.

3. The Z-Bucks are not worth what they are claiming

I am skeptical about the actual value of the z bucks.

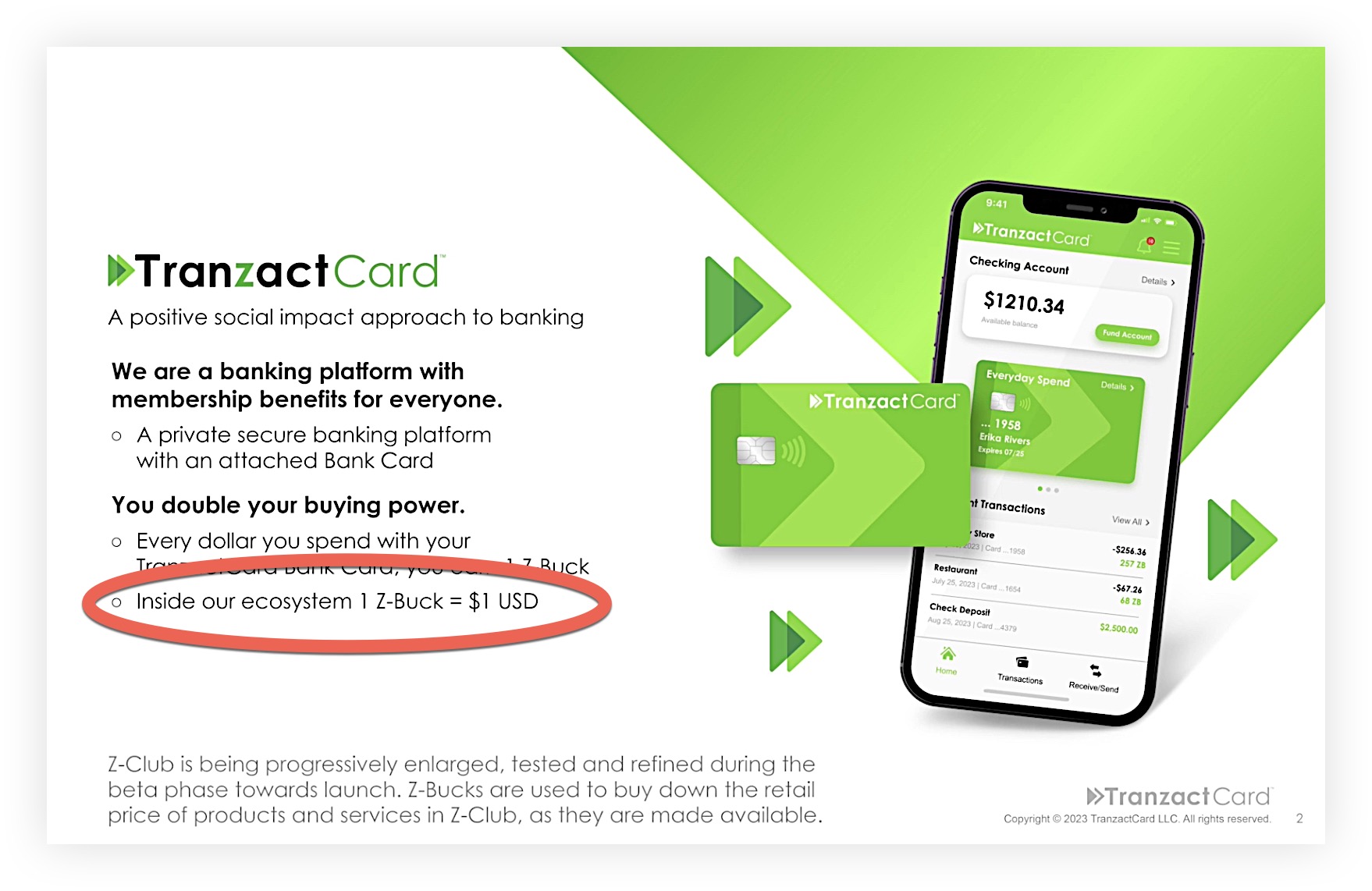

They claim that $1 Z-buck is worth $1 dollar (USD).

They can claim that they are worth $1 all they want but they are not worth the same amount as an actual dollar if you can only spend it on select items.

Think about it.

If you have a $500 gift card to Chuck E. Cheese or $500 cash which is actually worth more?

The cash right?

Because the ways you can spend it are unlimited therefore making it more valuable to you.

And if you had a $500 gift card at Chuck E Cheese you would likely buy things you didn’t need or even really want just because you have to use it.

But $500 cash has so much more value to use because we can use it ANYTHING – thus making it MORE valuable than $500 that you can only spend on overpriced items at Chuck E Cheese.

I suspect it is the same with Z-bucks.

Additionally…

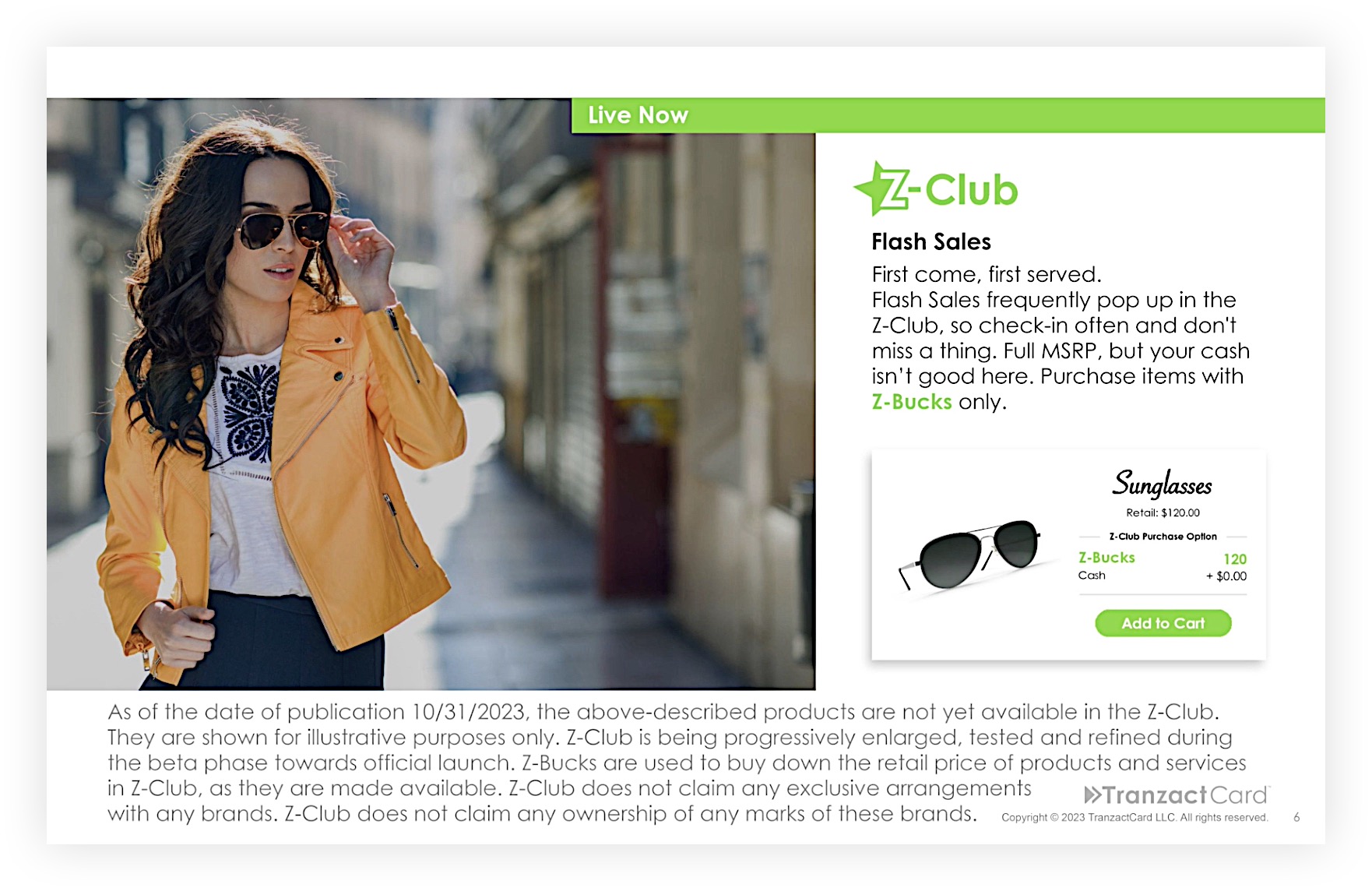

I am guessing the items you can actually spend Zbucks on are going to be greatly limited and inflated.

For example, in the video they talk about how you could get these knock-off RayBan Aviators for $120 Z-bucks.

Real RayBans cost that much, but you can find knock offs for a small fraction of that.

In fact, with just a quick search on Temu I found that I could get them for $7.48.

So, in that case, your $120 Z-bucks are actually worth… $7.48

My bet is that everything you can actually spend your Z-bucks on is similar and is wildly overpriced.

And finally, the nail in the coffin for me…

4. The founder, Richard Smith, has a very shady past

Ever wonder who is behind the Tranzact card?

I did too. And it turns out that the founder, Richard Smith, was charged with Securities Fraud in 2010, and “the charges pertained to Smith running two Ponzi schemes, which authorities claim Smith defrauded consumers out of ~$10.9 million dollars through.”

That is right there is enough for me to be extremely wary of getting involved with anything he created.

I have since heard that he is no longer the CEO, but let’s be real. It is really easy to step down as CEO while remaining a strong influence in the company.

So, is Tranzact a scam?

Like I said before, I really hope I am wrong and I hope this upends the whole banking world. That would be absolutely amazing.

But I am doubtful.

All that said I don’t think this is a scam per se, but rather I just don’t think it is actually a good deal – especially for most people who pay $495 to become a “branch manager”.

I would bet 98% of people who buy that package will end up losing money rather than making money, and I am sure Tranzact is planning on that as well.

And like I mentioned, I don’t think the value of these Z-bucks is anywhere close to the promise they are making.

Bottom line…

I have friends using this program, and I am going to stand on the sidelines and let them report back to me over the months to come.

I would love to see this be a smashing success. And if it is still around a year from now and I can see more value in it, I may reconsider at that point.

But for now, I am passing on it.

I would encourage you to do your research, be discerning, and pray about it if you decide to join.

Your friend and coach,