How Gold Protects Your Money’s Value (While the Dollar Doesn’t)

I have invested/owned gold for probably about 10 years at this point.

Probably 5% of our investments have been in gold, but if I am honest, I only really did it because it was what I understood to be part of a “balanced” portfolio.

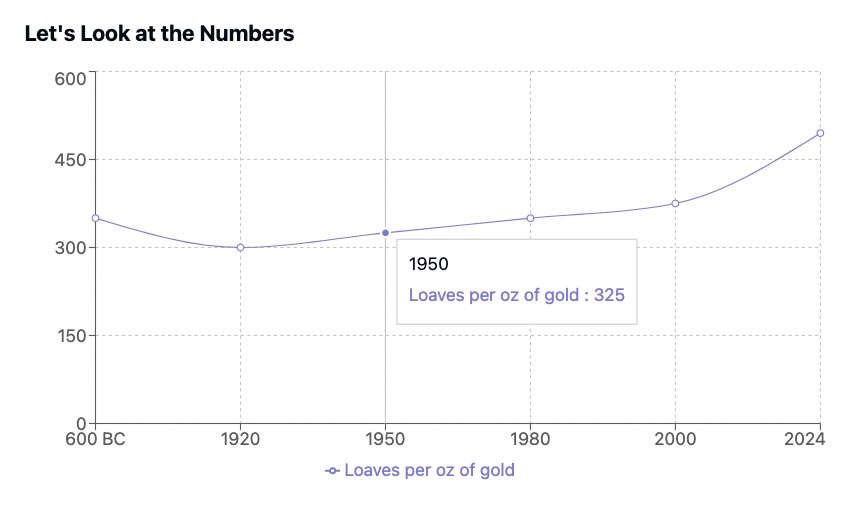

It wasn’t until I saw this chart (down below) that I thought I finally “get it.”

As always, this is NOT financial advice on what you should do, but just me sharing how I am thinking about some of my financial decisions in case it helps you on your journey!

Gold vs Bread: A 2,600-Year History of Value

Here’s something fascinating that most people don’t realize: throughout history, gold has been remarkably consistent in what it can buy.

Especially when compared to US Dollars.

Today, one ounce of gold (worth about $2,615) can buy roughly 495 loaves of bread at $5.28 per loaf.

But the US dollar? It’s a VERY different story.

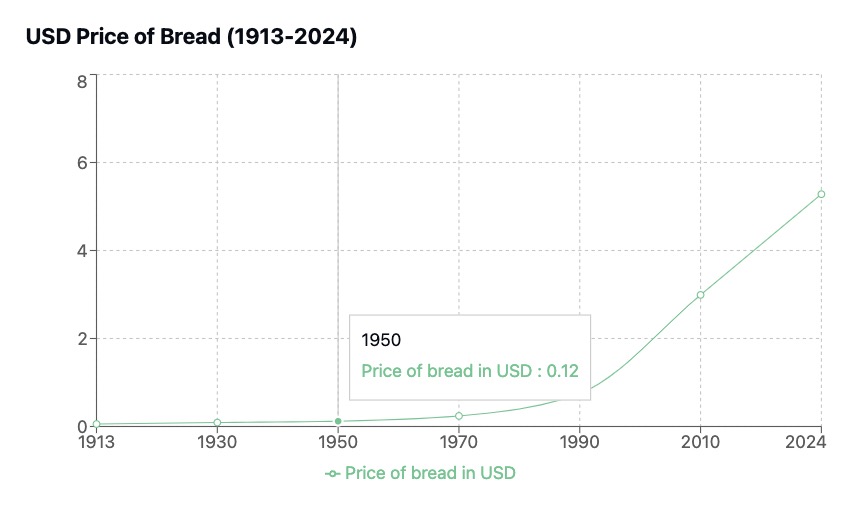

Since the Federal Reserve started in 1913, the dollar has lost almost ALL of its purchasing power.

And while that might sound like economic talk, here’s what it means for you and me: the money in our wallet is constantly losing its ability to buy things.

So here’s a real-world example that makes this super clear.

Back in 1913, you could buy a loaf of bread for about 6 cents.

Today?

That same loaf costs $5.28.

That’s not because bread got better – it’s because our dollars got much, much weaker.

What This Means for Our Money Today

Let’s say you have $1,000 saved up right now.

You could:

- Keep it in dollars: Today, you can buy 189 loaves of bread ($1,000 ÷ $5.28 per loaf). But in 50 years? Based on what we’ve seen over the last century, those same dollars might only buy 10 loaves.

- Convert it to gold: That $1,000 would buy you about 0.38 ounces of gold, which historically should still be able to buy around 189 loaves in 50 years just as it can today.

- Gold tends to keep its value, while dollars… well, you see what happens to dollars.

Of course, this assumes things continue as they have historically for the last 100 years- and as we know, past performance doesn’t guarantee future results. But it’s something to think about!

Important Notes About This Analysis:

- All bread prices are standardized to ~1kg loaves for fair historical comparision.

- Modern industrialization likely masks even greater historical consistency. Today’s mass-produced bread differs significantly from historical sourdough made with organic ingredients. If comparing identical quality bread, the loaves-per-ounce ratio would likely show even more stability.

- Similar patterns appear with other quality food commodities:

- Quality Wine:

- Ancient Rome: 1 oz gold = ~400 liters

- Today ($2,615/oz): ~348 liters ($30/bottle)

- Quality Olive Oil:

- Ancient Rome: 1 oz gold = ~200 liters

- Today ($2,615/oz): ~145 liters ($18/liter)

- Quality Wine:

- While you could earn interest by keeping money in savings accounts rather than cash, it doesn’t solve the fundamental problem. Over the past 50 years, inflation has consistently eaten away at purchasing power faster than typical savings rates. Even today, with “high-yield” savings accounts offering 4-5%, inflation often runs higher, meaning your money still loses real value over time.

Gold, on the other hand, has historically maintained its purchasing power regardless of inflation rates or banking yields. It’s not about maximizing returns – it’s about preserving what you already have.

What I am doing with this info

To me, seeing these charts with this much clarity makes me really fearful of having anything other than the bare minimum sitting in US Dollars.

Obviously, it isn’t easy to pay bills with gold coins, so we will, of course, still be using USD, but it has me moving more of my savings (that I actually want to maintain purchasing power) into Gold.

There are tons of ways to buy gold, but I’ll share exactly what we are doing right now…

We are auto-purchasing Gold each week using OneGold.

OneGold is a site where you can buy gold for as little as $10 and can do it automatically. After looking at a lot of other options, they are my favorite for a few reasons:

- You can automate the purchases, so you can set it and forget it and automatically build up your Gold savings.

- They have the lowest fees of any dealer that I found.

- You can easily sell your gold back to them at any time and transfer funds back to your bank account.

- You can have them store the gold (insured) or you can ask them to send it to you. It’s your choice.

Another Option: Vaulted

Vaulted is another option as well that has many of the same features, but their fees are higher than OneGold.

The Bottom Line:

Protecting Your Money in an Age of Inflation

While currencies come and go, gold has maintained its purchasing power for thousands of years.

As we’ve seen, an ounce of gold buys roughly the same amount of life’s necessities today as it did in ancient times.

So, I’m gradually increasing my gold allocation beyond that initial 5% “balanced portfolio” position. Not because I’m trying to get rich quickly but because I want to ensure my savings can still buy the same basket of goods decades from now.

Prayerfully consider taking a small step today to protect your purchasing power – even if it’s just setting up a $25 monthly auto-purchase like we are. Your future self might thank you for preserving some of your purchasing power in an asset that’s proven itself over millennia, not just decades.

Remember: the goal isn’t to abandon the dollar system we live in but to thoughtfully protect our money from its known limitations.

Your friend and coach,