(The following is a transcription from a video I recorded. Please excuse any typos or errors.)

If you want to get started investing and you can only come up with maybe a hundred dollars or so, I’m going to show you exactly how: I would invest and where I would invest. Because you can’t invest with a small investment in too many different places.

Also, I’m going to show you a really dangerous mistake that you should avoid as a new investor.

To get started, you’re going to need at least a hundred dollars, so start looking if you don’t have it already.

Unfortunately, it’s been challenging for smaller investors to get into the investment game because a lot of places, you actually need a good amount of money to get started.

I made a video that goes right along with this article. If you’d rather watch the video, you can do so here:

Difficulty Investing With Little Money

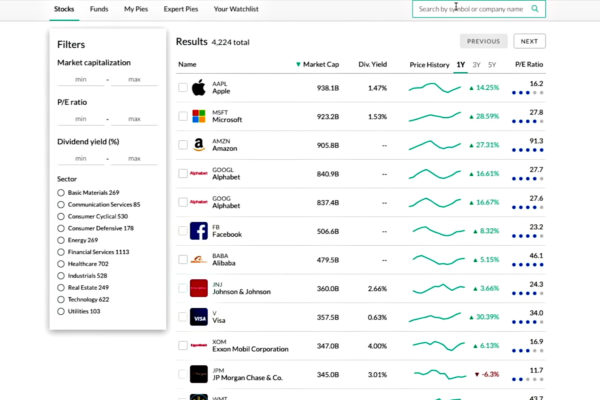

A lot of mutual funds require that you have a thousand, 5,000 or even $10,000 to get started. Then additionally, most online brokers and offline brokers won’t allow you to buy a partial share of a stock. If you want to buy a stock that’s actually expensive, you have to come up with that much money just to buy one share. I’ve been looking for a place where I can buy fractional shares.

The good news is that I’ve found one. What this means for you and I is that even if we don’t have a whole bunch of money, we can buy shares of Berkshire Hathaway. We can buy shares of Apple. We can buy shares of Google. I recently opened an account with this company because I’ve been so excited and I’m actually going to be funding my Roth IRA in there.

Before We Get Started

I’ll just show you a little bit what this process is like. Now at this point, I should mention a video I did about how to get started investing even if you have no money. To view this video, click here. This is a really cool alternative to get you started investing.

Before we get into the specifics of how I would invest a hundred dollars if that was all I had, and I just wanted to get started, I have to say, I am not an investment advisor. We actually have a directory of financial advisors if you want to hire one. You can check that out if you want, Seedtime Financial Advisory Directory.

If you were looking to do this yourself, I will tell you what I did. Note, this is not financial advice to you. I don’t know your situation, but you can take it and run with it and do what you wish.

Warren Buffett Investment Advice

I’ve been a student of Warren Buffett for a long time now. I’ve read a few books written about him. He hasn’t written many himself, but he has written his annual reports and he shares a lot of his wisdom in there. If you don’t know who Warren Buffett is, he’s one of the richest men in the world. He has been in the top five richest people probably for the last, I don’t know, 20, 30 years. On top of that, he has made his wealth by making smart investment choices. When Warren Buffett gives investment advice, I think it’s worth listening.

When people ask Warren Buffett what advice he has for new investors to get started investing, he doesn’t say buy my stock, which he could as it’s a great investment. But instead, Warren Buffett says that you should consistently buy an S&P 500 low cost index fund. Just in case you think he’s just blowing smoke and this is just what he’s telling the media but not the real thing.

In Warren’s will (you can create your own will in less than 10 minutes), he actually has these instructions for his wife on how to invest his money after he dies. He says to put 10% into short-term government bonds, and then the other 90% into an S&P 500 low cost index fund. He recommends Vanguard.

Again, I’ve met some really smart financial advisors out there, and you may have as well, but I’ve never personally met anyone who’s been as good with their money as Warren Buffett has. When he gives financial advice like this, and specifically for his wife after he dies, I just feel like that’s something that we have to pay attention to.

How I Would Invest $100

I’m going to walk you through the process of how I’m doing this with this new, awesome tool that I found: M1 Finance.

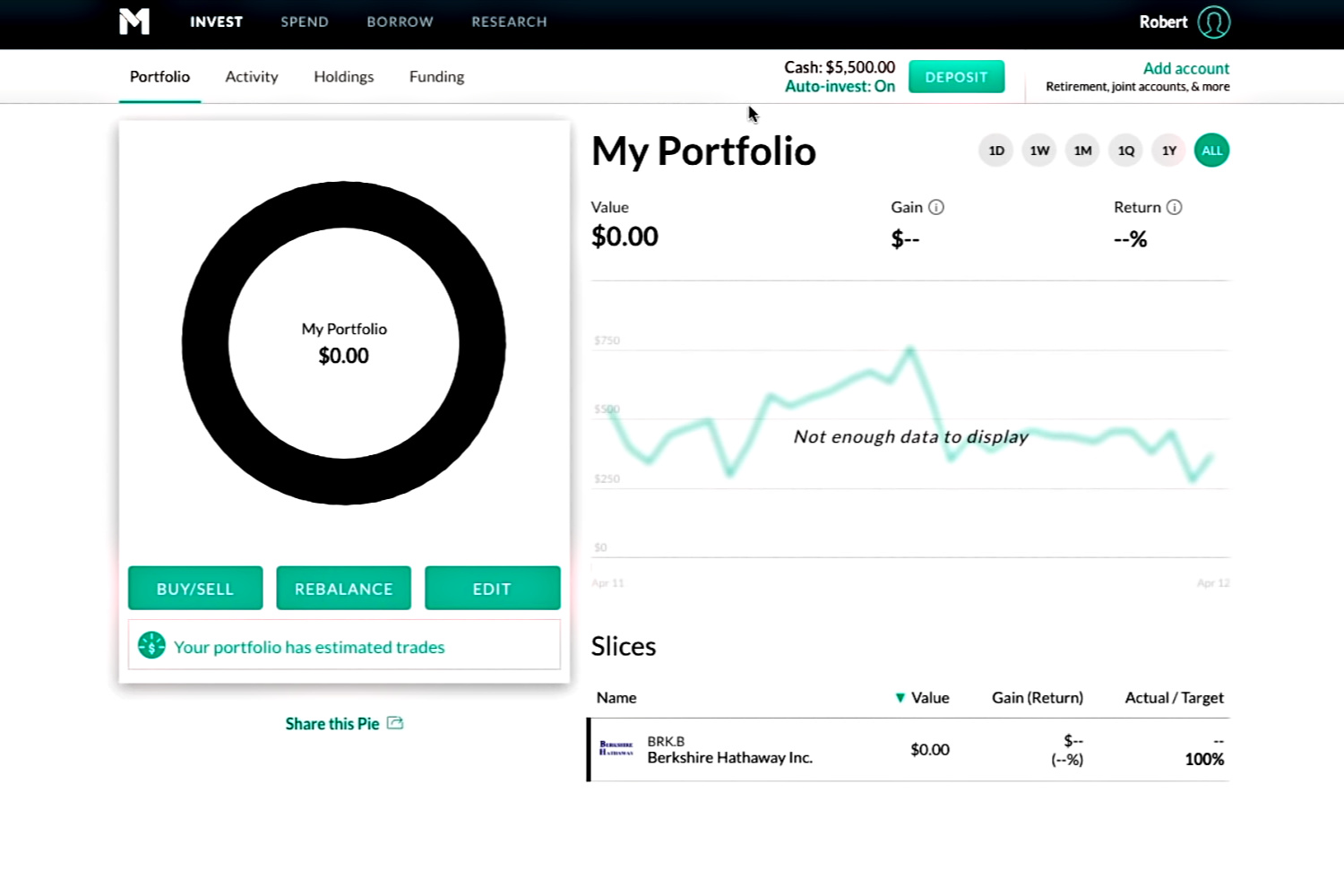

Here we are in my account and I’m just going to show you what’s going on. I opened this account a couple of weeks ago and I funded it. Since this is my Roth IRA, I have contributed my amount that I can contribute for the year, which is $5,500. Even though this article is about how to invest a hundred dollars, the process is going to work exactly the same way.

The way these guys do things is that you build a portfolio. You pick all the stocks or the mutual funds or index funds or whatever that you want and then they automatically invest the amount of money that you have in cash into those different investments.

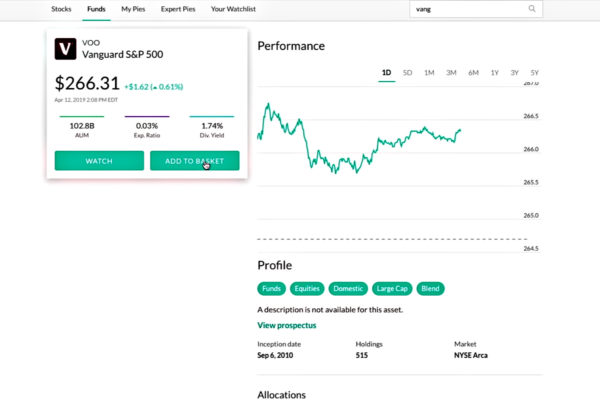

In my case, I’m just going to do what Warren Buffett recommends and just put 100% into the S&P 500 low cost index fund and Vanguard funds like he recommends. I’ve been invested in those in years in some of my other accounts. They’re just great. I love the way Vanguard does things. That is what we’re going to be doing today.

Editing And Adding Different Stocks To Your Portfolio

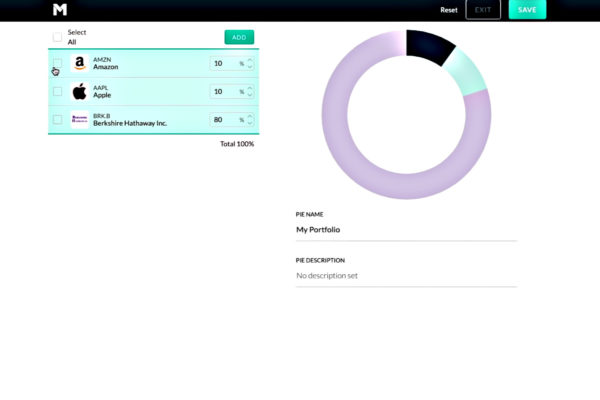

From here, all I need to do is edit my portfolio. Right now I have this Berkshire Hathaway in here, but what I’m going to do is change that. You can just add as many different stocks as you want. If you want to add different stocks, you can just add them to it and just add them to the mix.

You can set the percentage that you want. In our case, if we’re only investing a hundred dollars, what that’s going to do is it’ll invest $10 over to Amazon, 10 to Apple. Then we’re going to move this down to 80, over to Berkshire Hathaway if we were going to do that, but that’s not what I’m going to be doing today.

I’m going to be moving this out and I’m going to find, just search, Vanguard S&P 500. We’re going to go ahead and click add this to the basket. I’m going to change this to a hundred and then we’re going to remove Berkshire. Then we’ll click save, confirm our changes.

Funding Your Account And Automatic Investing

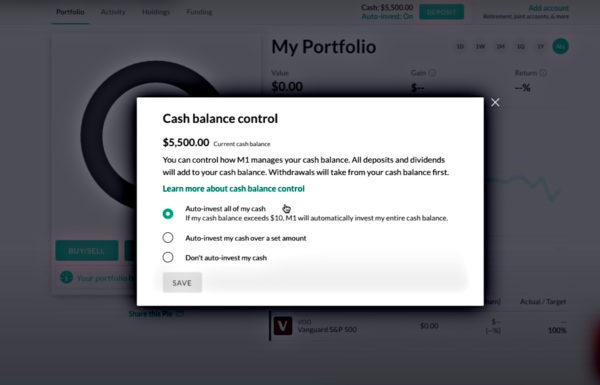

I already have my account funded, after opening the account I had to transfer money from my bank. And since that’s already taken care of, and I have auto invest already set, it will automatically invest all the money that’s in my account into whatever index funds that I’ve selected. You can change the setting if you want, but this is how I’m going to leave it. Anytime I transfer money over to this account, it’s going to automatically invest it in this S&P 500 fund for me.

Investing Your Money And Buying Stocks

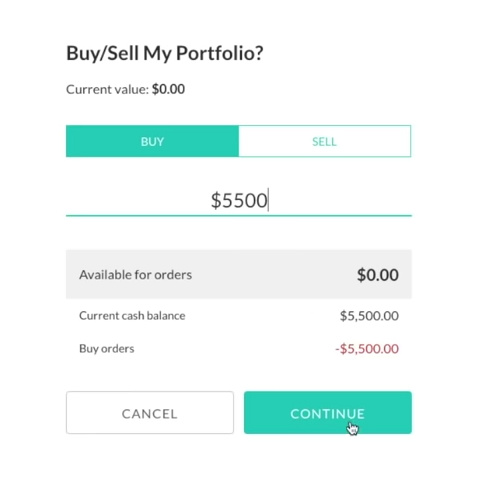

I’m just going to go ahead and get it started though just by coming over clicking buy. Then I can just type in the amount I want. What that’s going to do is clear out all of my cash balance and then buy that. Then I can just go ahead and click confirm. Now during the next trading window, it’s just going to go ahead and make that purchase for me.

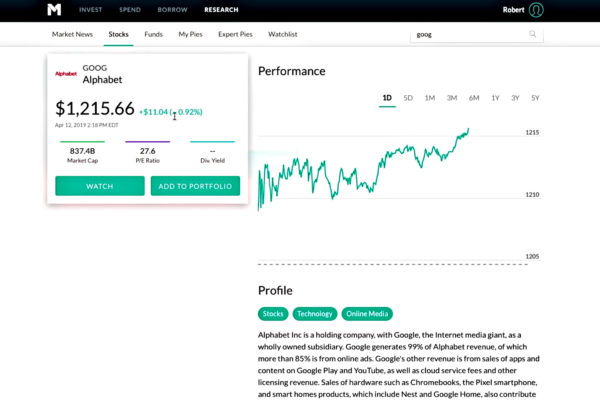

I have a pending buy of $5,500, and that will be invested in the Vanguard S&P 500. It’s really that simple. I love this platform. I love the ability to, like I said, buy fractional shares, because if you look at, let’s just go ahead and look over here. Let’s look at Google for example, it’s a really expensive stock. Right now it’s $1,200 a share. If you wanted to buy a share of Google at almost every other online broker, you’d have to have $1,200, but if you’re using this service. One here, you can buy it for really $10, $20. You can be buying a small fraction of Google and be getting some of their returns without having to buy the entire stock.

FAQs

Now, there are a handful of questions that I had before I got started with M1 Finance, and you might have the same question. I’m going to walk you through a few of those.

What does it cost to use?

This platform is free to use, which is amazing. They actually made this change about a year ago. They used to charge fees, but now they’ve since gotten rid of them.

You can invest for free using them. You don’t have to pay any commissions in which this is almost unheard of with online brokers. There’s another one I know of called Robinhood, which offers free trades, but it’s really, really rare that you find an online broker who offers free trades.

Do They Have Fees?

They do have fees for a whole bunch of random things. Like if you need paper copies or if you’re going to do wire transfers and things like this, these are all normal things that any kind of bank or brokerage firm charges fees for. In general, for most of what you and I are probably going to be doing with the service, we’re not going to pay any fees, which is just awesome.

How Does My Account Stay Secure?

Another question I had was about security. That’s always something I’m concerned about when I’m dealing with my money, when I’m dealing with any online account.

M1 Finance is SIPC secured and they’re protected up to $500,000. That’s a form of insurance that basically a lot of investment firms use. Just like you have FDIC for banking, that kind of insurance SIPC is for investments.

They also have everything encrypted, which makes me feel good. Then they have two factor authentication, which is the current standard that most websites use for keeping things secure. Basically, what that means is that you have to have your cell phone on you in order to log into the account, because they’re going to text you a code or that type of thing. It’s really a great way to make sure your account stays secured.

I honestly just love how simple it is and how they keep it really, really simple. I’ve worked with a lot of different investing platforms and a lot of them tend to get too complicated and just have too many things going on to where it’s a little bit overwhelming. I really like how these guys just keep it really simple and clean.

If you have any questions about them that I can answer, I’m happy to answer those down in the comments below.

Bonus Tips

Buying Individual Stocks

Now, the mistake that many new investors make and that Warren Buffett actually, again, cautions new investors against is buying individual stocks, especially when you don’t know what you’re doing and especially when you actually need the money for something in the future. Because when you buy a stock, you are becoming a part owner of that company. If the company happens to go under, you can lose all of your money.

I have done this with certain stocks that I’ve bought in the past. It actually can happen. Now, on the other hand, if you were buying an index fund or a mutual fund, the likelihood of you losing all of your money is very slim.

Buying At The Right Time

We all know the upside of buying the right stock at the right time. You can make tons and tons of money and you’re less likely to have those gains with an index fund or a mutual fund. The downside risk is a whole lot better.

If you’ve found this article helpful, I’d love it if you could leave us a comment down below to let me know!

Let me be your investing mentor

If my investing approach resonates with you, check out my 10x Investing Course where I lay out my entire strategy and walk you through how to develop your own long-term approach to investing.