When I was about 14 years old, my uncle suddenly and unexpectedly went home to be with the Lord.

When I was about 14 years old, my uncle suddenly and unexpectedly went home to be with the Lord.

He had meticulously taken care of the finances for their family and left my aunt on a very solid financial foundation.

Obviously, this didn’t take away the pain of him being gone, but his preparation eliminated additional stress that would have been present without it.

It’s one of those things we all prefer not to think about, but it is always better to be prepared. My aunt is still reaping from what my uncle sowed by having his things in order.

My FLOP

Being impacted by my uncle’s premature death and wanting to do everything I can do to help my wife, I decided to create a system for keeping things organized.

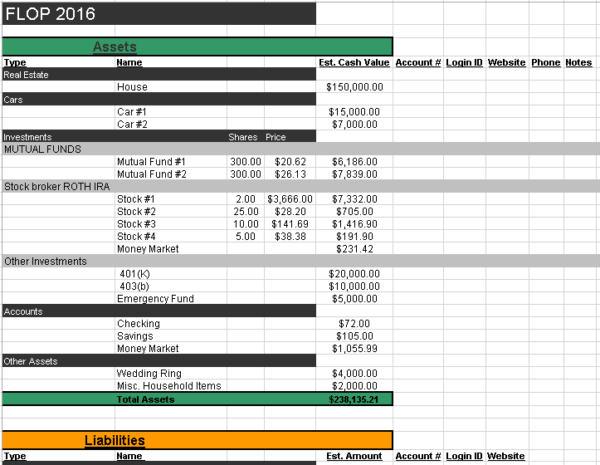

It has been a work in progress over the last few years, but has evolved into a very helpful tool. Simply put, it is a single file or location for all your financial account details. I call it a FLOP (Financial Life on One Page). FLOP sounds a little cooler than FLOOP, but not much 😉

Click Here to Download Excel or Google Sheets template

In adding to it over the last few years it has come to have three main purposes. The first being that it is a:

1. Balance Sheet

One of the best pieces of advice I received when I started my journey to clean up my finances was to keep a balance sheet. I didn’t really understand why at the time, but I did it anyway. I have updated it twice a year since then and it was a great source of encouragement as I was fighting to get out of debt.

The reason it was such a source of encouragement is because a balance sheet not only takes into account the debt you have been paying off, but all of your good financial decisions as well. So increasing your savings, paying down debt and making wise purchases all will affect your balance sheet in a positive way.

Also, looking at the size of your debts or assets does not necessarily give an accurate report of your financial condition. To get a accurate picture of your financial situation, you need a balance sheet to calculate your net worth. It is very easy to do and is just a big subtraction problem:

Assets – Liabilities = Net Worth

As with most things, you are either moving forward or you are going backwards. If you are increasing your assets or minimizing debts, your net worth should be growing. If your net worth is getting smaller, then it is an indication that you should re-evaluate how you are spending your money. And even if your situation is not very encouraging, it will force you to see the financial truth so you can make adjustments as needed.

In case you missed it earlier, read how to create a balance sheet.

2. Organize all my login information

In this day in age, where you just about need to login to open your refrigerator, it can be difficult keeping track of all your login information.

After adding all your accounts in the balance sheet section above, you should have all your account information listed already and you can just add a column to add your login for that company. If you use various passwords you could list them in another column as well, but consider using a password hint rather than the actual password. I still come back to my FLOP at least once a week to figure out a login that I forgot about.

3. Financial roadmap for my wife

The third and most important reason for my FLOP is for my wife. In most families, one person manages the finances and has a better understanding of the overall financial picture. I am that person in my family. Are you that person in yours?

If so, would your spouse (or other beneficiaries) know where to find your financial information? Insurance policies, bank accounts, investment accounts, safe deposit boxes?

I know for my personal situation, I know a bit more about our financial details than my wife does. I use my FLOP to layout all of the pertinent details for my wife, if she ever needed them. It contains the name, phone number or web address of each institution, our account numbers for those institutions and any other pertinent info that may be needed.

I then burned the file to a CD and kept it in our safe. Every year or so I put a copy of the updated FLOP in there.

Losing a loved one is a terribly difficult process. Having a “roadmap” prepared in advance for your loved ones is a great way to help eliminate unnecessary stress.

Homework

- Click this link to Download the Excel or Google Sheets template.

- Spend some time filling it out.

- Discuss with your spouse where they can find it if they ever need it.