Did you know that we have a Biblical responsibility to keep track our finances?

Proverbs 27:23 says that we should “Know well the condition of your flocks, and give attention to your herds,”

You see, thousands of years ago, wealth was measured differently than it is today. They obviously didn’t have paper money, but it wasn’t just silver and gold that functioned as the indicators of wealth.

In fact, if you look at Genesis 13:2, it says,”Abram had become very wealthy in livestock and in silver and gold.”

Isn’t it interesting that in this verse livestock is mentioned BEFORE silver and gold in defining his wealth?

My point is that a modern take on Proverbs 27:23 might read like this, “Pay attention to your money and know what’s going on with it.”

Just in case you want more evidence, check out the Parable of the Talents as it is a fantastic illustration on Biblical stewardship and our role as stewards of the money that has been entrusted to us.

So what does this mean practically?

This could be a good argument for budgeting, but just in case that is too far of a leap for me to convince you of right now, at the very least start tracking your net worth once a year.

Don’t worry, it is extremely easy to do and won’t take you much time.

Step-by-step instruction to calculate and track your Net worth

I made this video to show you how to track it and how to automate it so you can do it one time and have it tracked automatically in the future.

Oh, and if you use the tool I use they have a $20 signup bonus offer as well! (see their site for more details)

Why track Net Worth?

Your net worth gives you a true and accurate picture of your current financial situation in a way that nothing else does.

It is easy to assume that having a nice salary means that you are going to do well financially, but often that just is NOT true.

On the other hand, some people assume that their low salary means that they are doomed financially. That is NOT true either.

Your net worth shows you what is ACTUALLY going on with your money, instead of what you think or hope is going on.

Why Net Worth rather than just debt?

The primary reason I love using Net Worth as a gauge of your financial progress rather than the amount of debt you have is because it is more encouraging.

When you look at your amount of debt to track progress, you are only seeing the fruit of paying down those debts. On the other hand, your Net Worth increases for every good financial decision you make.

For example, you can increase your Net Worth with the following actions:

- Paying off credit cards or car loans

- Paying more towards your mortgage

- Buying property

- Funding a Roth IRA

- Contributing to your 401(k)

- Building an emergency fund

- Buying index funds, mutual funds, or dividend paying stocks

- Or even just not spending as much money

There are many more things you can do to increase your Net Worth, but these are some of the bigger and more common ones.

It changes how you think about buying decisions

The second reason I prefer to use my Net Worth to track my progress is because I have found it helps change how I think about my buying decisions.

One of the most valuable financial lessons I have learned can be summed up in this video.

The gist is that we should spend more of our money on things that will keep cash in your pocket. So they should at the very least:

- maintain their value,

- but better yet increase in value

- and the best would be increase in value and provide you income as well.

On the other hand, you should avoid buying things that are going to take cash from your pocket. Coincidentally, these are most of the things most of us spend our money on.

When you buy clothes, food, electronics, decorations, cars, entertainment, you are (generally) using cash for something that is going down in value and therefore decreasing your Net Worth.

Examples of this would be:

- Spending $200 on new clothes

- A $50 steak dinner

- Going to the Yankees game

- A brand new BMW

Think about how much you could sell each of these for 2 years from now. Each one of them is a depreciating asset, so 2 years later they would not be worth what you paid for it, if anything at all.

Obviously there is more to life than Net Worth, and you can never avoid spending money on depreciating assets, but you can avoid spending ALL of your money on depreciating assets. This is the key to why many people never get ahead financially. They spend all of their money on stuff that goes down in value. Once you start buying things that increase in value, you begin building a snowball that just grows larger and larger, faster and faster.

I don’t want to get the cart ahead of the horse, so lets get back to our Net Worth. The reason I mentioned this is because I want you to be thinking about the end result of each buying decision.

None of the things listed above are necessarily wrong, but they should be thought about and decided upon rather than just reacting to what you “feel like doing”.

Your Net Worth will reflect each buying decision that you make – good or bad – and as such it is the most encouraging view of our financial progress.

Don’t bury your head in the sand

There was a time in my life where it felt easier to just ignore my financial situation, rather than face the realities of it.

I was burying my head in the sand thinking that if I just ignored it, it would get better or maybe just go away.

Unfortunately it doesn’t work like that.

I believe God wants us to know exactly where we are financially, so He can get the glory when He does the miraculous in our finances.

Moses had to get up close to the Red Sea BEFORE God parted it. God didn’t part it when they were miles away. I suspect that He wanted the Israelites to get an up close and personal view of the insurmountable obstacle in their path.

By doing so, they would much better understand the scope of the miracle that God was doing in their lives – and that it would be a story that they could tell of God’s faithfulness for generations to come.

Regardless of how much of a mess you are in financially, find out where you really are – your starting point if you will – so you can start building your testimony.

The first time I calculated mine

When I did this for the first time in 2005 I found mine to be NEGATIVE 13k.

Initially I was discouraged by this number, but I quickly noticed that it was increasing every month as I began doing slightly less dumb things with my money. 😉

And now as I look back at all the miraculous things that God has done in our financial life I am so glad that I have that as part of my testimony.

I am honestly glad that it was negative, because it makes the story that much better.

If you haven’t done this, let’s do it today and start building your testimony.

Take action in the next 3 days

Do yourself a favor and carve out some time this weekend to do this.

Depending on your situation you might be able to do this in 15 minutes or less.

In the step-by-step video I created showing you how to calculate it, I also show a tool that I am using to track it that I love and is free to use.

And for a limited time they are offering a $20 signup bonus for new customers (check their website for details on this).

Just watch the video below to find out more.

How to calculate your Net Worth

There are 2 ways that I’ve used to calculate my net worth. The new way that I have been using is by using Personal Capital. Basically it is an extremely secure website that allows them to monitor (not make changes) all your financial accounts in one place. It is completely free to use, and provides a great snapshot of your overall financial picture.

It is the quickest and easiest way to calculate your net worth and continually monitor it over time.

All you need to do is:

1Create your free account with Personal Capital

To see more about what they do check out this video:

2Add all your financial accounts: banking, investments, credit cards, mortgages, etc.

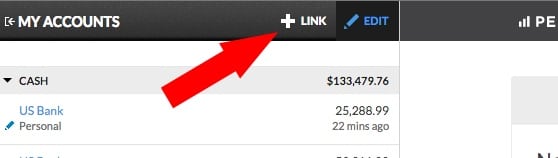

Just click the “+Link” button in the left corner.

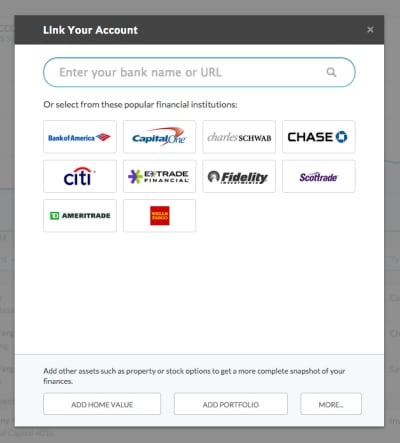

Then you will see a popup box that looks like this and from here you can search for each of your accounts.

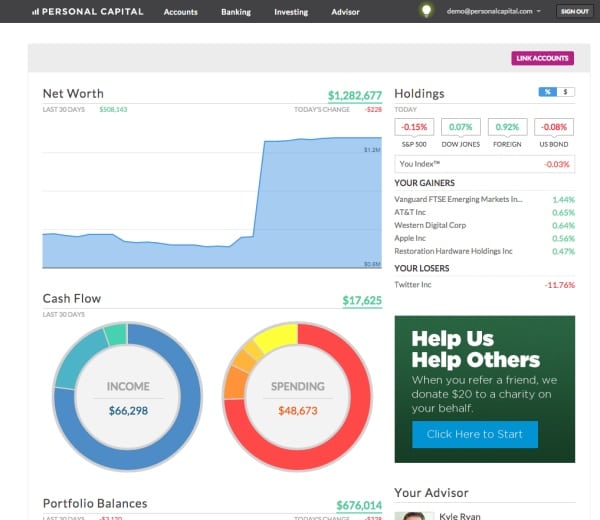

Unless you have a ton of accounts, you can probably do this in under 10 minutes and then you will have your net worth nicely displayed to you as you can see in this screenshot below.

And unfortunately, this isn’t a screenshot of my personal account (but rather a healthy demo account).

They even have an iPhone app, so you can calculate your Net Worth while you are sitting in the doctor’s office.

My Old Method of Net Worth Tracking

Before Personal Capital came along to automate this process, I used to just do it manually every 6 months or so in a spreadsheet, just like how I track my household budget. I have created a template from my own balance sheet that you can use if you would like. You can download it here.

1. Get a spreadsheet

First off, you can do this on paper if you really want to, but I suggest Excel, Google docs, Open Office, or really any kind of spreadsheet will do.

2. Total your assets

List every asset you can think of. Anything that you could realistically sell. For the purposes of sanity and simplicity, I don’t bother with items under about $500. Yea, I am sure I could find someone on Ebay to buy my socks, but I am just looking for a general picture. So I just lump together all these smaller items as one line called “Misc items” and take a conservative guess of what they could be sold for.

So your house, cars, retirement accounts, stocks, savings accounts, checking accounts, emergency fund, jewelry, and anything else similar would fall in this assets category.

To get real estate values you can use Zillow to get a decent estimate of what your home may be worth. For automobiles you can check out Kelley Blue Book to see what they could be sold for. For all your checking, savings and investment accounts you can either check the balances online, or just use your last statement.

Once you have them all listed with the estimated selling/liquidation value you can total them up.

3. Total your liabilities

A few lines below the Assets total, we are going to now list every debt you have. Mortgages, credit cards, student loans – they all apply. Do the same as above, checking balances on each one and then total your debts to get your liability total.

4. Subtract them

Now you can subtract your liability total from your asset total and viola! You have your Net Worth. Date it and save it.

Now what?

When I first calculated my Net Worth, it was -$13,843.84. This was eye-opening to me. I knew I had a bunch of debt, but didn’t realize how below par I was. Regardless of what your number is, just look at it as the starting point. It is from this point that it will become larger.

After we had been working at it for one year, it was up nearly $15K to +$746! We were so excited to have a positive Net Worth! Even if it was only $746. As we kept on working on it, it has just continued to grow.

I normally check on my Net Worth two times a year. But if you are working really hard at it and need to see the encouragement of it increasing, do it more! As in just about anything, you are either moving forward or you are going backwards. If you are increasing your assets by making good buying decisions or minimizing debts, your net worth will be growing.

Homework:

Your homework tonight is to calculate your Net Worth, using either Personal Capital, a spreadsheet, or a pencil and paper.