(The following is a transcription from a video I recorded. Please excuse any typos or errors.)

In this article, we’re going to talk about whether or not there’s a Stock Market crash coming soon.

And just like anyone else, I don’t know. I have my opinions and we’re going to talk a little bit about those. I’ll also give some of the reasons, three reasons, why I think we are probably going to be seeing a market crash soon. Considerably bigger than what we saw in February.

I hope that I’m wrong. I really do hope that I’m wrong. I’m not trying to be a doom and gloomer. I’m not trying to be any of those things, but there’s some writing on the wall and I think it’s naive to pretend like it’s not there. And, I don’t want to do that and that’s kind of where we are with everything.

If you would like to watch this Stock Market discussion, you can view it here:

First, I’ll talk about the three different things that all clicked for me. Where I’m going to start preparing for a Stock Market crash because I think the likelihood of this happening is getting higher and higher.

And then after we discuss the three reasons why, we’re going to discuss the five things that I’m doing to actually prepare for it.

First Reason

The first reason on this list is a New York Times article I read, titled “Worst Economy in a Decade: What’s Next? Worst in our Lifetime.” And I’m not an economist by any stretch of the imagination, but you can kind of see what’s going on here. Long story short, the Gross Domestic Product (GDP), and this in the first quarter of this year, dropped by 4.8%.

And there’s a couple of different things here. What that means for us, is that this is the first decline in GDP in the U.S. since 2014. And it’s the worst quarterly contraction since 2008 when the country was in a deep recession.

According to the writer in this article, he then interviewed a chief economist for a credit insurance company. In which he said, “The worst is yet to come.” Because the first quarter ended on March 31st (when a lot of the actual problems that have happened from this whole epidemic or pandemic), and then April 1st is when the second quarter started. Then all the bad stuff really started kicking into gear in April. And so what we have going on is most likely the second quarter of this year is going to be way, way worse than this first quarter in terms of GDP.

This guy goes on to say that this is going to be the worst in our lifetime. He said, “They are going to be the worst in the post World War Two era.” And besides that, there’s a couple other things they talk about here. Consumer spending fell by 7.6%. And again, this is the first quarter. It’s going to be way, way worse. On top of that, 30% of auto sales were down. Just so many different things.

But, the GDP alone is not super solid reason to base the potential of a Stock Market crash. That in and of itself doesn’t make me think, “All right, there’s a problem.” It’s just the GDP.

Second Reason

But this Business Insider article, pulling that in with the above article, is really, really interesting to me.

I’ve been a student of Warren Buffett for a long, long time. Warren has this ratio that he uses. Which is basically, probably the best, the single best measure of where valuations for the market as a whole come from. He said, “This ratio is probably the one thing if you’re going to look at anything to see whether the market is puffed up and ready to collapse, this is the one thing you should look at.”

Warren also said that, “It’s a very strong warning signal when the indicator peaked.” And he said this right before the “.com” burst in the late 90s and what we had happened then.

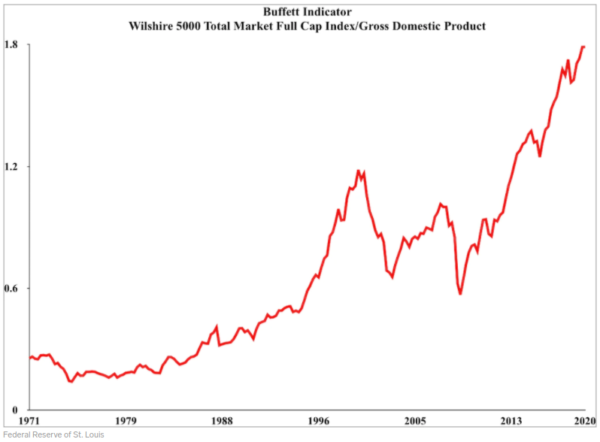

Let me tell you about this metric, it’s called Buffett Indicator. They’ve named it after Warren because he talks about this metric all the time. He says, “It takes a combined market capitalizations of a country’s publicly traded stocks and then divides it by the GDP.”

We were just talking about the GDP in the above article. Which dropped by 4.8% in quarter one, which is likely to go way beyond in quarter two. So with that ratio, he says just before the “.com” bubble burst in 2000, it’s surged to 118% for that ratio. And so that was the big warning sign that something was going to come.

In 2008, right before the financial crisis (the big recession we had at that point), it went over 100%. And as of quarter one of this year, with that GDP dropping 4.8%, it is at 180%.

So, in 2000, or right before the “.com” bubble burst in 2000, it was at 118% and now it’s at 180%! So yeah, it’s just way, way higher than it should ever be. And it’s just a very big warning sign of things to come.

The Buffett Indicator

Here’s a chart to show you The Buffett Indicator. It shows the “.com” burst of 2000. As well as the recession of 2008. And just look where we are right now in 2020.

After 2020’s quarter two, when all this stuff comes out at the end of June (when we see quarter two results), I think this indicator is going to be way up there. If it hasn’t crashed already.

Third Reason

And then you think about the reality of what this all looks like. In our town, we’re starting to open the doors up a little bit and people are starting to go out again. They’ve opened up restaurants, but there’s still social distancing in restaurants and people are wearing masks.

The point is the transition out of this, and I think we all know this, is not a flip a switch and now we’re all done back to normal. This is a long drawn out process that I think is going to continue. It’s just going to take a while.

I have a lot of friends, being in Nashville, who are musicians (touring musicians). And they’re like, “I can’t imagine we’re going to play a show this year.” How is a concert going to happen with social distancing? What does that look like?

I think we’re all trying to figure out optimistically what church is going to look like, hopefully soon. But a concert? When is that going to happen again? Anyway, point is that this is not going to be something we’re just going to fly back out of. And as a result, all of these things, all of these problems are just going to spread and just take a while to come back.

On top of that we’ve added, I think, $2 or $3 trillion to our national debt. So what does that mean? There’s so many brilliant economists who can talk for hours about this and that’s fine. I have people emailing me all the time who have massive overspending problems. They are adding $1000s a month to their credit cards and are just way upside down. So how do you get out of this? Where do you think this is going to end? But if you apply just a little bit of common sense to this, we can see where this may be going.

Just imagine yourself, and don’t think just about the right now, but look down the road six months or even two years. Where do you think this is going if you continue in this pattern with this habit? Anyone can see this is not going to end well. There’s going to be a crisis here. Something bad is going to happen, and that’s where we are as a country with our national debt. And the debt was huge before, and it’s just gotten so much bigger and it’s just going to continue to get bigger.

On YouTube, my wife Linda and I discussed a $2000 a month stimulus package that has been proposed. It would be $2000 a month per person over the age of 16 for six months with the option to extend for 12 months. So literally every American over the age of 16 will get $24,000 given to them by the government. This probably won’t happen. But the point is that our government is just going to keep trying to do whatever they can do to solve this problem.

I’m not saying that we shouldn’t try to fix it, but the problem is … It’s a BIG problem. And, I don’t know the answer and I don’t have the solution. All I’m saying is it’s becoming easier and easier to see this and realize that something is going to happen, something has to give.

How I’m Preparing

For me personally, I have concluded that I’m going to start doing a little preparing for what could be a bad crash. Who knows, maybe as bad as the Great Depression. What would that look like?

I’m asking that question, not because I want to sit and be negative and focus on the negativity, but I also don’t want to be naive. I have grandparents who lived through the Great Depression. What did they learn that we know nothing about, or my generation knows nothing about? That would be good for me to be thinking about at this point.

And I would rather be thinking about it now than thinking about it a week after it happens, and try to think “How can I prepare for that?” So with all that said, let’s talk about five different things that I’m doing to kind of prepare a little bit.

First Thing

One of the things I’ve done is that I’ve sold off a lot of our stocks, and the reason being is because I’m convinced more and more that selling off your stocks all the time just because you think something might happen and trying to time the market is just generally a bad idea. Most people will suggest that and I agree. It’s not a great idea to try to time the market. But, on the other hand, I’m becoming more and more convinced that the odds of something bad happening sooner rather than later are pretty high and I’m willing to take the risk of missing out on the gains as we come back out of this thing, to be better positioned to reinvest or survive, if need be, when that situation happens.

Now, we’ve held onto a few different stocks that made sense to me. One of which was Amazon. I think Amazon is going to come out of this looking pretty good. It seems like everybody’s complaining about how long it’s taken to get their orders from them, but the reality is that they have met the demand really, really well.

And a lot of people would be in really big trouble if it weren’t for Amazon. Not to mention that they just hired 175,000 new people. So they’re supplying work to such a large percentage of our country as well.

Someone was just asking about Amazon earnings. Bezos did come out to the shareholders, and said, “We’re basically going to reinvest every ounce, every dollar of profit that we got,” or something like that. I forgot what he said exactly.

So shareholders might not be happy and the stock price might come down for a little bit, but I think long term, which is exactly how Bezos thinks. He went like 15 or 20 years without making a profit because they just continually invent reinvested, and so he thinks very long term. And I think long term, it still makes a lot of sense.

Second Thing

Another thing I’m doing is I’m building up our savings. If I had debt that I was paying off, that would be something that I would be thinking a good bit about as well. But I would be even more concerned about having a good, solid emergency fund built up. And so what we’re doing is with some of this money that’s coming, this stimulus check. We are going to use some of it, but a lot of it’s definitely going to savings just to continue to build up that buffer. I just want to be as well positioned as we can be for something that may happen.

Third Thing

Another thing that I have been doing, or I’m not stopping doing, is buying a little bit of cryptocurrency. Which might sound weird, but I think it’s just interesting. It’s a little bit of a gamble, but I think it’s a little bit of a hedge.

This is what my thinking is, that it’s a little bit of a hedge against what’s going on. And if we have a really bad Stock Market crash, where whole currencies are just clobbered and with the United States dollar just continuing to give out all this money, the power of the dollar is just not going to be nearly as strong. And with cryptocurrency just being an independent currency that’s not attached to any one country.

It’ll be interesting to see. Cryptocurrency fared fairly well through this thing. It definitely went down with the market, but some of what I was reading was that that was actually because a lot of institutional investors like mutual fund managers and things like that were selling off all their positions in their cryptocurrency as soon as all that happened.

I have no idea what’s going to happen, but this is one thing that we’re just continuing to do a little bit, purchasing cryptocurrency.

Fourth Thing

Another thing we’re doing, is stocking up on food. And not in a hoarder way, or filling our entire closets in our bedroom with canned goods. But just buying food that’s on sale, shelf stable food that’s on sale, is just one of the best investments that you can make. You know what I mean?

Food is something that you’re going to buy anyway, and if you can get it for 25%, 50% off when you buy a bunch of it on sale, why not? And the reality is that buying when you’re not in a time of crisis and just continuing to buy a little bit more than you need to stock up your shelves, that’s completely fine. But if as soon as the crisis hits you run to the store and clean out all the toilet paper then you’re a bad guy and everybody hates you.

I think the smart thing to do is, in a time of peace when there’s not a problem (like right now), just continue to buy a little bit extra than what you need each time. Or if something’s on sale, really stock up. We have a deep freezer so we filled that up with a lot of meat and things that can last for a long time and we’ll try to get it on sale. And it’s just, in general, a good investment.

The reality is, we learned a lot from this pandemic that we’ve gone through the last couple of months. Just seeing a little bit of a market, I wouldn’t call it a crash but just a hiccup, a little bit of a market contraction and problem. And just learning everything that we’ve learned from this, we got to see how society responded. Toilet paper apparently is the answer (so buy your paper now that it’s back on the shelves), but seeing that and seeing how people respond and what are the in demand items.

It’s just been really enlightening, and it’s a good educational thing for us to prepare for what may be to come in the future. So those are the practical things.

Fifth Thing

I don’t like being a doom and gloom type person. I don’t like talking about the negative as I’m a very optimistic person. But I think the most important thing and the thing that we should be talking about and focusing on the most, because, is we need to get in The Word more.

We need to be in the Bible. This is the thing that’s going to strengthen us and being strong for situations like this. Being strong in The Word, being strong in Christ, is the thing that we need to be able to handle these situations. Whatever the thing is, regardless of whether it’s our own personal crises because we lost our job or a big, broad economic one, that’s affecting everyone, the best thing that we can be doing is being strong in the Lord.

The more that we get into The Word, the stronger that we’re going to be and the better we’re going to be able to handle this. I want to be like Jesus when he was asleep in the boat in the middle of a hurricane and all the apostles are freaking out saying, “We’re going to die, we’re going to die,” and Jesus was asleep.

What would it look like to have that much confidence and that much trust in the Lord? Regardless of what’s going on, we can be at rest and we can be taking a nap in the midst of the storm. You know what I mean? For me personally, that’s where I want to be. And so that’s why I’m really doubling up my Word intake and really trying to, most importantly, get strong in The Word.

So we mentioned some of the practical things we can do to prepare, but to be honest, if I’m not solid in the Lord, it just doesn’t matter. All that stuff just does not matter. I would so much rather have none of the practical basis covered but be in a really solid position spiritually to kind of be able to weather those storms.