You’ve probably noticed something strange about money. Despite spending 12+ years in school learning about everything from algebra to ancient history, most of us graduate without ever learning one of life’s most essential skills: Money. Think about that for a second. We spend years learning how to diagram sentences and calculate geometric angles, but somehow […]

The Blog

Biblical Contentment: The Surprising Power of Wanting Less & a Biblical perspective

What Ancient Rome and the Bible can Teach Us About True Financial Freedom and contentment Yesterday I read a chapter from Ryan Holiday’s Discipline is Destiny that helped me put to words something that I have been thinking on for years. There’s a particular kind of power that comes from being content with little. It’s […]

Should You Tithe On Business Income?

A Business Owner’s Guide to Tithing As a Christian business owner, understanding how to honor God with your business finances can often feel complex. One of the most common questions I receive is about tithing on business income – should you tithe on revenue, profits, or just your personal income from the business? This question […]

Streets of Gold in Heaven: What They Reveal About God’s Provision

Have you ever stopped to really think about the streets of gold in heaven? Not just as a nice mental picture, but what it actually reveals about God’s heart and His abundance? Recently, I was talking with Linda about this, and it hit me in a fresh way that completely transformed how I view God’s […]

Is Paying Off Your Mortgage Early Possible? Here’s How We Did It In 3 Years

How We Paid Off Our Mortgage in 3 Years: 5 Unconventional Steps We Took I know it feels nearly impossible to even buy a house these days, let alone dream about paying it off early. But even if you barely scraped together enough for that down payment, I don’t want you to fall for the […]

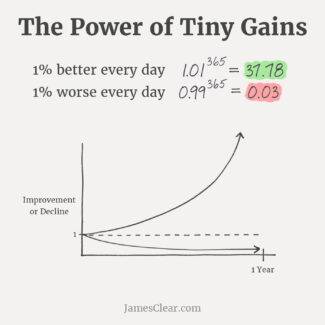

37x your finances in minutes per day

Here’s something that could make a massive difference in your finances in just a few minutes per day: Best-selling author and habit-building expert James Clear found that improving by just 1% each day makes you 37 times better over a year. In financial terms, even doubling your AUM (or net worth) would be just a 2x improvement. So 37x? […]

Does God care about your finances?

I got this question from a reader the other day that I have gotten enough times that I thought it was worth addressing. The question, “Does God care about my finances?” often comes from a place of deep pain and struggle. When the bills are piling up, health challenges strike, and it feels like you’re […]

Gold vs Inflation: How gold protects your money (and why I am buying more)

How Gold Protects Your Money’s Value (While the Dollar Doesn’t) I have invested/owned gold for probably about 10 years at this point. Probably 5% of our investments have been in gold, but if I am honest, I only really did it because it was what I understood to be part of a “balanced” portfolio. It […]