Why have all your eggs in one basket, when you can have them spread around into 7-8 baskets?

That way if one of them falls, you can still make some scrambled eggs for breakfast! I get such a kick out of it when I find scriptures that are still amazingly relevant to our lives today that were written thousands of years ago.The Bible verse that says to diversify

What does Ecclesiastes 11:2 say about diversification?

Solomon actually left us with some investment advice about proper diversification in Ecclesiastes 11:2:“Divide your portion to seven, or even to eight, for you do not know what misfortune may occur on the earth.”So, this is great that the Bible has specific advice about diversifying, but it gets better… I just finished reading this book by Robert Katz in which he was talking about this same verse of scripture mentioned above. Robert goes on to talk about a recent study that was done comparing a variety of asset allocation (or diversification) strategies over the last 37 years to see how they compare…

Dr. Israelsen had decided to study various asset allocations, such as a one-asset portfolio (all cash), two-asset portfolios (cash and bonds), three-asset portfolios (cash,bonds and large U.S. stocks), etc., up to seven-asset class portfolios. He also studied traditional portfolio mixes, such as 60 percent stocks and 40 percent bonds, or 40 percent stocks and 60 percent bonds. He studied a total of ten possible portfolio combinations. He then compiled statistical data on each portfolio for the last thirty-seven years to see which would produce the highest return on your investments with the lowest amount of risk. Here is the truly amazing part that was like an arrow of revelation hitting me as I read his study. The absolute best portfolio allocation, providing an average yield of 11.25% over thirty-seven years with the lowest standard deviations for risk, was the portfolio that included all seven assets. In fact, with this portfolio, the chance of losing 10 percent or more of the value of your portfolio in any one year was zero.I love when Science “discovers” something that has been in the Bible for thousands of years. 😉

Multiple streams of income in the Bible

Another way I look at this is a Biblical encouragement to have multiple streams of income. If 100% of our income comes from one single source, then we put ourselves in a vulnerable position. Right? This is one reason I have sought to have a few different streams of income to minimize my dependence on any one of them. And if you can make any of the sources of income passive, then things really get fun.The 7 streams of income

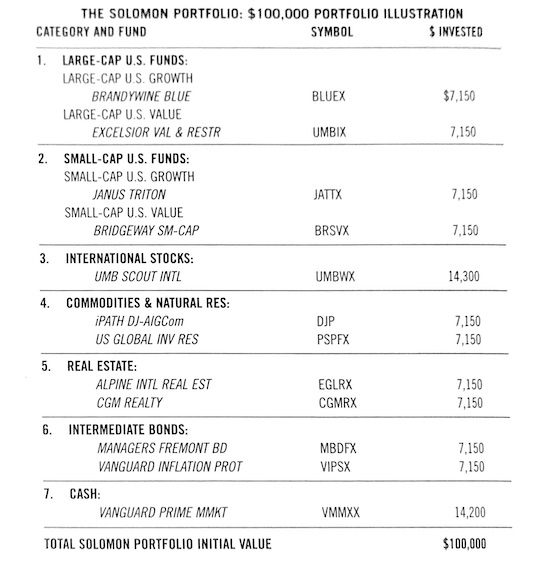

Now Solomon didn’t specify which streams of income you should have or which asset classes to invest in, so we have to take care of that part ourselves. Robert has seven that he recommends and I assume that he talks about this in his book The Solomon Portfolio but his recommended seven asset classes are…- Large-cap U.S. stocks

- Small-cap U.S. stocks

- Non-U.S.stocks

- Commodities

- Real Estate Investment Trusts (REITs)

- Intermediate bonds

- Cash

According to Robert all seven investments should be made and maintained in equal portions.

In his book, which you should check out, He goes into a lot more detail about each of the 7 different asset classes he recommends. And he also provides a breakdown of how to invest in each asset class: So what are your thoughts on this?

So what are your thoughts on this?