Do you think that it is impossible to build a balanced investment portfolio if you have very little money to invest?

Do you think that it is impossible to build a balanced investment portfolio if you have very little money to invest?

Think again.

Using very little money, you can spread your investments across the full spectrum of asset classes ”“ stock-based mutual funds and exchange-traded funds, bonds, and even commodities.

All you have to do is know where to find investments that you can start with as little as $1. And there are plenty of options.

1. Acorns

Simply put, the easiest way to start investing with no money. They just round up all the purchases you make to the next dollar and invest the difference.

So, say you go to the grocery store and spend $16.25, they will round up to $17.00 and take the 75 cents and invest it. If you do that over and over, it quickly adds up to some big savings.

By far, the easiest set-it-and-forget-it way to get started investing.

Here is how it works:

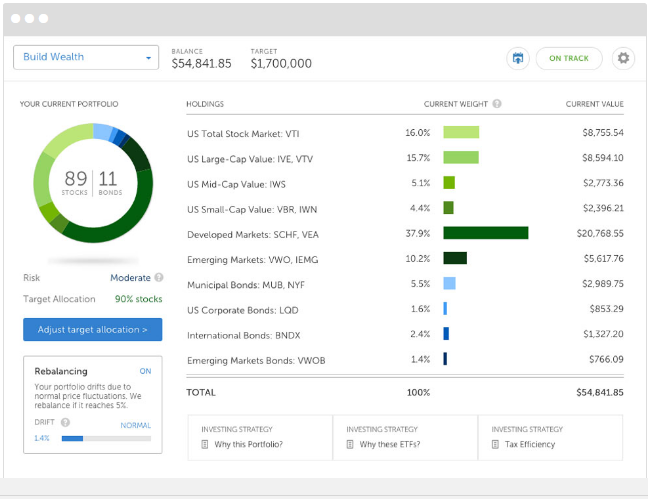

2. Give Betterment a whirl.

Betterment is an online investment firm that has no minimum investment or balance requirement. They do however require that you contribute a minimum of $100 per month to your account.

It is not a traditional brokerage firm that will allow you to invest in the stocks and funds of your choice, but is an excellent place to start investing with very little money.

How they are different (and simpler)

With Betterment, you basically have two investment options. Each option is referred to as a basket that is made up of a mix of exchange traded funds, or ETFs. One basket is comprised of stocks, and the other of treasury bonds. All you need to do is to choose your allocation between the two baskets, and your contributions will automatically be invested based on the allocation.

Another benefit to small investors is that Betterment does not charge transaction fees. The only charge they assess is an annual fee equal to .35% of your account balance, on account balances up to $10,000. If you have $1,000 in your account, your annual fee will be $3.50. When your balance exceeds this amount, the annual fee will be progressively lower.

The strategy is simple yet aggressive, and this can be a benefit to someone investing with very little money. Since you don’t have a lot of money to spread over many different assets, you need to keep your investment system as simple as possible. And since you want to grow a small amount of money into a large amount, Betterment”s aggressive approach is a solid way to get there.

Nearly every large investor started out as a small one. But the advantage that you have today is that there are more options for the small investor than ever before. Start with the investment options above, build a larger amount of money, and then you”ll be able to expand your options even more.

The most important part of investing is always getting started. And having very little money is no longer an excuse.

Read more in our Betterment Investing Review.

3. Use a broker without an account minimum.

Some brokerage firms will either lower or waive minimum initial investment requirements on certain funds.

One that I have used for years is Ally Invest. There is no minimum to open an account. This won’t allow you to invest in anything you want, but as a small investor, it is still an excellent way to get started.

4. Try the Fundrise Starter portfolio

When I started with Fundrise they required a $10,000 minimum investment. Since then they have rolled out a starter portfolio which allows you to get started with only $500. I know that might still be a stretch if you only have $100 or so to start investing, but if you can round up $500, they are a good option to consider.

I have been using Fundrise for real estate investing for almost 2 years now and I actually ended up selling my physical rental property because my Fundrise earnings were better. You can read all about that in my Fundrise Review here.

Or check the video below for my experience as well.

5. Try out I Bonds.

I Bonds are US government securities and they can make the perfect bond allocation of a small investor”s portfolio. You can buy them directly from the U.S. Treasury through their website at Treasury Direct.

You can purchase I Bonds in denominations as low as $25 ($50 if you buy using your income tax refund), up to a maximum denomination of $10,000. The minimum term is one year, running to a maximum of 30 years.

Rate of return on the bonds is a combination of interest and semi-annual adjustments for inflation. All income is added to the face amount of the bond and payable at redemption. The current rate of return on an I Bond is 2.52% (as of Sept 2018), which is far better than what you can get on certificates of deposit for much longer terms, and for far larger denominations.

I Bonds are also tax-exempt for state income tax purposes, though the income earned is taxable at the federal level.

If you have $100 sitting and waiting to be invested, check out this video to see how I invest $100, Warren Buffet style.

Have you been avoiding investing because you think you don’t have enough money? Have you tried any of the investments above? Leave a comment!