Batching the Process

Anyone who has ever forgotten to get something from the grocery store realizes that it requires a lot less time to buy everything one day than having to go get something as you need it. It requires a grocery list and a bit of foresight, but it saves you hours throughout the week by NOT having to go back to pick up missed items. Why not implement the same type of planning to the paying of your bills? Rather than sporadically paying them as they come in or checking a pile on your desk every few days, you should be able to designate 2 days a month to pay your bills. And of course, if you want to save even more time, use your bank’s online bill pay.4 Steps to Manage your Bills

1. Make a list of all of your bills

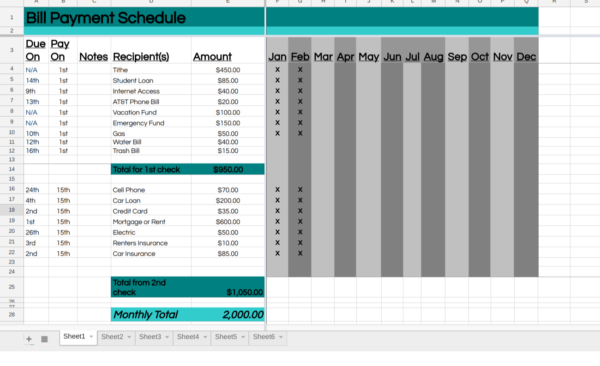

Next to each one write the day that it is due. If there is not a due date just leave it blank.2. Decide on 2 days per month that you will pay your bills

I recommend the 2 days you when you get paid (if you receive a regular bi-monthly check).3. Organize them by due dates

Assuming the days you get paid are the 1st and 15th – you would then take all of your bills due the 22nd through the 6th and pay these on the 15th. And on the 1st of the month you would pay the bills due from the 7th -21st. This will give each bill at least a week to get to you through the mail.4. Figure out what your monthly dollar amount needed for bills is and divide it by 2.

If your monthly bills total $2000, then you will want to pay as close to $1000 worth of bills on the 15th and $1000 worth on the 1st. Use the bills that don’t have a due date (i.e. savings accounts) to balance this out as best as possible.Download a bill pay template

Homework:

- Follow steps 1-4 above and get your bills organized!