Creating a debt snowball is my preferred method of getting out of debt.

When Linda and I were paying off $46k of debt, we actually didn’t use a debt snowball spreadsheet or worksheet, but looking back I think it really could have helped us.

If you are wanting to pay off debt on your own, this works!

And while Dave Ramsey popularized the Debt Snowball method, he didn’t actually create it.

The strength of using this method is that it focuses on the behavioral side of personal finance rather than the mathematical.

Since we are not robots that always do exactly what we know we should, I recommend this method for most people trying to pay off debt.

Debt snowball definition:

So, if you are new to this method of paying down your debt you might have thought “what is a debt snowball anyway”?

Well, simply put it can be defined as a simple approach where you pay off the smallest debts first.

You just start with the smallest one and get it paid off ASAP.

As soon as you do, you now have more to put towards the next smallest debt. And as you keep paying each off, you have more and more going to the next one and the momentum builds like a snowball rolling down a hill – hence the name.

The Debt Snowball steps

Depending on who you hear discussing this method it may be more or less steps, but this how I define the steps:

- Create a list of all of your debts: credit cards, car loans, student loans, mortgages, etc…

- Next to each one write down the total balance owed.

- Re-order these from smallest to largest debts (use Excel or Google Docs to make this simpler.)

- Pay the minimum payment on all of the debts – except the smallest one.

- Put every extra dollar you can find towards paying off that smallest debt.

- Celebrate like crazy when you get that first debt paid off.

- Take the amount you were paying towards the first debt and put towards the next smallest debt. Do this until this one is paid off.

- Celebrate again!

- Continue this process until all debts are paid off.

What you will find is that each time you pay off a debt, the “snowball” gets larger.

Since you are taking the amount you used to pay off the first debt and putting it all + the minimum payment that you were already paying to the second together, you are making more of an impact towards that debt.

Each time you pay off a debt, the snowball gets larger and more powerful – which is great, because it just increases the speed that each debt gets paid off.

Watch this for an example of how the debt snowball works:

Debt Snowball vs. Debt Avalanche

If you are like most logical people out there (like me 🙂 ) you are probably saying, “you could save more money by paying the highest interest rate cards off first.” You are right – calculators do not lie and they will give you the correct logical answer. Paying your credits cards off starting with the highest interest rate to the lowest is “mathematically” the best idea.

That my friend, is the Debt Avalanche approach. Investopedia defines it here:

“A method of repaying debts in which a debtor allots enough money to make the minimum payment on each debt, then devotes any remaining debt-repayment funds to repaying the debt with the highest interest rate. Using the debt avalanche method, once the debt with the highest interest rate is completely paid off, the extra repayment funds go toward the next highest interest-bearing debt. This process continues until all the debts are paid off.”

But, let’s look it at from another angle:

If we DID what we knew we SHOULD do 100% of the time, using the mathematical approach would be best. But, we are emotional beings and even the most disciplined among us still have emotions and are affected by them.

Computers use logic 100% of the time. Humans do not. We were not created to. We make decisions based on our emotions. We get let down, we get encouraged, we feel motivated, we get scared, we feel hopeful, we feel like quitting. These are all emotional states that each one of us could feel on any given day!!

Knowing that we are emotional beings, the key is to use our emotions to our advantage. Just like jogging with the wind at your back, it is a nice little boost to use our emotions to give us a little edge. So, rather than tackling the debt like a math problem, we can tackle it in a way that will give us emotional boosts!

After all, isn’t it better to get out of debt and spend an extra $100 in interest than to give up halfway to our goal because we were discouraged?

The scientific evidence for why the Debt Snowball is more effective

There have been a couple studies I have found that prove the effectiveness of the debt snowball vs the debt avalanche approach.

Northwestern University examined a study that confirmed that “The number of accounts closed better predicted successfully completing the program than the dollar amount an individual had paid off.”

Texas A&M concluded in their study here (see page 19) that “The experiment indicates subject performance is best when tasks are grouped from smallest to largest.”

The bottom line is that even science is proving that paying of debt isn’t about the math, it is about doing whatever is going to keep us motivated to the end.

Status Bars and Debt

Ever wonder why there are status bars showing you the progress of the item you are loading on your computer?

It is to keep us from going crazy while waiting 10 minutes for the computer to do what we told it to do!!

Even though that little bar moves slowly sometimes, it is encouraging because we know how much longer we have to endure the torture of waiting.

It is extremely DE-motivating when there is no end in sight. Without that “light at the end of the tunnel”, it can be hard to keep going.

That little bar that shows us the progress that we have made gives us hope. What if there were no status bars?

Or what if you saw no progress on the bar until you got to the 70% loaded point? Would you keep waiting or would you reboot, assuming there was a problem?

When on the phone, have you ever been waiting on hold for 15 minutes wondering, “Did they forget about me? Should I wait it out? What if they never remember that I am on hold?” Do you cut your losses or wait it out, having no idea when they will pick up, or if they ever will?

This is the advantage of using the snowball approach to paying down debt. If you focus on the highest interest rate, it could be months or even years before you reach that first milestone. Would you have the endurance to keep going that long without reaching that first milestone?

It is a wonderful feeling to be able to celebrate your first milestone – paying off the first credit card is a blast! Speaking from experience, I was fueled with motivation after reaching that first milestone. The fact is that most people are strengthened by seeing even a small goal accomplished.

I love the debt snowball approach to paying down debt because it focuses on reaching these small goals first and using them as motivation to keep going. Let me know how it works for you!

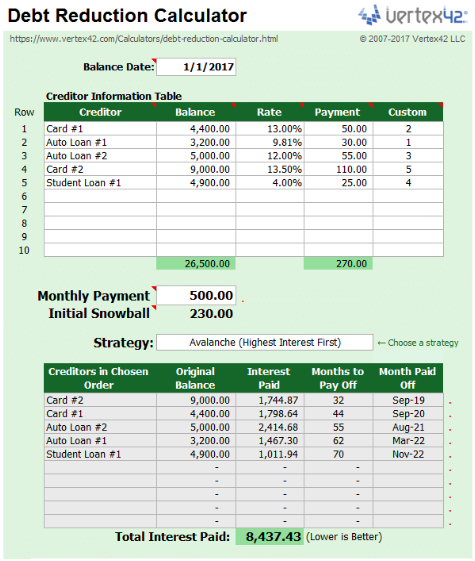

Debt Snowball Spreadsheet & Calculator [Free Download]

Well Kept Wallet has a great debt snowball calculator that can help figure out your debts so I encourage you to give that one a try.

I just was making some updates to our budgeting templates page where we have a bunch of free Excel and Google Doc spreadsheets available.

While I was working on it and getting a few new ones added to the page I stumbled upon this Debt snowball calculator for Excel and it is really cool tool to help you track your debt snowball.

As you can see below it has a lot of pretty helpful features and I wish I had a spreadsheet this cool when we were using the Snowball method to pay off our debt.

You can download the Debt Snowball Excel (XLS) file or find more out at the creators website.

Click here to get the spreadsheet for Google Docs (or Google Sheets)

Printable Debt Snowball Worksheet / Template / Form

The Ramsey team created this helpful downloadable debt snowball worksheet PDF template that you can print off as you work your way through the process…