Organize your Bank accounts

If there is one thing that I have learned about personal finances, it is that nothing is one-size-fits-all. There are different tools, methods, products, and investments that work for different people at different phases of their lives. My system that I am currently using to manage my accounts and cashflow did not work for me 5 years ago.

But now I couldn’t think of anything easier or more efficient.

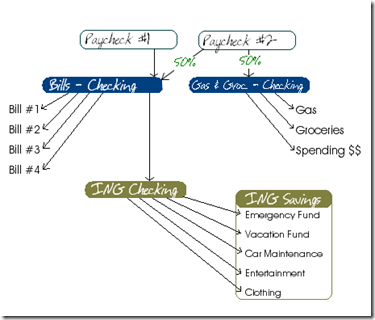

Below is a diagram showing how cash flows through my accounts.

This is a simplified version, but it gets the point across.

Variable Expenses

Every two weeks, our paychecks are direct deposited as noted above in the diagram into our accounts at our credit union. Our checking account for GAS & GROCERY gets a fixed amount deposited into it every two weeks. From this account we get our spending cash (or blow money), pay for fuel for our cars, and groceries. None of the three are really fixed expenses, so when gas prices rise we are forced to cut back on our spending money or grocery bill.

I sure hope that gas doesn’t go up to $4 a gallon – I won’t be able to eat!! 🙂 Keeping a leash on variable expenses is extremely important when trying to save money. Most people do not realize that expenses rise to meet income, and they pay the price because of it.

Look at any well established business and you will find that each department has a set budget for the quarter or year. They have to stay within those limits that have been created for them.

Why do they do this? Because it works. Businesses are in business to make money, so if it minimizes expenses they are happy.I am not suggesting to manage your finances like a CFO, but we can learn a lot about how to get things done from the business world.

Fixed Expenses

Roughly 75% of our paychecks go into our BILLS account. When we set this account up, I calculated how much all of our monthly bills cost, divided it by two and set up a schedule for when each would be paid. So, in all honesty I don’t check the balance in this account very often. Since we know how much needs to be paid out each month, we have exactly that amount deposited in. I use bill pay to pay my bills out of this account every two weeks based on my bill payment schedule.

Budgeting

Part of this fixed amount that gets direct deposited into our BILLS account is our Capital One 360 savings. Cap One 360 is a great budgeting tool and if you don’t have an account with them, I recommend that you take a look at what they have to offer.

From our BILLS account (every two weeks) I transfer a fixed amount into each one of our Cap One 360 savings accounts. As the accounts grow I am earning a good interest rate on my budgeted money.

I would love to hear how you manage your money or any other thoughts or suggestions…