(The following is an abbreviated transcription from a podcast Linda and I recorded. Please excuse any typos or errors.)

Today we’re talking about the four steps that we’re taking with this crazy record-breaking inflation we are experiencing right now.

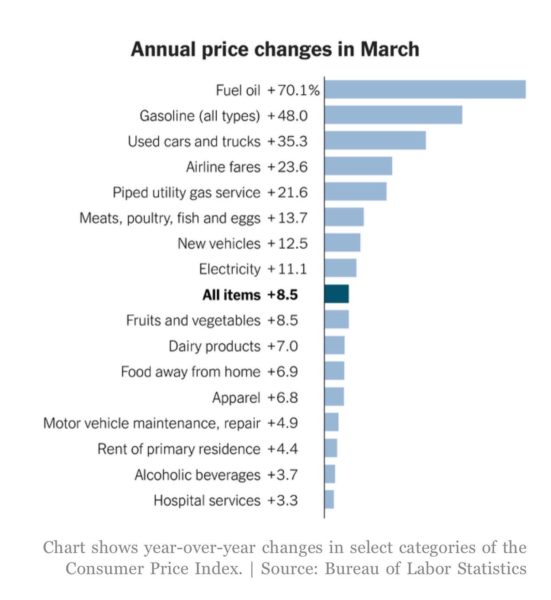

According to CNBC, I read this article and they just came out with the newest inflation rates, inflation rates are up 8.5% of the US CPI (Consumer Price Index).

So we’re gonna talk about the four specific steps we’re taking right now, because this is mind blowing.

Before we get into the steps we’re taking, I recorded our discussion that you can listen to on our Podcast. But, if you would rather read the full transcription, you can do so here in this article!

Enjoy.

Record-breaking inflation IRL

Bob: I just shared this post from the New York Times on Instagram (so you should follow us on Instagram if you’re not already, we’re @seedtime), but it shows the annual price changes. So since March of 2021, it shows how much things have gone up and it’s mind-blowing. A year-over-year change, fuel prices have gone up 70% per the Bureau of Labor Statistics. Crazy!

Linda: Oh gosh. Which I don’t think many of us are surprised by that because we’ve seen how the prices have just skyrocketed! And you actually found some cool new app to help us save money at the gas pump.

How we save money at the pump

Bob: We sent an email about this. So be sure to get on our email list, if you’re not on the email list, subscribe at: seedtime.com/subscribe. But yeah, we share with our email subscriber this app called Get Upside. Which, I think a lot of people are talking about right now because it’s a great way to get some cashback on gas.

So for example, the first time I used it, we ended up saving like 44 cents per gallon. Well, they gave us 44 cents per gallon back.

Linda: So it’s kind of like Rakuten a little, but for gas.

Bob: Yeah a different cashback type of app. But anyway, just a really cool app.

Inflation rates of various purchases

Bob: This is nuts used cars and trucks are 35% higher than they were last March 35% for used cars.

Linda: Yeah. Which, you know, and I knew that they had spiked. And I think it’s because new cars are really hard to come by. Like you got to get on a waiting list for that, eight months-10 months for some of these cars.

Bob: Yeah. And airline fares are up 23% (check out how we travel for free)! Meat, poultry, fish and eggs are up 13%! Electricity is up 11%! Fruits and vegetables, 8%!

Yeah, like it’s just nuts. The CPI, consumer price index, gives a whole list of a variety of different items (it’s a basket of 35 different categories of goods) and how the prices have gone up. But on average, they’ve determined that average rate of inflation is 8.5%.

And so bottom line, if it feels like things are tighter, they are because a lot of prices have been going up.

Linda: So I went to the grocery store the other day. I only ended up getting half of the items on my list because honestly I was not feeling very good. I needed to, and I had a kid who was, yeah. Being a little bit intense, but I ended up spending like $500.

When I saw this number, I was like, “oh my gosh, I didn’t even get everything we needed to get!” Typically, for us to buy about that amount of groceries, it would have normally have been like $300-$350. I mean, I got a bunch of stuff, but it wasn’t even a normal amount of groceries (check out ways you can save on groceries!).

I was blown away that I had just spent $500. When I brought the groceries home, you were like “where’s the rest of it? Well you just weren’t checking prices” and dah, dah, dah. And I’m like, I got the same things that I’ve been normally getting and he was blown away looking at the receipt at the price of things.

Bob: Yeah. Because things have gone up. It’s just crazy! It’s crazy.

Our game plan

Linda: We gotta talk about our game plan. Because I think everybody else needs a game plan as well with all these rising prices.

Step 1: Focusing on the truth of The Word

Bob: I think the first thing that we’re doing that we are always doing, no matter what our financial situation looks like, is focusing on the truth of The Word. Philippians 4:19 is one of my favorite verses and it will always apply.

“And my God will meet all your needs according to the riches of his glory in Christ Jesus.” Philippians 4:19 (NIV)

God is our provider and so it doesn’t matter what inflation is doing. It doesn’t matter what the government’s doing. It doesn’t matter if there are wars, like none of this stuff matters. Whether it’s macro, micro, whatever the situation is, trucker convoy, etc. It’s always going to be true in any and all circumstances and situations.

And so, it’s easy to forget that when we’re staring at the news all day, or staring at all of the crises and everything that’s happening… but it is true. I think that’s one of the most important things to focus on in the midst of this. It’s my biggest encouragement to anybody who is freaking out about the inflation rates and how expensive things have gotten.

So that’s number one.

Step 2: Focus on your household budget

Bob: The second thing I’m encouraging people to do is making sure that your money management is tight. Make sure that there aren’t any holes in your bucket where you’re just losing money. Where you’re just wasting money.

We’ve talked to so many people who think they know what’s going on. Think they know how much they’re spending and they don’t. And when you’re not actually paying attention, when you don’t know exactly what’s going on, it gets really, really sloppy.

The Real Money Method

Bob: Our recommendation for this is our Real Money Method course.

Linda: This is the only thing that has actually worked for us.

Bob: Yeah. And we ended up developing a budgeting method that has just worked really, really well for us.

Linda: It’s super accountable.

Bob: Like there’s no, there’s no fudging the numbers. And it’s by far, like I’ve created a lot of products over the years of doing all this stuff, the best product that we’ve ever created in terms of just constant amazing testimonials and results from students. It’s just mindblowing the results that so many of our students get. And it’s just a simple process to hone in your money management, build in some accountability.

Linda: And it’s easy to understand,

Bob: Even for some easier than any budgeting tool that I think we ever used, right?

Linda: Yes, which is why I like it. Well, originally you had tried all these other budgeting apps. You know, fancy budgeting software or whatever method. This was the thing that we had done originally when we first got married and I said, “dude, you got to figure all this other stuff out.”

If anything ever happens to you and I have to take over, I’m going back to the original method. And that’s what this is, The Real Money Method. It’s just really simple method.

Bob: Yeah. So we started there. Then took a long and winding road trying fancy or shiny or new budgeting things, and then came back to the good old faithful.

But anyway, that’s what’s worked for us. And if you need help, check it out. But the point is, you need to make sure your money management is tight.

Do you have unused subscriptions?

Bob: So another example here of something that blows my mind. I’m on top of this stuff, but I just went into our iTunes account or Apple account to cancel one of our subscriptions. I don’t remember if it was a Discovery+ or Disney that we subscribe to. And I thought, “oh, we stopped watching whatever show it was, so we don’t need that subscription anymore.”

So I went to cancel it, and there were three other subscriptions running. I’m like, how did we miss this? We’ve been paying for this for the last three months?! And then it was the same way with Amazon. I went into Amazon prime and there were multiple subscriptions where we’re not even using.

The kids aren’t even watching that anymore. We’re wasting money on these unused subscriptions. So that simple exercise we probably saved $50 or $70 a month just by going through our subscriptions and cancelling the ones we no longer use.

Bob: My point is, you gotta be on top of that stuff, especial in this situation of this world of crazy inflation. When things are getting tighter, let’s pay attention.

Linda: It might even be time to say, you know what, we’re going to have Netflix for this month and we’ll have Hulu the month after that, you know? Or just focus on one at a time.

Step 3: Storing less money in savings accounts

Bob: All right. Number three is three. And this is a little bit more of a strategy in terms of inflation and the hit that it’s taking. But what we are doing is storing less money in our savings account.

And the reason being is because we have a savings account just like anybody else does, and we’re getting half a percent interest in there. And that that’s completely pointless if the dollar is being devalued by 8.5% each year.

Linda: And so apparently we should move it into a used car and truck or gasoline. We should start controlling the gasoline in the area. It’s a good investment!

Bob: Yeah. Anyway, so that’s something that we’ve been shifting. I’m all for having an emergency fund and I think that’s really good. But, each person will have to make this decision according to how you want to manage risk and everything else. But for us, we’ve moved more of that money out of savings and more into investments that can keep pace with inflation.

Linda: So you’re not talking about tucking it under your mattress, when pulling cash out of savings?

Bob: No. I mean, we do have cash have some cash set aside that we can use for certain types of emergencies. But the investments are different. That’s a different thing than kind of as a hedge against inflation. Because again, that money is being eroded really quickly by inflation. But there still is a value in that in certain crises and situations.And so I feel a little better having a little bit cash.

Anyway, that’s part of the equation, but in general, You don’t want to have tons and tons of money sitting in a savings account right now.

Linda: It’s just not the time to do that because you’re just basically losing a ton of money every year.

Bob: Yeah. And there are phases in the economic cycles where it makes a whole lot of sense to have money in savings because the rates are really great. But right now, the interest rates are terrible and inflation is high. It’s just not where you want to be and have a lot of money tied up in a savings account.

Investing in T.I.P.S.

And so I’m not going to go real deep with this because we can talk about this for hours. But one simple thing that we’re doing is we started investing in T.I.P.S. (Treasury Inflation Protected Security).

So basically it’s a type of bond that you can buy from the government that keeps pace with inflation. And so it’s really, really cool. And you can also buy I bonds, which function really similarly. And like the current rates for I-bonds, I think it’s like 7.1%, and that will adjust up to the 8.5%. It just continues to match where the, whatever the inflation rate is. And so it’s a great way to at least keep pace with inflation.

Our 10x Investing Course

And we go into a lot of other different ideas along these lines and different ways to invest in our 10X Investing Course for anybody wants to dive deeper. But it’s just a great way to not have money sitting in a savings account and keep pace with this rate of inflation.

Linda: Yes, exactly. Because that’s the thing we’re all trying to avoid is just our money becoming worthless, or the dollar becoming worthless. Which I think when we see big spikes like this with inflation, it can feel like all of a sudden I’m not making enough money. Or, I’ve got to work harder or take on another job or start a side hustle or whatever. Which is true, maybe you do need to do some of that. But I think every little bit helps.

Bob: Yeah. That’s what I’m saying.

Step 4: Stocking up on goods

Bob: And I think this one is really underutilized and under appreciated. But stocking up on goods. So food items, household items, things that hold their value. And I remember Mark Cuban talking about this saying one of the best ways for most average Americans to invest their money is by bulking.

In bulking up on sale items that they can throw in the freezer or that they can keep it a pantry for a couple of years, because say you can buy something, whatever, maybe it’s ground beef, 20% off or something like that. And you can buy two years worth of it. Like you’re basically making a 20% return on your money, which is fantastic.

And I think it’s specially in terms of inflation, I’m stocking up in all these things that you can stock up in that you are actually going to use. If you can buy them at today’s prices, rather than having to buy them next month. Or in the case of a sale, even a discounted price, it’s a great way to just take advantage of that and set yourself up (check out our article on how to find the best price for all the stuff you buy). On top of that, given the fact that there’s a war going on that we could possibly be drug into, it makes sense to stock up on some stuff a little bit.

Linda: Like, we saw what happened with COVID (a total unexpected financial challenge) with the toilet paper shortage. You know, you’re seeing families with five kids and they can’t find toilet paper anywhere. They’re driving all over town because they just got one roll left.

Bob: Biden said a couple of weeks ago that there’s gonna be major supply shortages because of what’s going on.

Linda: So this is your tip. So don’t miss out on that!

Bonus tip: Inflation is working against your lenders

Bob: And I’ll just add another piece here. Because this is a question I got just the other day, too. We don’t have any debt right now, but if we did have debt I’ll tell you, what should we be thinking about? I don’t know exactly what we would be doing, but the thing is with debt in the case of inflation, the bank or the lender is the one who’s taking the hit.

Okay. So, you could argue we didn’t pay off our mortgage early because it made the most sense mathematically. My accountant and other people in my life were like, that’s just a bad idea. That’s a bad math. And I’m like, I understand it’s bad math, but it’s good stewardship of my family and of my peace of mind.

And so, we sleep better knowing that the bank doesn’t own our house, we do. I’m glad we made that decision. It wasn’t a math problem, you know, but along those lines, another additional argument against paying off your mortgage right now, I’m just throwing out the counterpoint here is that.

That situation right there at the inflation is working against the bank. It’s working against the lender. So they’re the ones who are taking the hit from that. And that’s an argument for not racing to pay down debt in this situation. I’m not saying I recommend that and I don’t even know that we would pause a slow down, but it would definitely be something I’d be thinking about.

Linda: Right. And get in the information so that you can evaluate your situation better because everybody’s situation is different.

Bob: Yeah. And so somebody was asking me just the other day, should I slow down on my debt payments so that I can save more money in an inflationary period like this. And, I think it makes a lot of sense to have debt.

Bob: After COVID, especially. We had emergency fund before that, but once COVID hit, it’s like, all right, everyone should understand the importance of having an emergency fund and having some somewhat liquid cash available. If you don’t have an emergency fund, I suggest you start saving now.

You know, typically I like having an emergency fund in a savings account. But again, in this situation that what’s going on with inflation, I still want it to be liquid (as in we can access it pretty quickly). But it doesn’t have to be like right this minute. So our savings account, we still have some money in a savings account that we can get to probably within an hour. But some of our other investments are liquid enough that we could get to them within a day or two, you know? So it’s not like a house where it might take you months to get to.

Linda: Is this T.I.P.S.? Is that one of those investments now?

Bob: Yeah. The way that we’re investing in T.I.P.S. it’s that is fairly easily accessed at our bank.

Linda: Well and maybe we don’t need to tell them necessarily what we’re doing, but what are some of those assets that could be easily..

Bob: …liquidated? Yeah, so investing in stocks or anything. Like it’s so easy. You can sell them, at worst by the end of the business day on a regular business, and then have it.

In closing

Bob: Yeah. So those are the four of the things (plus bonus tips!) that we’re doing right now of how we’re working through this crazy inflation that we’re dealing with.

Simple Money, Rich Life

And, when this article comes out, our book will probably already have been released. We would love for you to order a copy for yourself! We really believe lives are going to be changed through this book, which you can get at seedtime.com/SMRL (stands for Simple Money, Rich Life – the name of our book).

I think that’s it. Hope you have an awesome day. We’ll talk to you soon.