(The following is a transcription from a video I recorded. Please excuse any typos or errors.)

We are talking about nine millionaire success habits that hopefully will inspire you.

If you are curious as to what habits you need to develop to start building wealth a little bit faster than you currently are, stay tuned because that will be addressed as well.

Speaking of building wealth, before we get started, I encourage you to check out an article wrote in which I list 5 Ways To Get Started Investing With Very Little Money.

You can actually build a balanced investment portfolio without already being a millionaire. All you have to do is know where to find investments that you can start with as little as $1. And there are plenty of options.

All right, now let’s get to these nine millionaire success habits to inspire us all!

Linda and I sat down and discussed these nine habits, and you can read that transcript below. But, if you would like to watch our discussion instead, you can do so here:

All right, let’s see if any of our habits line up. Be sure to see if any of your habits line up, too!

1. Read For Personal Development

Linda: Okay. Number one, the first habit is read for personal development.

Bob: Yeah. So are you doing this? Are you reading nonfiction that is making you smarter and sharper and better with your money? There’s been research has been done that shows that 85% of self-made millionaires read at least two books a month.

Linda: That is amazing.

Bob: So it’s a good habit to be in, to be reading stuff to further your development, particularly in your job, in your career, in your business, any of those things that can help you grow in that.

2. Establish Multiple Sources Of Income

Linda: Number two is to establish multiple sources of income.

Bob: I think a lot of us now, after the whole Coronavirus thing, realize how unstable our incomes may have been.

Linda: Yeah.

Bob: And this is a great, great thing to do. And particularly I would add to this, looking for sources of passive income. We’ve wrote a couple of articles talking about passive income and we have some ideas. And the author of this article actually defined it as this, they are passive income addicts.

Millionaires are passive income addicts.

So do what you can to start thinking along these lines of how you can start building up some passive income streams and just any other sources of income other than your one current source you may have right now.

3. Live On A Monthly Budget

Linda: So number three is live on a monthly budget, which I think this is probably going to surprise people.

Bob: Yeah. No, I think this is really important. It makes sense to me, and I think people define budget differently.

We describe a budget as telling your money where to go, instead of it telling you where it went.

Bob: Yeah. Yeah, exactly. I thought this was really interesting seeing this because it makes a lot of sense. If you look at businesses, successful businesses, big businesses, you’re going to have a hard time finding some that do not have a budget in place.

Linda: Right.

Bob: Businesses put budgets in place because it helps them make more money. So it makes sense that as human beings, just individuals, we should have a budget in place to maximize what we have going on. So it makes perfect sense.

Linda: It’s efficient.

Bob: Yeah. It’s absolutely the key to just being as efficient as possible with your money.

4. Manage And Maximize Your Money

Linda: All right. So number four is manage and maximize your money.

Bob: Yeah. So I think this ties into the previous one a little bit, but the author is talking a little bit about the tax benefits and really maximizing your tax strategy and just reducing the amount of tax you’re paying legally, of course, but just doing things in a way that you don’t have to pay more taxes than you should.

5. Avoid Debt

Linda: All right, number five is to avoid debt.

Bob: I think it was Robert Kiyosaki who said:

…that the difference between the rich and the poor and middle-class is that the rich buy luxuries last, whereas the middle class and the poor buy them first, and often on credit.

Linda: Yeah.

Bob: If I think back to my early years, that’s what I was doing all the time. I was buying things I couldn’t actually afford on a credit card and then carrying a balance with them. And thankfully we’ve made some progress over the years, gotten a little bit smarter with the money doing less and less of that.

But that’s a key is minimizing debt usage. And if you are actually going to use debt, it needs to be used in a way that’s actually going to make you money. Not just because you want to get something sooner and you don’t want to wait for it. All right, if you’re enjoying this at all, hit the like button to let us know and we will continue.

6. Set Daily Goals

Linda: Number six, set daily goals.

Bob: Yeah, I feel like I’ve been a little bit slack on my goal setting-

Linda: Me too.

Bob: Lately, but yeah, it is such an important part. I mean, setting a daily goal in order to reach your quarterly goal, your annual goal or whatever, just finding out the big thing you want and then working backwards. It’s like, if I want to be here in a year, what do I need to do on a daily basis or weekly basis in order to get there? And establishing a habit like that, I’ve had some really crazy things happen based on goals that I set and then created systems in place to reach them.

Linda: Yeah. And I think the other thing-

Bob: So I’m a big proponent of this.

Linda: The other thing it’s going to do is kick out all the things that you don’t want to do, right?

Bob: Yeah.

Linda: Because you’re not going to have time for them anymore.

Bob: Exactly. Yeah.

7. Don’t Act Rich

Linda: Number seven, don’t act rich.

Bob: Yeah. This is so funny to me because so many people who don’t have a lot of money actually pretend like they do. And because debt is so readily available, you can create the illusion of having some wealth, even when you don’t. On the other hand, a lot of really wealthy people, you would never know it by the way they handle things. So there’s a proverb that says:

One person pretends to be rich, yet has nothing; another pretends to be poor, yet has great wealth.

Linda: This kind of reminds me of when we were living in our house in St. Louis and you were driving around a 14 or 15 year old car that you had paid $1,000 for, and then you sold for $1,000 a little while later. And you were driving this really beat up car, but we were living in a paid-off house.

Bob: Yeah. Yeah.

Linda: You kept thinking, you were like, “I wonder what people think.” Because-

Bob: And I clearly didn’t really care, but-

Linda: No, you didn’t care what you were like, “I wonder, based on me driving this car, what people actually think our financial situation, is because it really looks like one thing.”

Bob: Yeah.

Linda: But the reality of it was that we were actually doing really well at that point.

Bob: Yeah. Yeah. All right. So there’s a great book out there called The Millionaire Next Door that kind of addresses this.

Linda: So yeah. We’re going to read this part for you real quick:

While most believe that people with huge fortunes tend to drive exotic cars, in reality, the largest consumers of pricey cars are aspiring millionaires.

Bob: Not real millionaires. The ones who want to be.

Linda: And then it says that,

61% of individuals who earn $250,000 or more rarely buy luxury brands, instead they buy Hondas, Toyotas, and Fords like the rest of the world.

Bob: Yeah. That is insightful. I love that.

8. Own Or Buy Businesses

Linda: Okay. So number eight is own or buy businesses.

Bob: I remember a mentor of mine told me this. Basically he said,

The fastest path to building wealth is owning your own business.

And as an employee, it’s not that you can’t build wealth, it just takes longer. It’s a longer journey.

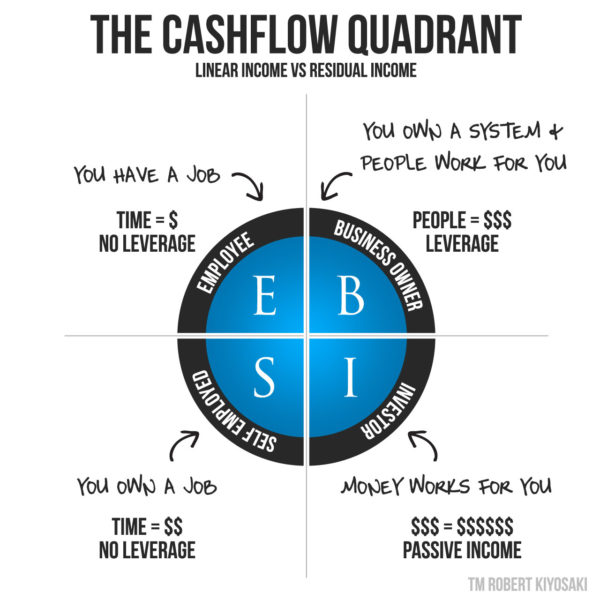

And the author here mentions Robert Kiyosaki and his Cashflow Quadrant, which is actually kind of cool model where he breaks it into four quadrants. So you have employee, which is E. S for self-employed, which is working for yourself. B is business owner, where you have many employees under you, building business. And then I is for investor. Kiyosaki says you want to focus on being in the business owner or investor category, because the employee and the self-employed where you’re just working for yourself, those categories are a lot more difficult to build wealth in. Whereas if you get on the other side, it’s a lot quicker to be able to build and grow wealth.

9. Avoid Get-Rich-Quick Schemes

Linda: All right. So number nine, this is the last one. Avoid get rich quick schemes.

Bob: It takes time, my friend. So in Proverbs 28:22, it says in New Living Translation,

Greedy people try to get rich quick, but don’t realize they’re headed for poverty.

And so there are always things out there that look like shortcuts. And honestly, this is how a lot of scams thrive and succeed is they prey on that desire for us all to get rich quick.

Linda: Yeah.

Bob: And so being wise about that is one of the best things that we can do.

Linda: So sending the Nigerian prince $1,000, we’re not going to make 10 million back instantly.

Bob: Yeah. I don’t know, I haven’t heard of anybody yet. Let us know in the comments if that’s worked for you, but I haven’t heard that working out so far.

It’s Your Turn!

Linda: Okay. So we would love to hear in the comments if you want to add anything to this list, if you agree or disagree with anything on this list.

Bob: Yeah, let us know. Let us know.

Linda: We want to hear from you!