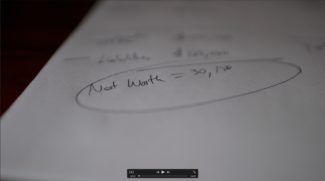

While I think few would argue that paying off debts is a good thing, there is a better way to accurately see the big picture of your finances. It is called your NET WORTH. And no it is not just a number that rich people talk about at cocktail parties. It is what financially savvy people use to track their progress.

Money Management

7 Reasons You Should Review Your Life Insurance Policy

Figuring that you never have to review your insurance needs is one of the most common misconceptions about life insurance! But, if you don’t review your plan annually — or, for that matter, don’t have a financial plan — here are some guidelines to know when you should review your life insurance.

The 5 Best And Worst Car Insurance Companies As Rated By Consumers

Every year, J.D. Power and Associates ranks consumer satisfaction across a variety of industries and services using information gathered through surveys, and one of their most areas of expertise is the automotive world. Their list is acclaimed for its accuracy and respectability. In August 2009, they released their annual ratings of auto insurance providers determined by customer satisfaction…

How To Manage Bills With A Bill Payment Schedule (Free Download)

Why not implement the same type of planning to the paying of your bills? Rather than sporadically paying them as they come in, or checking a pile on your desk every few days, you should be able to designate 2 days a month to pay your bills…

How To Set Up A Budget With Inconsistent Income

The fact is, it is more difficult to set up a budget when you never know how much you are going to make each month – but it still can (and in my opinion) should definitely be done. I happen to think it is far more important for those with irregular income to set up a budget because of the quick damage that can be caused if you don’t…

4 Simple Ways to Pay Off Your Mortgage Early

Buying a home is a major expense — and a major debt. It’s said it’s the biggest purchase you’ll make in your life. A traditional mortgage loan is repaid over the course of 30 years, but today, some terms call for up to 40 years of repayment. To some, three or four decades seem like an interminable amount of time to take to pay off a debt… These are 4 simple ways to pay off your mortgage early!

Free Spreadsheet To Get Your Financial Life On One Page

Being impacted by my uncle’s premature death and wanting to do everything I can do to help my wife, I decided to create a system for keeping things organized. It has been a work in progress over the last few years, but has evolved into a very helpful tool…

10 ways to become poor

These are some simple ways to become poor… 1. Spend more than you make – Actually if you only do #1, you won’t have to worry about the other 9. This is the easiest way for anyone to become poor. It doesn’t matter if you make millions or hundreds each month, the same principle applies.