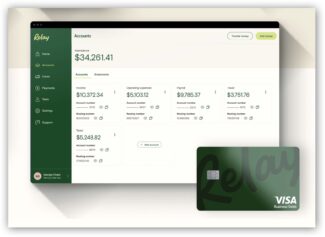

Ok, I keep getting asked about the business bank account that we use… These are just 2 in the last week… And, honestly, I feel like I get this question all the time, so let’s chat… I haven’t liked many business checking accounts. In the last 16 years, I have had quite a few business […]

Banking

How To Manage Bills With A Bill Payment Schedule (Free Download)

Why not implement the same type of planning to the paying of your bills? Rather than sporadically paying them as they come in, or checking a pile on your desk every few days, you should be able to designate 2 days a month to pay your bills…

4 Simple Ways to Pay Off Your Mortgage Early

Buying a home is a major expense — and a major debt. It’s said it’s the biggest purchase you’ll make in your life. A traditional mortgage loan is repaid over the course of 30 years, but today, some terms call for up to 40 years of repayment. To some, three or four decades seem like an interminable amount of time to take to pay off a debt… These are 4 simple ways to pay off your mortgage early!

Free Spreadsheet To Get Your Financial Life On One Page

Being impacted by my uncle’s premature death and wanting to do everything I can do to help my wife, I decided to create a system for keeping things organized. It has been a work in progress over the last few years, but has evolved into a very helpful tool…

New Law on Bank Overdraft Fees & The “Courtesy” Overdraft Protection

Recently Consumer Reports released an article discussing the new Federal law pertaining to banks and their overdraft services. Not sure if the motivation for the new regulation was customers like the one above, but I think it is probably a good thing.

Believe it or not, that $35 fee that the bank charges you when you overdraw your account is actually a “service” that your bank is offering you. They care so much about your well being that they want you to be able to buy that Snickers bar without being told that you don’t have the money in your account. 😉 And then they charge you $35 when you spend 50 cents more than you have in your account…

FDIC and NCUA Insurance: Which is Safer?

Insurance is important when it comes to the money in the bank. That’s why FDIC insurance was created. But what about credit unions, do they have the same protection as banks? It might surprise you, but credit unions don’t use FDIC. They use a form of insurance provided by the NCUA. What’s the difference?

Do You Need an Emergency Fund?

Do you need an emergency fund? Well, I used to think of an emergency fund as robbing myself. Thankfully, I learned how beneficial an emergency fund is to my long-term financial well being.

How to make more money with your emergency fund

This post will walk you through the steps to leverage your emergency fund to make more money…. Everyone’s definition of an emergency is different. But, if you want it to be of some use to you, you need to have a strict definition of an emergency. Your emergency fund should put more dollars into your pocket once it has been well established. Here is how: